Region:North America

Author(s):Geetanshi

Product Code:KRAD4844

Pages:84

Published On:December 2025

Market.png)

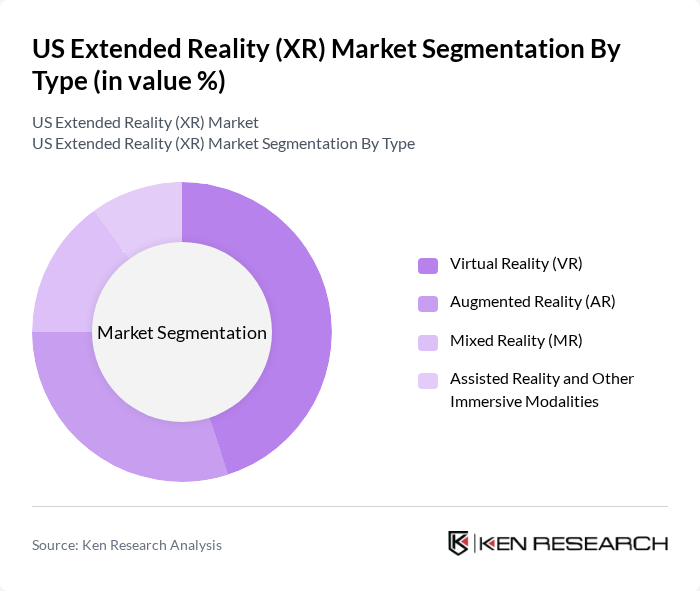

By Type:The XR market can be segmented into four main types: Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), and Assisted Reality and Other Immersive Modalities. Among these, VR has emerged as the leading sub-segment in terms of consumer revenue, owing to its extensive applications in gaming, simulation, and location?based entertainment, supported by the widespread availability of standalone VR headsets and rich gaming ecosystems. AR and MR are rapidly scaling on the enterprise side for remote assistance, field service, design collaboration, and training, while assisted reality and other immersive modalities are seeing growing use in hands?free industrial workflows and specialized professional environments.

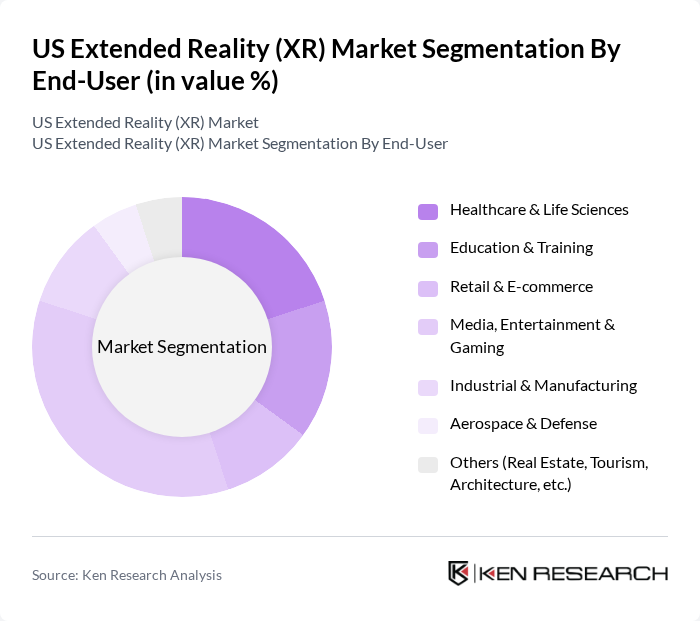

By End-User:The XR market is further segmented by end-user applications, including Healthcare & Life Sciences, Education & Training, Retail & E-commerce, Media, Entertainment & Gaming, Industrial & Manufacturing, Aerospace & Defense, and Others. The Media, Entertainment & Gaming sector is currently the dominant end-user, supported by strong consumer spending on immersive gaming, social VR, and virtual events, alongside the integration of XR into streaming, sports, and location?based entertainment experiences. At the same time, enterprise?oriented segments such as Healthcare & Life Sciences and Education & Training are expanding quickly as organizations deploy XR for surgical simulation, mental health therapies, medical visualization, workforce upskilling, remote collaboration, and virtual classrooms.

The US Extended Reality (XR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Meta Quest), Apple Inc. (Apple Vision Pro), Microsoft Corporation (HoloLens & Mesh), Sony Group Corporation (PlayStation VR), HTC Corporation (Vive), Samsung Electronics Co., Ltd., Alphabet Inc. (Google), Qualcomm Technologies, Inc., NVIDIA Corporation, Unity Technologies, Epic Games, Inc. (Unreal Engine), Magic Leap, Inc., Niantic, Inc., PTC Inc. (Vuforia), Varjo Technologies Oy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US XR market appears promising, driven by technological advancements and increasing integration into everyday life. As remote work continues to rise, XR solutions are expected to enhance collaboration and productivity. Furthermore, the integration of AI and machine learning will likely lead to more personalized and adaptive XR experiences. These trends indicate a robust growth trajectory, with significant investments anticipated in content creation and application development, fostering innovation and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Reality (VR) Augmented Reality (AR) Mixed Reality (MR) Assisted Reality and Other Immersive Modalities |

| By End-User | Healthcare & Life Sciences Education & Training Retail & E-commerce Media, Entertainment & Gaming Industrial & Manufacturing Aerospace & Defense Others (Real Estate, Tourism, Architecture, etc.) |

| By Industry | Gaming & Esports Automotive & Transportation Real Estate & Construction Industrial & Manufacturing Defense, Public Safety & First Responders Healthcare & Medical Devices Others |

| By Device Type | Head-Mounted Displays (PC/Console VR, Standalone VR, MR Headsets) AR Smart Glasses & Head-Up Displays Mobile- and Tablet-Based XR Spatial & Projection-Based Systems Others (Peripherals, Haptics, Sensors) |

| By Content Type | Gaming & Interactive Entertainment Content Training & Simulation Content Design, Visualization & Collaboration Content Marketing, Advertising & Retail Experiences Educational & EdTech Content Others |

| By Distribution Channel | OEM & Brand Online Stores Third-Party E-commerce Platforms Consumer Electronics & Specialty Retail Stores Enterprise Direct & Channel Partners Others |

| By Geographic Distribution | Northeast West Midwest South Others (Multi-State / National Deployments) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare XR Applications | 120 | Medical Professionals, Healthcare Administrators |

| Education and Training Solutions | 90 | Educators, Training Coordinators |

| Gaming and Entertainment Sector | 130 | Game Developers, Content Creators |

| Corporate Training Programs | 100 | HR Managers, Learning & Development Specialists |

| Retail and E-commerce XR Integration | 80 | Retail Managers, E-commerce Strategists |

The US Extended Reality (XR) Market is valued at approximately USD 75 billion, reflecting significant growth driven by advancements in immersive technologies and increased adoption across various sectors, including gaming, healthcare, and enterprise training.