Region:North America

Author(s):Dev

Product Code:KRAD7647

Pages:92

Published On:December 2025

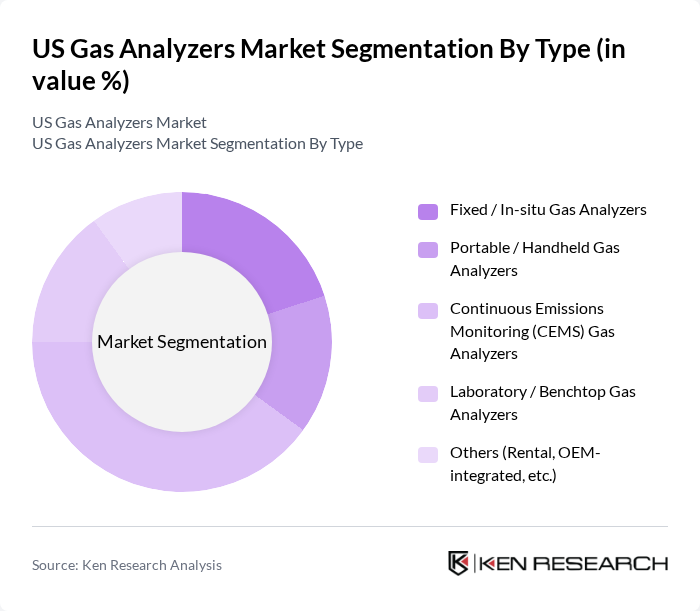

By Type:

The segmentation by type includes Fixed / In-situ Gas Analyzers, Portable / Handheld Gas Analyzers, Continuous Emissions Monitoring (CEMS) Gas Analyzers, Laboratory / Benchtop Gas Analyzers, and Others (Rental, OEM-integrated, etc.). Among these, Continuous Emissions Monitoring (CEMS) Gas Analyzers are dominating the market due to their critical role in regulatory compliance and environmental monitoring. The increasing focus on reducing emissions and improving air quality has led to a surge in demand for CEMS, particularly in industries such as oil and gas, power generation, and manufacturing. The trend towards automation and real-time monitoring further supports the growth of this sub-segment.

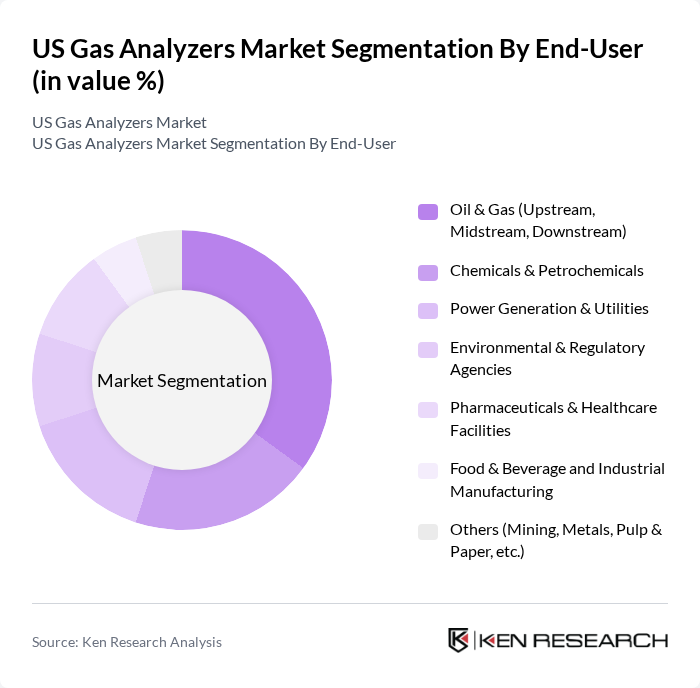

By End-User:

The end-user segmentation includes Oil & Gas (Upstream, Midstream, Downstream), Chemicals & Petrochemicals, Power Generation & Utilities, Environmental & Regulatory Agencies, Pharmaceuticals & Healthcare Facilities, Food & Beverage and Industrial Manufacturing, and Others (Mining, Metals, Pulp & Paper, etc.). The Oil & Gas sector is the leading end-user of gas analyzers, driven by the need for stringent emissions monitoring and safety compliance. The increasing exploration and production activities, coupled with regulatory pressures, have resulted in a heightened demand for gas analyzers in this sector. Additionally, the growing focus on environmental sustainability across industries is further propelling the adoption of gas analyzers.

The US Gas Analyzers Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., Siemens AG, Emerson Electric Co., Honeywell International Inc., Teledyne Technologies Incorporated, AMETEK, Inc., HORIBA, Ltd., Yokogawa Electric Corporation, Thermo Fisher Scientific Inc., Servomex Group Limited, MSA Safety Incorporated, Testo SE & Co. KGaA, RKI Instruments, Inc., Gasmet Technologies Oy, Drägerwerk AG & Co. KGaA contribute to innovation, geographic expansion, and service delivery in this space.

The US gas analyzers market is poised for significant transformation, driven by technological advancements and increasing regulatory pressures. The integration of artificial intelligence and machine learning into gas analysis systems is expected to enhance data accuracy and predictive capabilities. Additionally, the growing emphasis on sustainability will likely propel demand for innovative solutions that minimize environmental impact. As industries adapt to these changes, the market is expected to witness a shift towards more automated and efficient gas monitoring systems, ensuring compliance and operational excellence.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed / In-situ Gas Analyzers Portable / Handheld Gas Analyzers Continuous Emissions Monitoring (CEMS) Gas Analyzers Laboratory / Benchtop Gas Analyzers Others (Rental, OEM-integrated, etc.) |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Chemicals & Petrochemicals Power Generation & Utilities Environmental & Regulatory Agencies Pharmaceuticals & Healthcare Facilities Food & Beverage and Industrial Manufacturing Others (Mining, Metals, Pulp & Paper, etc.) |

| By Application | Continuous Emissions Monitoring (CEM) Process Gas Monitoring & Control Occupational / Workplace Safety Monitoring Ambient & Indoor Air Quality Monitoring Leak Detection and Fugitive Emissions Research, Testing & Calibration Others |

| By Technology | Non-Dispersive Infrared (NDIR) Tunable Diode Laser Absorption Spectroscopy (TDLAS) Electrochemical & Galvanic Sensors Paramagnetic, Zirconia & Thermal Conductivity Gas Chromatography & Mass Spectrometry FTIR & Other Optical Technologies Others |

| By Industry Vertical | Industrial & Process Manufacturing Energy, Oil & Gas, and Power Environmental Monitoring & Testing Services Healthcare, Pharma & Life Sciences Transportation & Automotive Testing Others |

| By Region | Northeast Midwest South West |

| By Policy Support | Federal Grants State Incentives Tax Credits Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry Applications | 120 | Field Engineers, Safety Managers |

| Environmental Monitoring Sector | 90 | Environmental Scientists, Compliance Officers |

| Manufacturing Process Control | 85 | Production Managers, Quality Assurance Leads |

| Research and Development Labs | 65 | Lab Technicians, R&D Managers |

| Academic Institutions and Research Bodies | 55 | Professors, Research Fellows |

The US Gas Analyzers Market is valued at approximately USD 1.0 billion, driven by regulatory requirements for emissions monitoring, advancements in gas analysis technologies, and increasing demand for air quality monitoring across various industries.