Region:Global

Author(s):Geetanshi

Product Code:KRAD4170

Pages:92

Published On:December 2025

Market.png)

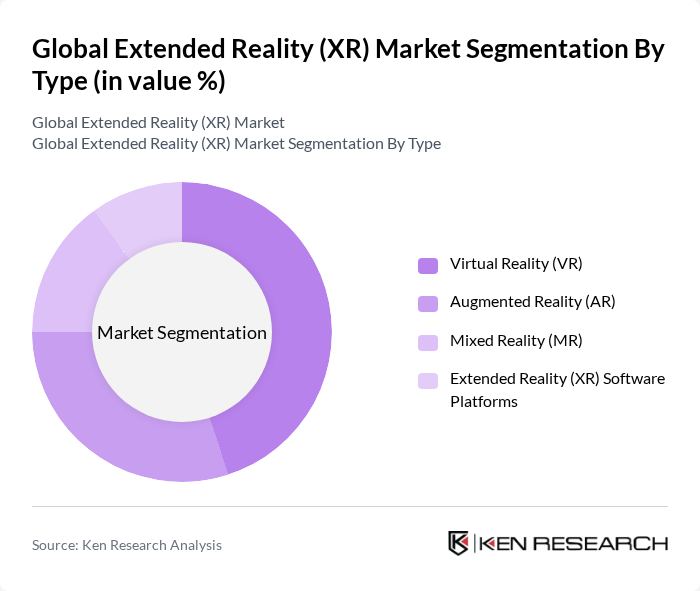

By Type:The XR market is segmented into four main types: Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), and Extended Reality (XR) Software Platforms. VR and AR together account for the majority of spending, with VR particularly strong in consumer gaming and location-based entertainment, and AR widely adopted for enterprise use cases such as remote assistance, maintenance, and visualization. Virtual Reality (VR) is currently a leading segment in consumer applications, driven by its extensive use in gaming, immersive media, and simulation-based training. Augmented Reality (AR) follows closely and shows particularly strong momentum in industrial, retail, and field-service scenarios, where it enhances customer engagement, in-store and online product visualization, and worker productivity through real?time digital overlays.

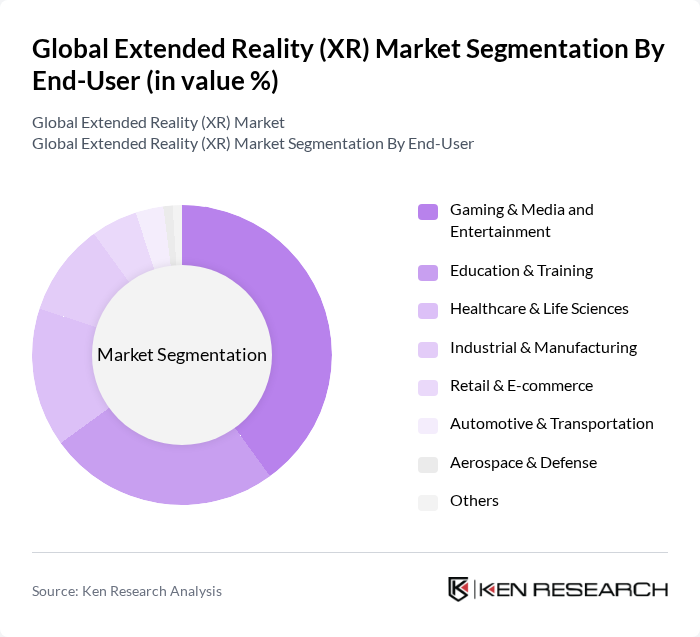

By End-User:The XR market is further segmented by end-user applications, including Gaming & Media and Entertainment, Education & Training, Healthcare & Life Sciences, Industrial & Manufacturing, Retail & E-commerce, Automotive & Transportation, Aerospace & Defense, and Others. Gaming & Media and Entertainment is a leading segment, supported by strong consumer demand for immersive gaming, virtual concerts, and experiential content on VR and AR platforms. Education & Training is also a significant and rapidly growing segment, as schools, universities, enterprises, and defense organizations increasingly adopt XR for interactive learning, skills training, simulation, and remote collaboration, improving knowledge retention and reducing training costs. Healthcare & Life Sciences, Industrial & Manufacturing, and Automotive & Transportation are expanding use cases for XR in surgical planning, therapy, digital twins, product design, and operator guidance, further broadening the technology’s end?user base.

The Global Extended Reality (XR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc., Microsoft Corporation, Sony Group Corporation, HTC Corporation, NVIDIA Corporation, Unity Technologies, Inc., Epic Games, Inc., Google LLC, Apple Inc., PTC Inc., Varjo Technologies Oy, Magic Leap, Inc., VIVEPORT (HTC Corporation), Snap Inc., and Niantic, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the XR market appears promising, with significant advancements expected in both technology and application. As hardware becomes more affordable and user-friendly, adoption rates are likely to increase across various sectors. Additionally, the integration of AI and machine learning will enhance XR experiences, making them more personalized and effective. Companies are expected to invest heavily in XR training programs, further solidifying its role in professional development and collaboration, thus driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Virtual Reality (VR) Augmented Reality (AR) Mixed Reality (MR) Extended Reality (XR) Software Platforms |

| By End-User | Gaming & Media and Entertainment Education & Training Healthcare & Life Sciences Industrial & Manufacturing Retail & E-commerce Automotive & Transportation Aerospace & Defense Others |

| By Application | Training, Simulation & Skills Development Marketing, Advertising & Experiential Commerce Gaming & Interactive Entertainment Remote Collaboration & Assistance Design, Prototyping & Digital Twins Field Service & Maintenance Others |

| By Device | Head-Mounted Displays (HMDs) Handheld & Mobile Devices Smart Glasses & Smart Viewers Spatial Computing Devices & XR Hubs Others |

| By Industry Vertical | Gaming & Entertainment Automotive Real Estate & Architecture, Engineering and Construction (AEC) Retail & Consumer Goods Healthcare Education Aerospace & Defense Industrial & Manufacturing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By User Experience | Fully Immersive Experiences Semi-Immersive & Assisted Experiences Non-Immersive & Companion Experiences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gaming Industry Adoption of XR | 120 | Game Developers, Product Managers |

| Healthcare XR Applications | 90 | Medical Professionals, Healthcare Administrators |

| Education Sector XR Integration | 80 | Educators, Curriculum Developers |

| Corporate Training Solutions | 70 | HR Managers, Training Coordinators |

| Virtual Tourism Experiences | 60 | Travel Industry Executives, Marketing Directors |

The Global Extended Reality (XR) Market is valued at approximately USD 250 billion, driven by advancements in technology, increased adoption in enterprise workflows, and rising demand for immersive experiences across various sectors such as entertainment and education.