Region:North America

Author(s):Shubham

Product Code:KRAD6812

Pages:100

Published On:December 2025

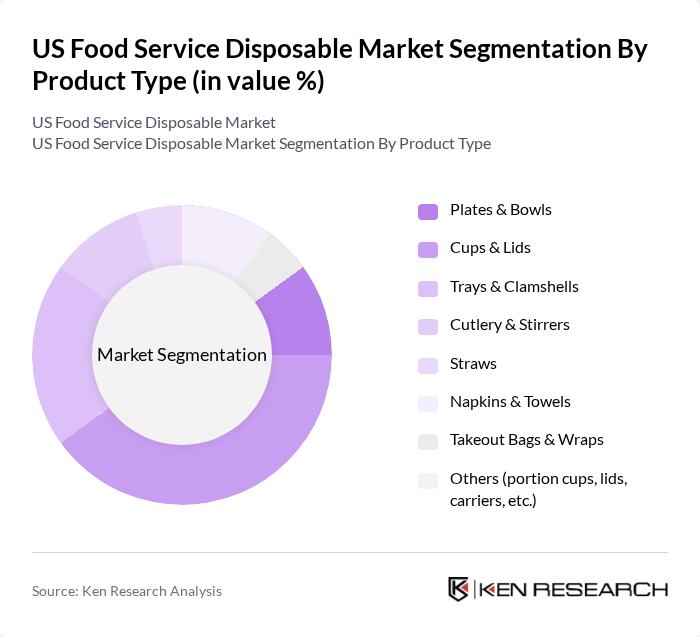

By Product Type:The product type segmentation includes various categories such as plates & bowls, cups & lids, trays & clamshells, cutlery & stirrers, straws, napkins & towels, takeout bags & wraps, and others. Among these, cups & lids are currently leading the market due to the growing popularity of beverages on-the-go and the increasing number of coffee shops and quick-service restaurants. The convenience of single-use cups, especially in the context of takeaway services, has made them a staple in the food service industry.

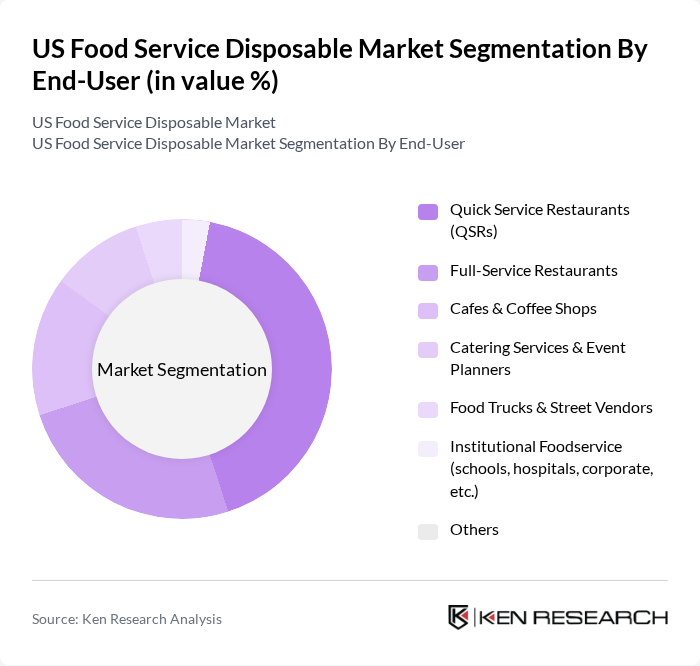

By End-User:The end-user segmentation encompasses quick service restaurants (QSRs), full-service restaurants, cafes & coffee shops, catering services & event planners, food trucks & street vendors, institutional foodservice (schools, hospitals, corporate, etc.), and others. Quick service restaurants are the dominant segment, driven by the increasing consumer preference for fast food and convenience. The rise of delivery apps has also contributed to the growth of this segment, as QSRs adapt to meet the demand for takeout and delivery options.

The US Food Service Disposable Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dart Container Corporation, Huhtamaki Oyj, Berry Global Group, Inc., Pactiv Evergreen Inc., Genpak, LLC, International Paper Company, Novolex Holdings, LLC, Reynolds Consumer Products Inc., Eco-Products, Inc., BioPak Pty Ltd, Packnwood (First Pack LLC), AEP Industries Inc. (a subsidiary of Berry Global Group, Inc.), WinCup, Inc., Sabert Corporation, Vegware Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The US food service disposable market is poised for transformation as sustainability becomes a central focus. With increasing consumer demand for eco-friendly products, businesses are likely to invest in biodegradable and compostable materials. Additionally, the rise of online food ordering platforms will continue to drive the need for innovative packaging solutions. As regulatory pressures mount, companies that adapt to these trends will not only comply with regulations but also enhance their brand reputation and customer loyalty in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Plates & Bowls Cups & Lids Trays & Clamshells Cutlery & Stirrers Straws Napkins & Towels Takeout Bags & Wraps Others (portion cups, lids, carriers, etc.) |

| By End-User | Quick Service Restaurants (QSRs) Full-Service Restaurants Cafes & Coffee Shops Catering Services & Event Planners Food Trucks & Street Vendors Institutional Foodservice (schools, hospitals, corporate, etc.) Others |

| By Material | Plastic (conventional & recycled) Paper & Paperboard Fiber-based & Molded Pulp Bioplastics (PLA, PHA, etc.) Foamed Polymers Others |

| By Distribution Channel | Direct Sales (manufacturers to chains) Foodservice Distributors & Wholesalers Cash & Carry / Cash-and-Carry Retail Online B2B Platforms Others |

| By Region | Northeast Midwest South West |

| By Application | On-premise Dine-in Service Takeaway / Carry-out Online Food Delivery & Aggregator Platforms Catering & Events Beverage Service (hot & cold) Others |

| By Sustainability Attribute | Conventional Single-use Disposables Recyclable Disposables Compostable & Biodegradable Disposables Recycled-content Disposables Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Quick Service Restaurants | 120 | Restaurant Owners, Operations Managers |

| Catering Services | 100 | Catering Managers, Event Coordinators |

| Food Trucks and Mobile Vendors | 80 | Food Truck Owners, Vendor Operators |

| Institutional Food Services | 70 | Facility Managers, Procurement Officers |

| Consumer Preferences for Disposable Products | 100 | General Consumers, Food Service Patrons |

The US Food Service Disposable Market is valued at approximately USD 18 billion. This growth is driven by increased demand for convenience, particularly in takeout and delivery services, and heightened consumer preference for hygiene due to the COVID-19 pandemic.