Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3721

Pages:99

Published On:November 2025

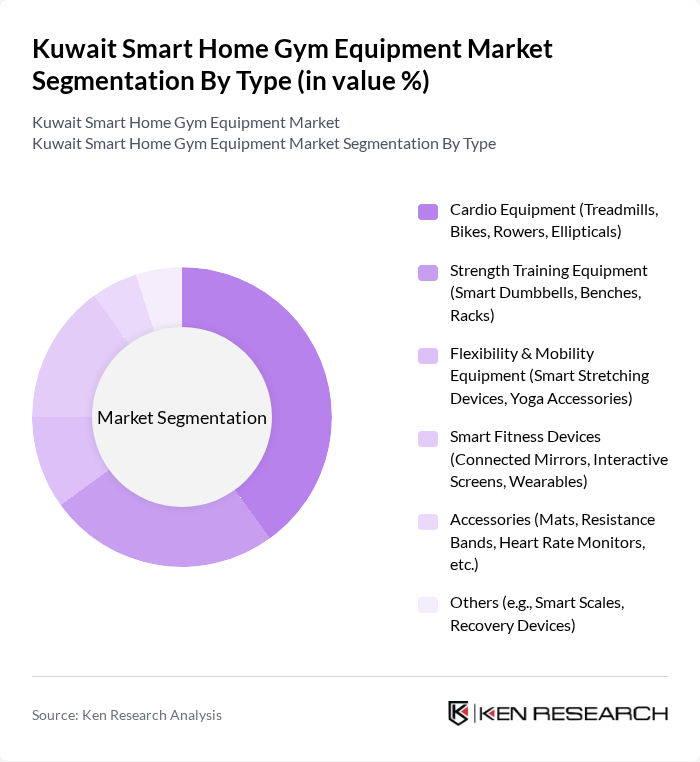

By Type:The market is segmented into cardio equipment, strength training equipment, flexibility and mobility equipment, smart fitness devices, accessories, and others. Cardio equipment leads the market, driven by high demand for treadmills, bikes, and ellipticals, as consumers prioritize cardiovascular health and efficient home workouts. The adoption of smart features, such as app integration and performance tracking, further enhances the appeal of these products. Strength training equipment and smart fitness devices are also experiencing robust growth, reflecting a broader shift toward comprehensive home fitness solutions .

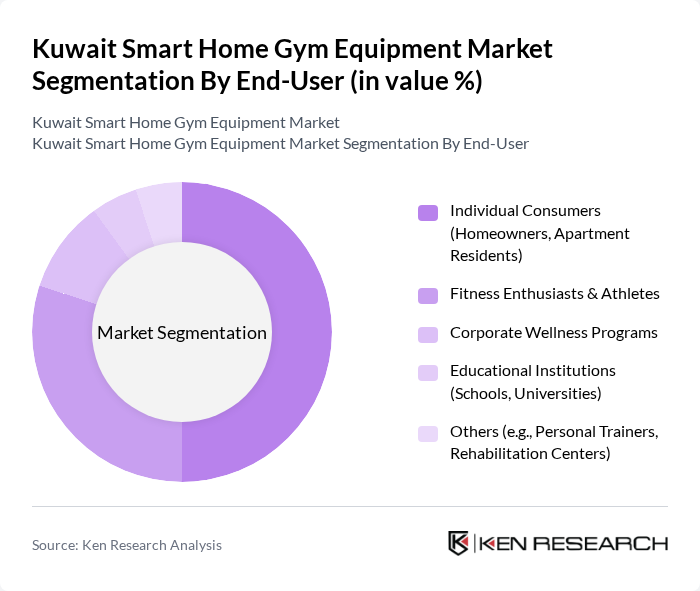

By End-User:End-user segmentation includes individual consumers, fitness enthusiasts and athletes, corporate wellness programs, educational institutions, and others. Individual consumers constitute the largest segment, reflecting the growing trend of home fitness and the convenience of personalized gym equipment. This segment encompasses a wide range of users, from casual exercisers to dedicated fitness enthusiasts, all seeking tailored and technology-enabled solutions for their fitness needs. Corporate wellness programs and educational institutions are also contributing to market growth as organizations increasingly invest in employee and student well-being .

The Kuwait Smart Home Gym Equipment Market features a dynamic mix of regional and international players. Leading participants such as Technogym S.p.A., Life Fitness (Brunswick Corporation), Precor Incorporated, NordicTrack (ICON Health & Fitness, now iFIT Health & Fitness Inc.), Bowflex Inc. (Nautilus, Inc.), Peloton Interactive, Inc., ProForm (iFIT Health & Fitness Inc.), Sole Fitness, Schwinn Fitness (Nautilus, Inc.), Cybex International (Life Fitness), Octane Fitness (Nautilus, Inc.), Matrix Fitness (Johnson Health Tech Co., Ltd.), Hammer Strength (Life Fitness), Echelon Fitness, and Vision Fitness (Johnson Health Tech Co., Ltd.) drive innovation, geographic expansion, and service delivery in this market.

The future of the Kuwait smart home gym equipment market appears promising, driven by increasing health awareness and technological advancements. As more consumers prioritize fitness, the demand for innovative solutions is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to smart equipment. With a projected increase in disposable income and a growing trend towards home fitness, the market is likely to witness significant growth in the coming years, fostering a healthier lifestyle among Kuwaitis.

| Segment | Sub-Segments |

|---|---|

| By Type | Cardio Equipment (Treadmills, Bikes, Rowers, Ellipticals) Strength Training Equipment (Smart Dumbbells, Benches, Racks) Flexibility & Mobility Equipment (Smart Stretching Devices, Yoga Accessories) Smart Fitness Devices (Connected Mirrors, Interactive Screens, Wearables) Accessories (Mats, Resistance Bands, Heart Rate Monitors, etc.) Others (e.g., Smart Scales, Recovery Devices) |

| By End-User | Individual Consumers (Homeowners, Apartment Residents) Fitness Enthusiasts & Athletes Corporate Wellness Programs Educational Institutions (Schools, Universities) Others (e.g., Personal Trainers, Rehabilitation Centers) |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Specialty Stores, Hypermarkets) Direct Sales (Brand Showrooms, Local Distributors) Fitness Equipment Rental Services Others (e.g., Marketplace Apps) |

| By Brand Positioning | Premium Brands Mid-Range Brands Budget Brands Others |

| By Product Features | Smart Connectivity (Wi-Fi, Bluetooth, App Integration) User-Friendly Interfaces (Touchscreens, Voice Control) Customizable Workouts (AI/ML-based Personalization) Others (e.g., AR/VR Integration, Real-Time Feedback) |

| By Age Group | Youth (Under 25) Adults (25-45) Seniors (45 and above) Others |

| By Fitness Goals | Weight Loss Muscle Building General Fitness Rehabilitation & Recovery Others (e.g., Sports Performance, Stress Relief) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Gym Equipment Users | 120 | Fitness Enthusiasts, Homeowners |

| Fitness Equipment Retailers | 60 | Store Managers, Sales Representatives |

| Health and Fitness Trainers | 50 | Personal Trainers, Group Fitness Instructors |

| Smart Technology Developers | 40 | Product Managers, R&D Specialists |

| Health and Wellness Influencers | 40 | Social Media Influencers, Bloggers |

The Kuwait Smart Home Gym Equipment Market is valued at approximately USD 150 million, reflecting a growing trend towards home fitness solutions driven by health consciousness and technological advancements in fitness equipment.