Qatar C4ISR Market Overview

- The Qatar C4ISR Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by rising defense budgets, increased regional geopolitical tensions, and the expanding need for advanced surveillance and reconnaissance capabilities. The market is further propelled by the integration of artificial intelligence, machine learning, and cybersecurity features into C4ISR systems, as well as the adoption of multi-domain operations and network-centric warfare strategies, which are becoming central to military modernization programs in the region .

- Key players in this market include Doha, the capital city, which serves as a hub for defense procurement and technology development. The presence of major military bases, such as Al Udeid Air Base, and the hosting of international defense exhibitions like DIMDEX, enhance Qatar’s position as a leading player in the C4ISR market. Qatar’s strategic location in the Gulf region continues to facilitate defense collaborations and partnerships, supporting its role as a regional center for innovation and procurement .

- In 2023, Qatar’s government enacted the Defense Procurement Policy, 2023 issued by the Ministry of Defence. This policy mandates increased local content requirements for C4ISR technologies, prioritizes domestic production, and encourages collaboration with international defense firms. It allocates USD 300 million for research and development initiatives, requiring compliance with technical standards for secure communications, data protection, and interoperability across military branches .

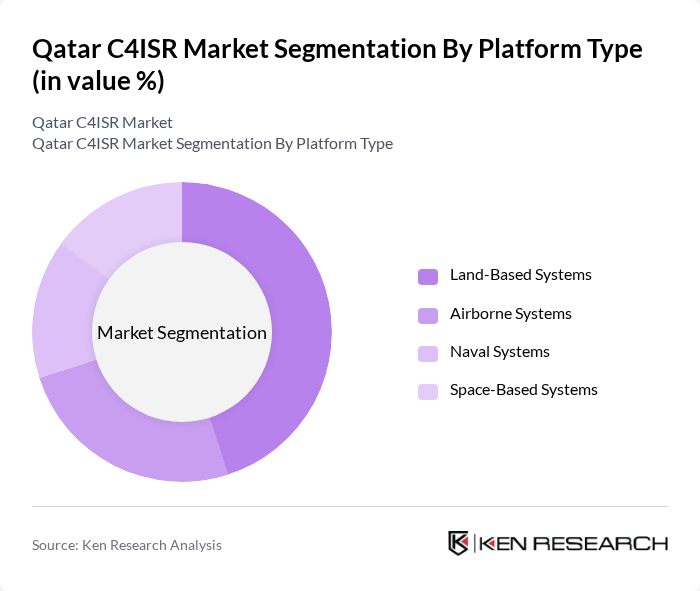

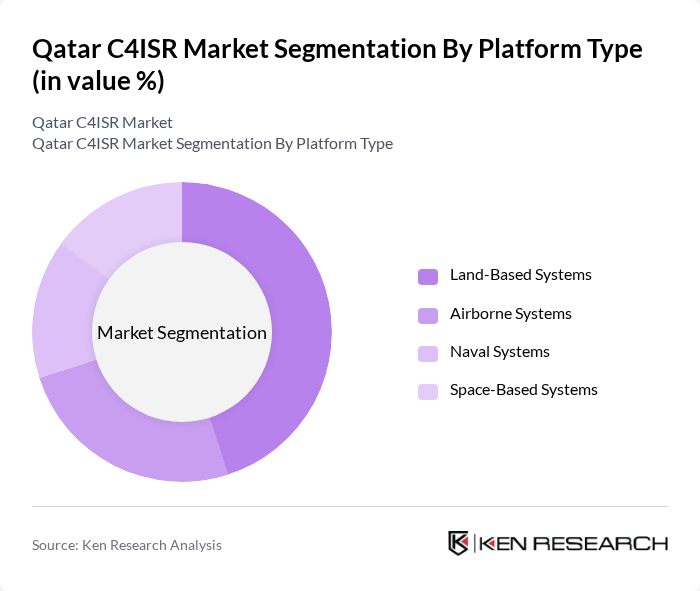

Qatar C4ISR Market Segmentation

By Platform Type:The platform type segmentation includes Land-Based Systems, Airborne Systems, Naval Systems, and Space-Based Systems. Land-Based Systems continue to dominate the market, driven by their extensive use in ground operations, border security, and mobile command centers. The integration of advanced technologies such as artificial intelligence, machine learning, and real-time data analytics in these systems is enhancing operational efficiency, situational awareness, and rapid decision-making capabilities. Airborne and space-based platforms are also experiencing increased adoption due to the growing importance of satellite communications and unmanned aerial systems in modern military operations .

By Application:The application segmentation encompasses Command and Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (ISR), and Electronic Warfare. The Intelligence, Surveillance, and Reconnaissance (ISR) segment leads the market, driven by the increasing need for real-time data, situational awareness, and threat detection in military operations. Enhanced data analytics, secure information sharing, and the deployment of advanced sensor networks are further accelerating demand for ISR applications. Electronic warfare and cybersecurity are also gaining prominence due to the rising incidence of cyberattacks and the need for resilient defense networks .

Qatar C4ISR Market Competitive Landscape

The Qatar C4ISR Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales Group, Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, Elbit Systems Ltd., Leonardo S.p.A., General Dynamics Corporation, L3Harris Technologies Inc., Saab AB, Rheinmetall AG, Airbus Defence and Space, Kongsberg Gruppen ASA, QinetiQ Group plc, Hensoldt AG contribute to innovation, geographic expansion, and service delivery in this space.

Qatar C4ISR Market Industry Analysis

Growth Drivers

- Increasing Defense Budgets:Qatar's defense budget is projected to reach approximately $11 billion in future, reflecting a 5% increase from previous years. This rise is driven by the nation's commitment to enhancing its military capabilities amid regional tensions. The government aims to modernize its armed forces, focusing on advanced C4ISR systems to improve situational awareness and operational efficiency. This financial commitment underscores the strategic importance of defense in Qatar's national security policy.

- Technological Advancements in Surveillance:The global C4ISR market is witnessing significant technological advancements, particularly in surveillance systems. Qatar is investing heavily in cutting-edge technologies, with an estimated $1.5 billion allocated for surveillance upgrades in future. Innovations such as drones and satellite systems are enhancing real-time data collection and analysis capabilities, enabling Qatar to maintain a competitive edge in regional security dynamics and respond effectively to emerging threats.

- Rising Geopolitical Tensions:The geopolitical landscape in the Middle East remains volatile, with ongoing conflicts and territorial disputes. Qatar's strategic location necessitates robust defense mechanisms, prompting an increase in C4ISR investments. In future, the country is expected to allocate around $3 billion specifically for intelligence and reconnaissance capabilities. This focus on enhancing situational awareness is crucial for national security and regional stability, driving demand for advanced C4ISR solutions.

Market Challenges

- High Initial Investment Costs:The implementation of advanced C4ISR systems requires substantial initial investments, often exceeding $500 million for comprehensive solutions. This financial barrier can deter smaller defense contractors and limit participation in the market. Additionally, the long-term nature of returns on investment can pose challenges for stakeholders, making it essential for Qatar to balance immediate costs with future operational benefits to ensure sustainable growth in the sector.

- Regulatory Compliance Issues:Navigating the complex regulatory landscape poses significant challenges for C4ISR market participants in Qatar. Compliance with stringent export control regulations and defense procurement policies can delay project timelines and increase operational costs. In future, the government is expected to enhance regulatory frameworks, which may require additional resources for companies to ensure adherence, potentially impacting their ability to innovate and respond to market demands effectively.

Qatar C4ISR Market Future Outlook

The future of the Qatar C4ISR market appears promising, driven by ongoing investments in technology and infrastructure. As the nation continues to prioritize defense modernization, the integration of artificial intelligence and machine learning into C4ISR systems will enhance operational capabilities. Furthermore, collaboration with international defense firms is expected to foster innovation and knowledge transfer, positioning Qatar as a regional leader in advanced defense solutions while addressing emerging security challenges effectively.

Market Opportunities

- Expansion of Smart City Initiatives:Qatar's commitment to smart city projects presents significant opportunities for C4ISR integration. With an investment of $2 billion in smart infrastructure planned for future, the incorporation of advanced surveillance and data analytics will enhance urban security and operational efficiency, creating a synergistic effect that benefits both defense and civilian sectors.

- Development of Cybersecurity Solutions:As cyber threats escalate, the demand for robust cybersecurity solutions within C4ISR frameworks is increasing. Qatar is expected to invest approximately $500 million in cybersecurity initiatives in future, focusing on protecting critical defense infrastructure. This investment will not only safeguard national security but also stimulate growth in the cybersecurity sector, fostering innovation and collaboration among local and international firms.