Region:North America

Author(s):Dev

Product Code:KRAC3482

Pages:81

Published On:October 2025

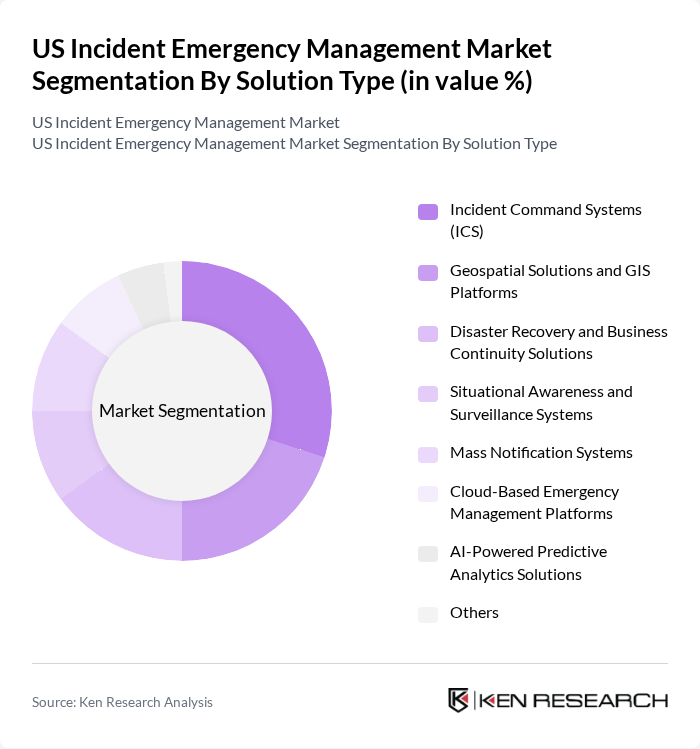

By Solution Type:The market is segmented into various solution types that cater to different aspects of incident management. The leading sub-segment is Incident Command Systems (ICS), which provides a structured approach to managing emergency incidents. Geospatial Solutions and GIS Platforms are also significant, offering critical data visualization and analysis capabilities. Disaster Recovery and Business Continuity Solutions are essential for organizations to maintain operations during crises. Other notable segments include Situational Awareness and Surveillance Systems, Mass Notification Systems, Cloud-Based Emergency Management Platforms, AI-Powered Predictive Analytics Solutions, and Others.

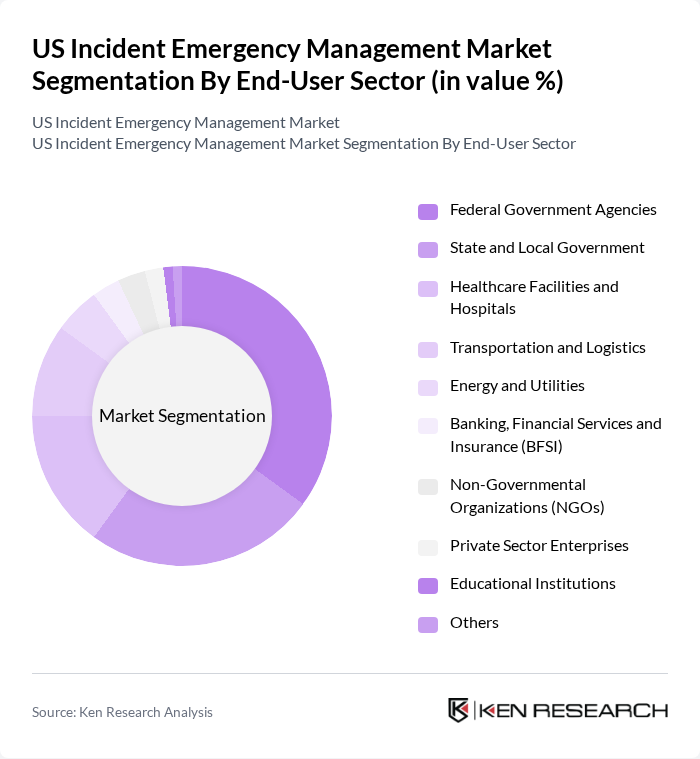

By End-User Sector:The end-user sector for incident emergency management includes various organizations that utilize these solutions for effective crisis management. Federal Government Agencies are the largest consumers, driven by the need for comprehensive disaster response strategies. State and Local Governments follow closely, as they are responsible for implementing emergency management plans at the community level. Healthcare Facilities and Hospitals are increasingly adopting these solutions to ensure patient safety during emergencies. Other sectors include Transportation and Logistics, Energy and Utilities, Banking, Financial Services and Insurance (BFSI), Non-Governmental Organizations (NGOs), Private Sector Enterprises, Educational Institutions, and Others.

The US Incident Emergency Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Motorola Solutions, Inc., Honeywell International Inc., Lockheed Martin Corporation, Siemens AG, IBM Corporation, Everbridge Inc., Hexagon AB, Palantir Technologies Inc., ESRI (Environmental Systems Research Institute, Inc.), Northrop Grumman Corporation, Cisco Systems, Inc., Microsoft Corporation, Alert Technologies Corporation, Datalink Internet Systems P/L, Accenture plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US incident emergency management market is poised for significant transformation, driven by technological advancements and a growing emphasis on community resilience. As agencies increasingly adopt AI and big data analytics, the ability to predict and respond to emergencies will improve. Additionally, the focus on multi-hazard preparedness strategies will enhance overall readiness. These trends indicate a shift towards more integrated and proactive emergency management approaches, ensuring communities are better equipped to handle future challenges.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Incident Command Systems (ICS) Geospatial Solutions and GIS Platforms Disaster Recovery and Business Continuity Solutions Situational Awareness and Surveillance Systems Mass Notification Systems Cloud-Based Emergency Management Platforms AI-Powered Predictive Analytics Solutions Others |

| By End-User Sector | Federal Government Agencies State and Local Government Healthcare Facilities and Hospitals Transportation and Logistics Energy and Utilities Banking, Financial Services and Insurance (BFSI) Non-Governmental Organizations (NGOs) Private Sector Enterprises Educational Institutions Others |

| By Application | Disaster Response and Mitigation Crisis Management and Coordination Risk and Threat Assessment Training, Simulation and Drills Recovery Planning and Business Continuity Real-Time Monitoring and Surveillance Cybersecurity Incident Response Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Deployment Models |

| By Technology Type | Artificial Intelligence and Machine Learning Geographic Information Systems (GIS) Drones and Unmanned Aerial Vehicles (UAVs) G Communication Networks Mobile Applications and IoT Devices Cloud Computing and Data Analytics Cybersecurity and Blockchain Others |

| By Service Type | Consulting and Strategy Services Implementation and Integration Services Training and Capacity Building Software as a Service (SaaS) and Support Equipment and Technology Rental Managed Services and 24/7 Support Others |

| By Funding Source | Federal Grant Programs (FEMA, DHS) State and Local Government Budgets Private Sector Investment Public-Private Partnerships (PPP) Insurance Industry Contributions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| State Emergency Management Agencies | 100 | Emergency Managers, Policy Advisors |

| Local Government Emergency Services | 90 | Fire Chiefs, Police Captains |

| Non-Governmental Organizations (NGOs) | 60 | Disaster Relief Coordinators, Program Managers |

| Private Sector Emergency Management Firms | 70 | Business Continuity Planners, Risk Management Officers |

| Community Preparedness Initiatives | 50 | Community Leaders, Volunteer Coordinators |

The US Incident Emergency Management Market is valued at approximately USD 39 billion, reflecting a significant growth trend driven by the increasing frequency of natural disasters, heightened awareness of emergency preparedness, and advancements in technology for response capabilities.