Region:North America

Author(s):Shubham

Product Code:KRAD6816

Pages:84

Published On:December 2025

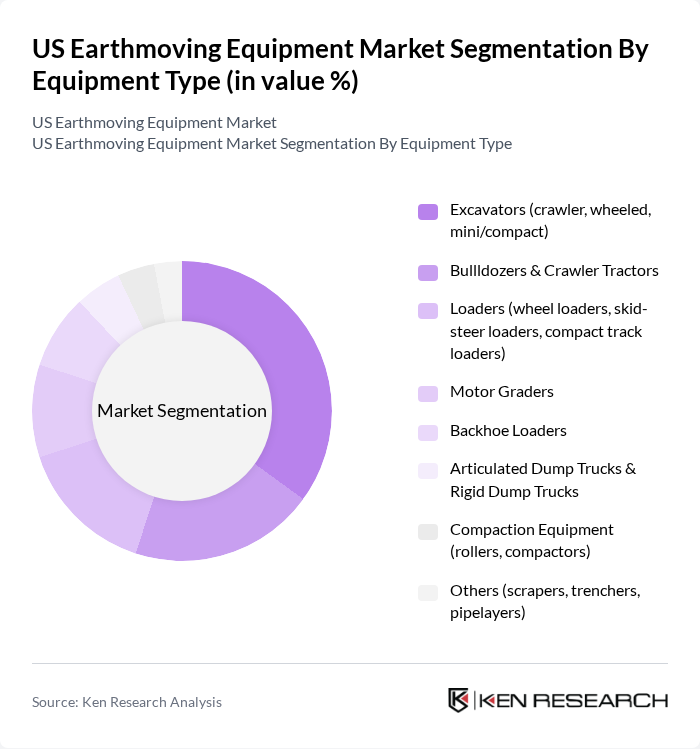

By Equipment Type:The equipment type segmentation includes various categories such as excavators, bulldozers, loaders, motor graders, backhoe loaders, articulated dump trucks, compaction equipment, and others. Each of these subsegments plays a crucial role in the earthmoving equipment market, with excavators being particularly dominant due to their versatility in digging, lifting, trenching, and material?handling applications across construction, mining, utilities, and industrial projects.

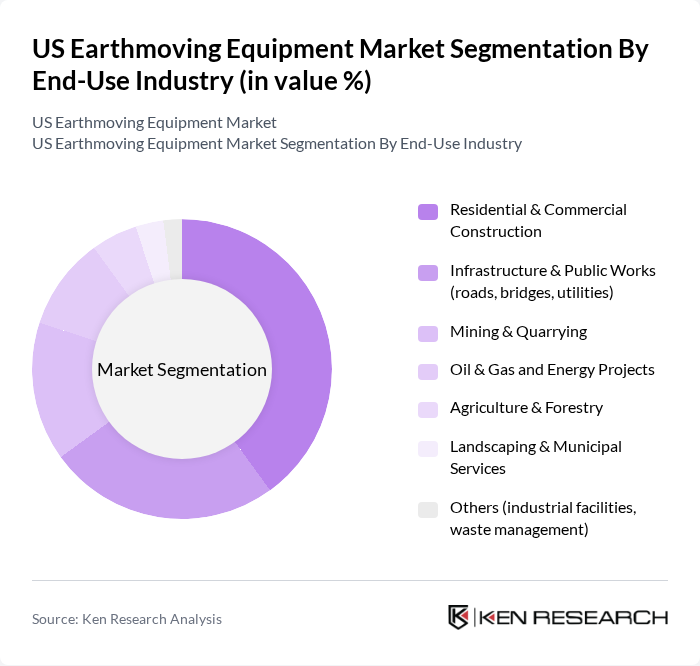

By End-Use Industry:The end-use industry segmentation encompasses residential and commercial construction, infrastructure and public works, mining and quarrying, oil and gas, agriculture and forestry, landscaping, and municipal services. The residential and commercial construction sector is the leading segment, driven by ongoing urban development, warehouse and manufacturing plant construction, and housing demand, while infrastructure and public works are increasingly supported by federal and state funding programs that prioritize roads, bridges, transit, utilities, and renewable energy projects.

The US Earthmoving Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Deere & Company (John Deere Construction & Forestry), Komatsu America Corp., Volvo Construction Equipment North America, Inc., Hitachi Construction Machinery Americas Inc., CNH Industrial – CASE Construction Equipment, CNH Industrial – New Holland Construction, Doosan Infracore North America (DEVELON), JCB Inc., Liebherr USA, Co., SANY America, Inc., Bobcat Company, Wacker Neuson America Corporation, Takeuchi US, and Kubota Tractor Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US earthmoving equipment market is poised for significant transformation, driven by technological advancements and increasing infrastructure investments. As the demand for sustainable construction practices grows, companies are likely to adopt electric and hybrid machinery, aligning with environmental regulations. Furthermore, the integration of automation and IoT technologies will enhance operational efficiency, making equipment more attractive to contractors. Overall, these trends indicate a dynamic market landscape that will evolve to meet the changing needs of the construction industry.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Excavators (crawler, wheeled, mini/compact) Bulldozers & Crawler Tractors Loaders (wheel loaders, skid-steer loaders, compact track loaders) Motor Graders Backhoe Loaders Articulated Dump Trucks & Rigid Dump Trucks Compaction Equipment (rollers, compactors) Others (scrapers, trenchers, pipelayers) |

| By End-Use Industry | Residential & Commercial Construction Infrastructure & Public Works (roads, bridges, utilities) Mining & Quarrying Oil & Gas and Energy Projects Agriculture & Forestry Landscaping & Municipal Services Others (industrial facilities, waste management) |

| By Application | Excavation & Site Preparation Earthmoving & Grading Material Loading & Hauling Demolition & Recycling Road & Highway Construction Snow Removal & Maintenance Others |

| By Propulsion / Fuel Type | Diesel CNG/LNG/RNG and Other Alternative Fuels Hybrid (diesel-electric) Battery Electric |

| By Operating Weight / Size Class | Compact Equipment (< 6 tons) Medium Equipment (6–30 tons) Heavy Equipment (> 30 tons) |

| By Ownership Model / Distribution Channel | Direct OEM Sales Authorized Dealers / Distributors Rental & Leasing Companies Online & Digital Channels Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental | 120 | Rental Managers, Business Development Executives |

| Heavy Machinery Sales | 100 | Sales Managers, Product Line Directors |

| Infrastructure Development Projects | 80 | Project Managers, Civil Engineers |

| Mining Equipment Usage | 70 | Operations Managers, Site Supervisors |

| Government Infrastructure Initiatives | 60 | Policy Makers, Economic Development Officers |

The US Earthmoving Equipment Market is valued at approximately USD 13 billion, making it the largest segment within the broader US heavy construction equipment market. This valuation reflects a five-year historical analysis and is driven by increased infrastructure investments and construction activities.