Region:North America

Author(s):Dev

Product Code:KRAD5289

Pages:91

Published On:December 2025

Testing Market.png)

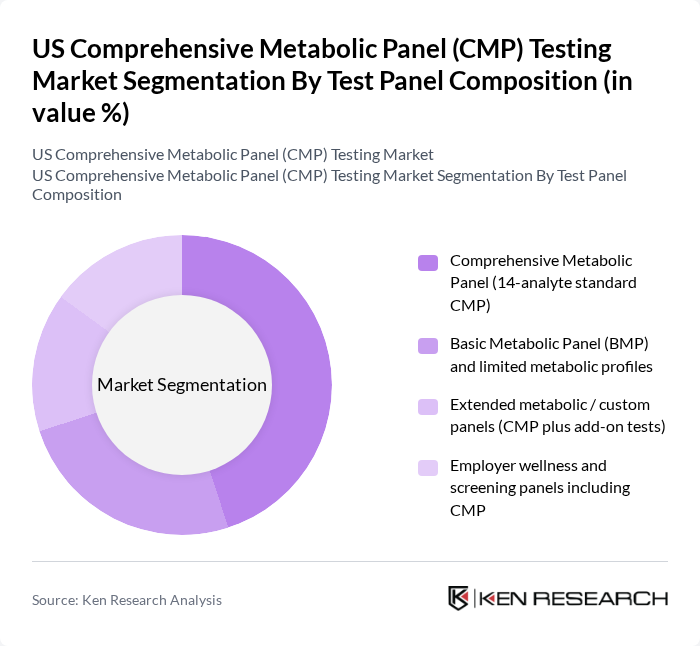

By Test Panel Composition:The test panel composition segment includes various types of metabolic panels that cater to different diagnostic needs. The Comprehensive Metabolic Panel (14-analyte standard CMP) is the most widely used due to its extensive range of tests that provide critical information about a patient's metabolic state. The Basic Metabolic Panel (BMP) and limited metabolic profiles are also popular for routine screenings, while Extended metabolic/custom panels offer tailored testing options for specific patient needs. Employer wellness and screening panels are gaining traction as companies focus on employee health.

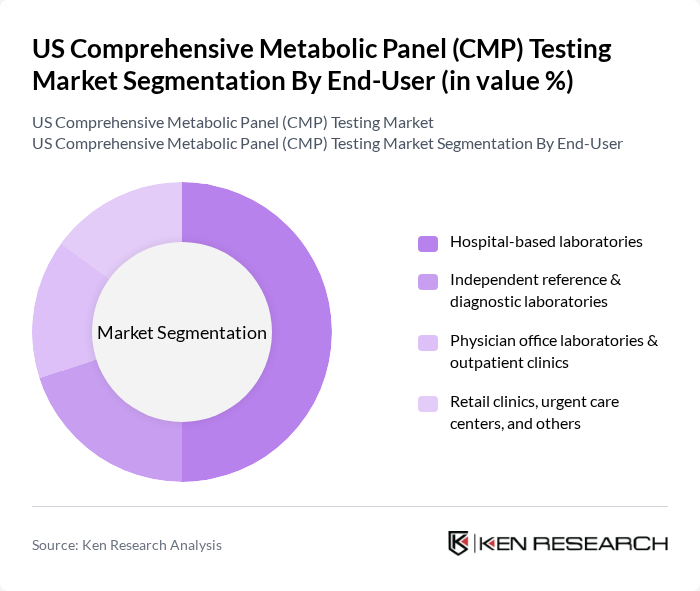

By End-User:The end-user segment encompasses various healthcare settings where CMP testing is conducted. Hospital-based laboratories are the largest segment, driven by the high volume of tests performed in acute care settings. Independent reference and diagnostic laboratories are also significant players, offering specialized testing services. Physician office laboratories and outpatient clinics are increasingly adopting CMP testing for convenience and immediate results, while retail clinics and urgent care centers are expanding their testing capabilities to meet patient demand.

The US Comprehensive Metabolic Panel (CMP) Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (Labcorp), Sonic Healthcare USA, BioReference Health, LLC (an OPKO Health company), Mayo Clinic Laboratories, ARUP Laboratories, Abbott Laboratories (Core Laboratory Diagnostics), Roche Diagnostics Corporation, Siemens Healthineers (including Atellica Solution platforms), Beckman Coulter, Inc. (a Danaher company), Thermo Fisher Scientific Inc., Ortho Clinical Diagnostics (QuidelOrtho Corporation), Bio-Rad Laboratories, Inc., Hologic, Inc., Everly Health, Inc. (including Everlywell direct-to-consumer testing) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the CMP testing market appears promising, driven by ongoing advancements in technology and a shift towards value-based care. As healthcare providers increasingly adopt patient-centric approaches, the demand for comprehensive testing solutions is expected to rise. Additionally, the integration of artificial intelligence in diagnostic processes is anticipated to enhance accuracy and efficiency, further propelling market growth. The focus on preventive healthcare will likely continue to drive the adoption of CMP testing as a standard practice in routine health assessments.

| Segment | Sub-Segments |

|---|---|

| By Test Panel Composition | Comprehensive Metabolic Panel (14-analyte standard CMP) Basic Metabolic Panel (BMP) and limited metabolic profiles Extended metabolic / custom panels (CMP plus add-on tests) Employer wellness and screening panels including CMP |

| By End-User | Hospital-based laboratories Independent reference & diagnostic laboratories Physician office laboratories & outpatient clinics Retail clinics, urgent care centers, and others |

| By Testing Setting | Centralized high-throughput core laboratories Point-of-care testing settings At-home and remote sample collection services Others |

| By Sample Type | Venous blood serum / plasma Capillary blood (fingerstick) for CMP-compatible devices Alternative specimens used in metabolic profiling Others |

| By Ordering Channel | Physician-ordered tests (in-network) Direct-to-consumer (DTC) & self-pay channels Employer-sponsored and wellness program testing Others |

| By US Region | Northeast Midwest South West |

| By Reimbursement & Payer Mix | Medicare & Medicaid-covered CMP testing Commercial insurance-covered CMP testing Self-pay and uninsured patient testing Value-based contracts and capitated arrangements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Outpatient Clinics | 90 | Healthcare Providers, Nurse Practitioners |

| Diagnostic Laboratories | 70 | Operations Managers, Quality Assurance Officers |

| Health Insurance Companies | 60 | Policy Analysts, Claims Managers |

| Patient Advocacy Groups | 50 | Patient Representatives, Health Educators |

The US Comprehensive Metabolic Panel (CMP) Testing Market is valued at approximately USD 5.3 billion, reflecting a significant growth driven by the rising prevalence of chronic diseases and advancements in laboratory diagnostics.