Region:North America

Author(s):Dev

Product Code:KRAC8745

Pages:97

Published On:November 2025

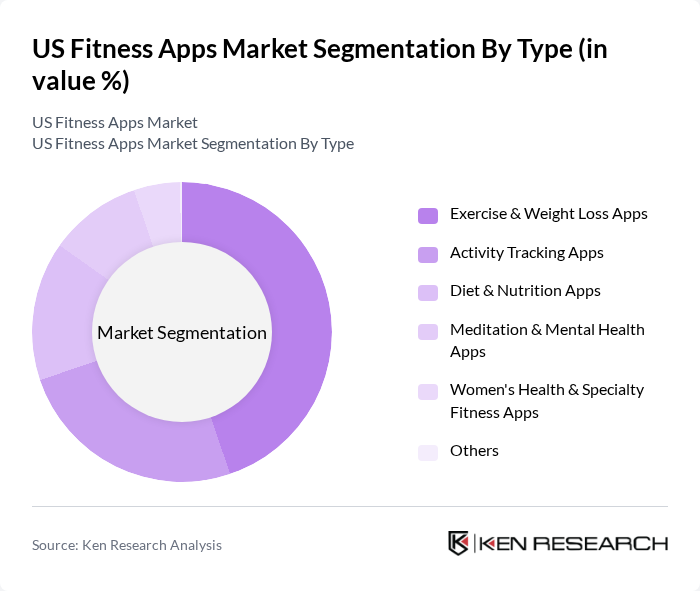

By Type:The fitness apps market can be segmented into various types, including Exercise & Weight Loss Apps, Activity Tracking Apps, Diet & Nutrition Apps, Meditation & Mental Health Apps, Women's Health & Specialty Fitness Apps, and Others. Among these, Exercise & Weight Loss Apps have emerged as the dominant segment, driven by the increasing focus on weight management and fitness among consumers. The popularity of these apps is further fueled by social media trends and the influence of fitness influencers, making them a preferred choice for users seeking effective workout solutions. The exercise and weight loss segment is projected to grow at a CAGR of 12.5%, while activity tracking is anticipated to expand at 14.9%.

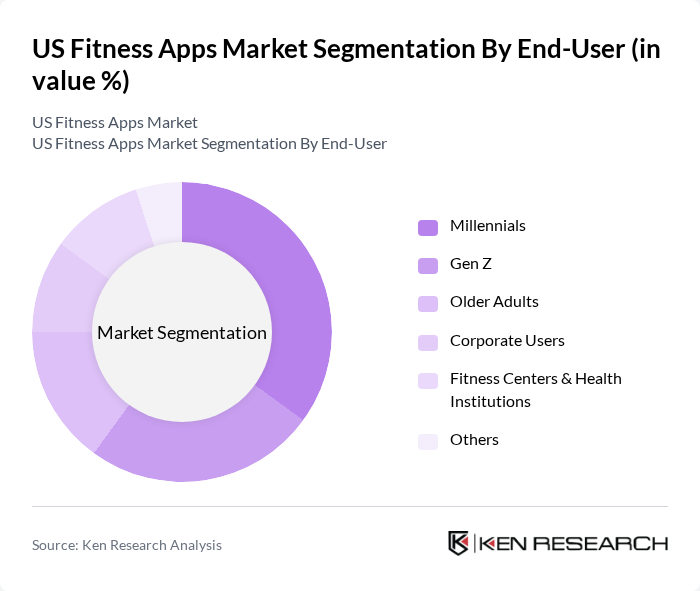

By End-User:The end-user segmentation of the fitness apps market includes Millennials, Gen Z, Older Adults, Corporate Users, Fitness Centers & Health Institutions, and Others. Millennials represent the largest user group, driven by their tech-savvy nature and a strong inclination towards health and fitness. This demographic is particularly engaged with fitness apps that offer personalized experiences and social sharing features, making them a key target for app developers.

The US Fitness Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal (Under Armour, Inc.), Fitbit (Google LLC), Strava, Inc., Nike Training Club (Nike, Inc.), Peloton Interactive, Inc., MapMyRun (Under Armour, Inc.), JEFIT, Inc., 8fit GmbH, Sworkit (Nexercise, Inc.), Aaptiv Inc., Fitbod (Fitbod Inc.), Freeletics GmbH, Daily Burn (IAC/InterActiveCorp), Centr (Centr Group Operations Pty Ltd), Tone It Up (Tone It Up, LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The US fitness apps market is poised for continued evolution, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning will enhance personalization, making fitness solutions more effective and engaging. Additionally, the growing emphasis on mental health and wellness will lead to the incorporation of holistic approaches within fitness apps, catering to a broader audience. As corporate wellness programs expand, fitness apps will increasingly become integral to employee health initiatives, further solidifying their market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Exercise & Weight Loss Apps Activity Tracking Apps Diet & Nutrition Apps Meditation & Mental Health Apps Women's Health & Specialty Fitness Apps Others |

| By End-User | Millennials Gen Z Older Adults Corporate Users Fitness Centers & Health Institutions Others |

| By Subscription Model | Freemium Monthly Subscription Annual Subscription One-Time Purchase Others |

| By Device Compatibility | Smartphone Apps Tablet Apps Wearable Device Apps Smart TV Apps Others |

| By Geographic Distribution | Northeast Midwest South West Urban Areas Suburban Areas Rural Areas Others |

| By Fitness Goals | Weight Loss Muscle Gain Endurance Training General Fitness Specialized Diets (e.g., Keto, Vegan) Others |

| By User Demographics | Age Groups Gender Fitness Levels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness App User Demographics | 120 | Active Users, Casual Users, Non-Users |

| Market Trends in Fitness Apps | 75 | Industry Analysts, Market Researchers |

| Consumer Preferences in Fitness Apps | 100 | Fitness Enthusiasts, Health Coaches |

| Impact of Technology on Fitness | 65 | Tech Developers, Fitness Trainers |

| Subscription Models and Pricing | 85 | Product Managers, Marketing Executives |

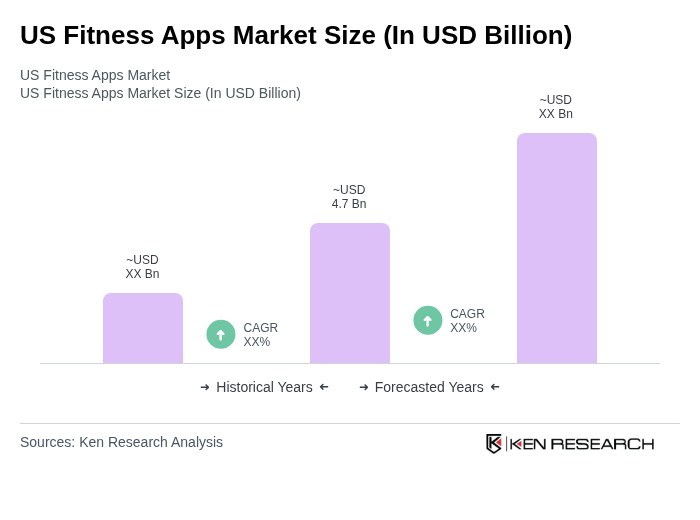

The US Fitness Apps Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by smartphone adoption, health consciousness, and personalized fitness solutions. This market is expected to continue evolving as consumer demand for fitness tracking and health management increases.