US C4ISR Market Overview

- The US C4ISR Market is valued at USD 48 billion, based on a five-year historical analysis. This growth is primarily driven by increasing defense budgets, advancements in technology including artificial intelligence and machine learning integration, and the rising need for enhanced situational awareness in military operations. The demand for integrated systems that combine command, control, communications, intelligence, surveillance, and reconnaissance capabilities has surged, reflecting the strategic importance of these systems in modern warfare. Military expenditure in the Americas reached USD 1,100 billion in 2024, representing a 5.8% increase from 2023, which has directly fueled investments in advanced C4ISR platforms combining surveillance, intelligence gathering, and communication technologies.

- The United States is the dominant player in the C4ISR market, with key cities such as Washington D.C., San Diego, and Huntsville leading the way. The concentration of defense contractors, government agencies, and military installations in these areas fosters innovation and collaboration. Additionally, the U.S. government's significant investment in defense and national security initiatives further solidifies its position as a leader in the C4ISR sector. North America dominated the global C4ISR market with over 39% revenue share, with the U.S. leading the region in terms of market presence and technological advancement.

- The National Defense Authorization Act (NDAA), enacted annually by the U.S. Congress with recent iterations through 2024, emphasizes the modernization of C4ISR systems. This binding legislation mandates increased funding allocations for research and development in advanced technologies, including artificial intelligence and machine learning, to enhance the capabilities of military communication and surveillance systems. The NDAA establishes specific authorization levels for defense programs, requires competitive procurement processes for C4ISR contracts, and sets operational readiness standards for integrated command and control systems across all military branches, ensuring that the U.S. maintains its technological edge in defense operations.

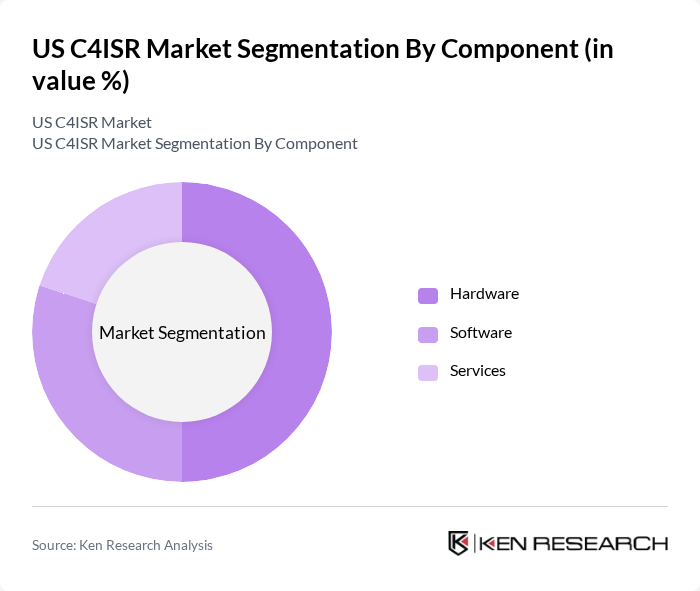

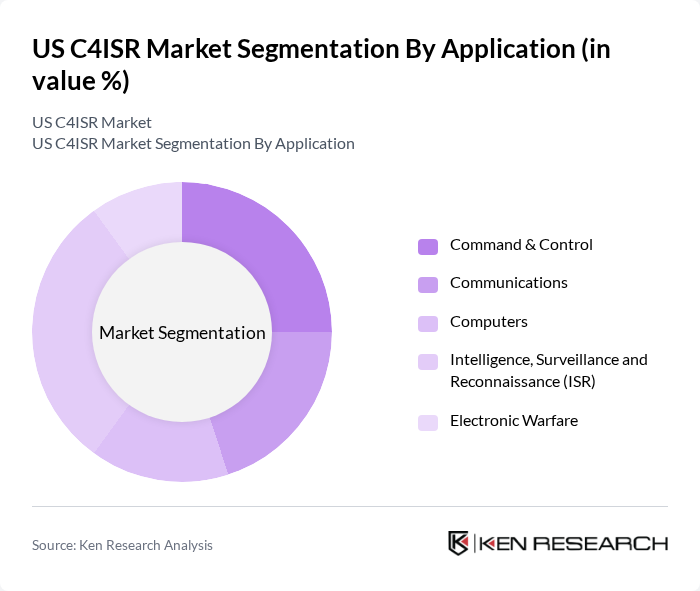

US C4ISR Market Segmentation

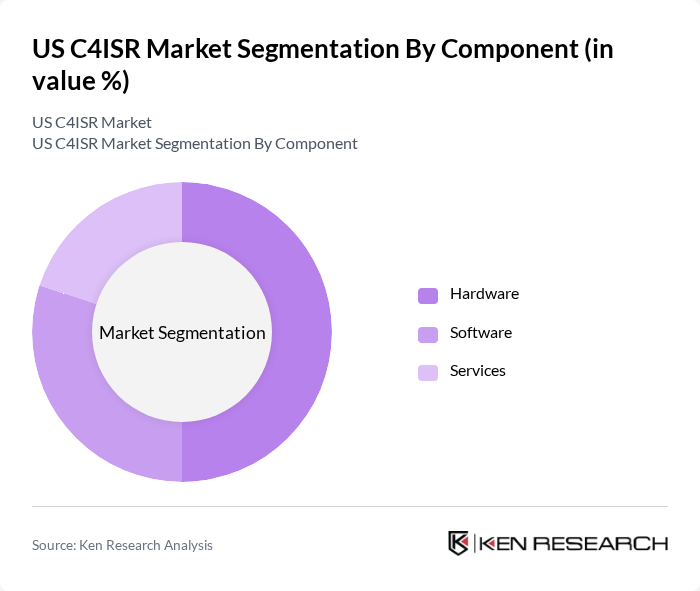

By Component:The C4ISR market is segmented into three main components: Hardware, Software, and Services. Among these, the Hardware segment is currently dominating the market with over 58% market share due to the increasing demand for advanced communication and surveillance equipment including radar sensors, satellite imagery systems, and drone technologies. The need for robust and reliable hardware solutions is driven by the growing complexity of military operations and the necessity for real-time data processing capabilities. The Software segment is also significant, as it supports the integration and functionality of hardware systems through data analytics tools and artificial intelligence platforms, while Services encompass maintenance and support, which are essential for operational efficiency.

By Application:The C4ISR market is further segmented by application into Command & Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (ISR), and Electronic Warfare. The Intelligence, Surveillance, and Reconnaissance (ISR) application is leading the market with over 42% market share due to the increasing need for real-time intelligence in military operations. The demand for ISR capabilities is driven by the necessity for enhanced situational awareness and decision-making in complex operational environments, with defense forces increasingly deploying integrated platforms that leverage satellite imagery, unmanned systems, and advanced sensor technologies to monitor enemy movements and terrain. Command & Control and Communications applications are also critical, as they facilitate effective coordination and information sharing among military units, linking strategic headquarters with frontline forces to support rapid response in combat scenarios.

US C4ISR Market Competitive Landscape

The US C4ISR Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, Northrop Grumman Corporation, RTX Corporation, L3Harris Technologies, Inc., BAE Systems plc, The Boeing Company, General Dynamics Corporation, Leidos Inc., Elbit Systems Ltd., Honeywell International Inc., CACI International Inc., Thales Group, Leonardo DRS, Inc., Kratos Defense & Security Solutions, Inc., and SAIC, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

US C4ISR Market Industry Analysis

Growth Drivers

- Increased Defense Spending:The US defense budget for the upcoming period is projected to reach approximately $886 billion, reflecting a 3% increase from the previous period. This rise in funding is primarily driven by the need to enhance national security and modernize military capabilities. The allocation for C4ISR systems is expected to see a significant portion of this budget, as the Department of Defense prioritizes advanced technologies to maintain strategic advantages. This financial commitment underscores the growing importance of C4ISR in defense operations.

- Technological Advancements in Communication:The US C4ISR market is benefiting from rapid advancements in communication technologies, with the global military communications market expected to reach $35 billion in the near future. Innovations such as secure satellite communications and high-frequency data links are enhancing operational effectiveness. These technologies enable real-time data sharing and improved situational awareness, which are critical for mission success. As the military adopts these advancements, the demand for integrated C4ISR solutions is anticipated to grow significantly.

- Rising Demand for Integrated Solutions:The integration of various defense systems is becoming increasingly vital, with the US military investing over $20 billion in integrated C4ISR solutions in the near future. This trend is driven by the need for seamless interoperability among different platforms and services. As military operations become more complex, the demand for systems that can provide comprehensive situational awareness and decision-making support is expected to rise, further propelling the C4ISR market.

Market Challenges

- Budget Constraints:Despite increased defense spending, budget constraints remain a significant challenge for the US C4ISR market. The Congressional Budget Office projects that discretionary spending will face limitations, potentially impacting funding for advanced C4ISR projects. This financial pressure may lead to prioritization of certain programs over others, hindering the development and deployment of innovative technologies. As a result, companies may face difficulties in securing contracts and funding for new initiatives.

- Cybersecurity Threats:The rise in cybersecurity threats poses a critical challenge to the US C4ISR market, with cyberattacks on defense systems increasing by 30% in the past year. As military operations become more reliant on digital technologies, the vulnerability to cyber intrusions grows. This necessitates significant investments in cybersecurity measures, diverting resources from other essential areas. The ongoing threat landscape requires constant vigilance and adaptation, complicating the operational environment for C4ISR systems.

US C4ISR Market Future Outlook

The US C4ISR market is poised for significant evolution, driven by technological advancements and increasing defense priorities. The integration of artificial intelligence and machine learning into C4ISR systems is expected to enhance decision-making capabilities and operational efficiency. Additionally, the collaboration between government and private sectors is likely to foster innovation, leading to the development of next-generation systems. As geopolitical tensions persist, the demand for robust C4ISR solutions will continue to grow, shaping the future landscape of defense operations.

Market Opportunities

- Expansion of AI and Machine Learning:The integration of AI and machine learning into C4ISR systems presents a significant opportunity, with the AI in defense market projected to reach $18 billion in the near future. These technologies can enhance data processing and analysis, enabling faster and more accurate decision-making. As military operations increasingly rely on data-driven insights, the demand for AI-enhanced C4ISR solutions is expected to rise, creating new avenues for growth.

- Increased Collaboration with Private Sector:The US government is actively seeking partnerships with private companies to drive innovation in C4ISR technologies. In the near future, the Department of Defense plans to allocate $5 billion for collaborative projects with industry leaders. This collaboration can accelerate the development of cutting-edge solutions, leveraging private sector expertise and resources. As these partnerships grow, they will create opportunities for companies to contribute to advanced C4ISR capabilities.