Region:North America

Author(s):Dev

Product Code:KRAD2431

Pages:96

Published On:January 2026

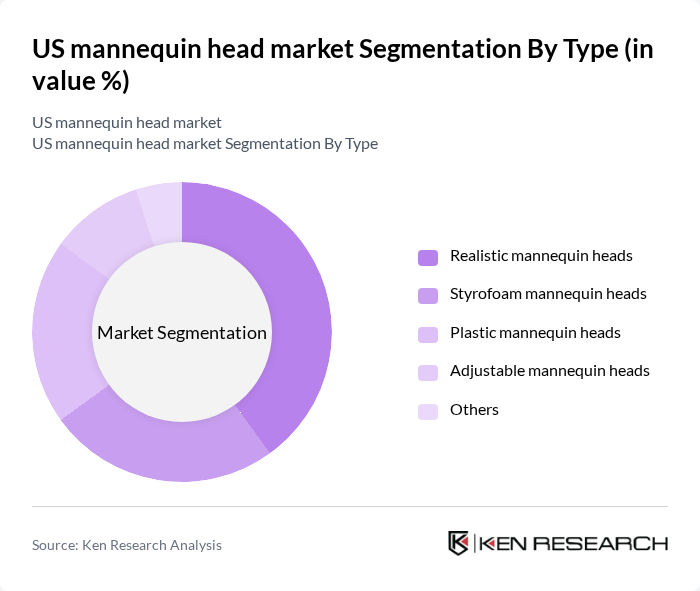

By Type:The market is segmented into various types of mannequin heads, including realistic mannequin heads, styrofoam mannequin heads, plastic mannequin heads, adjustable mannequin heads, and others. Realistic mannequin heads are particularly popular due to their lifelike appearance, making them ideal for high-end retail displays. Styrofoam mannequin heads are favored for their lightweight and cost-effective nature, while plastic mannequin heads offer durability and versatility. Adjustable mannequin heads cater to specific needs in styling and display.

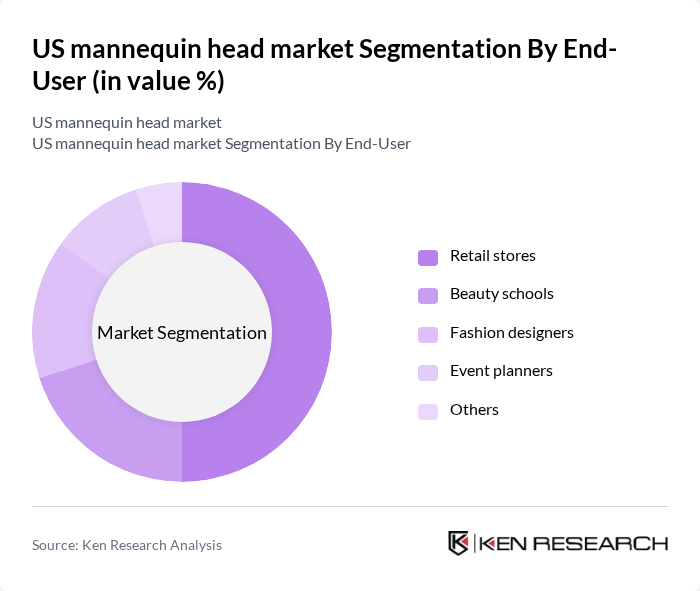

By End-User:The end-user segmentation includes retail stores, beauty schools, fashion designers, event planners, and others. Retail stores are the largest consumers of mannequin heads, utilizing them for product displays to attract customers. Beauty schools also represent a significant segment, as they require mannequin heads for training purposes in hairstyling, makeup, and skincare. Fashion designers use them for showcasing their designs, while event planners utilize them for themed displays and exhibitions.

The US mannequin head market is characterized by a dynamic mix of regional and international players. Leading participants such as Mannequin Madness, The Mannequin Store, Display Importer, ULINE, Store Supply Warehouse, A1 Mannequins, Fashion Forms, J. M. Mannequins, Roxy Display, Mannequin Mall, The Display Guys, A & A Global Industries, The Mannequin Company, M. J. M. Mannequins, Display Warehouse contribute to innovation, geographic expansion, and service delivery in this space.

The US mannequin head market is poised for transformation as it adapts to evolving consumer preferences and technological advancements. The integration of augmented reality in retail displays is expected to enhance the shopping experience, while the shift towards eco-friendly products will drive innovation in materials. Additionally, the growing influence of social media on fashion trends will further shape the market, encouraging brands to invest in visually appealing displays that resonate with consumers, ultimately fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Realistic mannequin heads Styrofoam mannequin heads Plastic mannequin heads Adjustable mannequin heads Others |

| By End-User | Retail stores Beauty schools Fashion designers Event planners Others |

| By Material | Fiberglass Polyurethane PVC Others |

| By Size | Adult mannequin heads Child mannequin heads Specialty sizes Others |

| By Color | Skin tone White Black Others |

| By Functionality | Display purposes Training purposes Artistic purposes Others |

| By Price Range | Budget Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Fashion Outlets | 100 | Store Managers, Visual Merchandisers |

| Beauty Schools and Training Centers | 80 | Instructors, Program Coordinators |

| Event and Theatrical Productions | 60 | Costume Designers, Production Managers |

| Online Retailers | 90 | E-commerce Managers, Product Buyers |

| Wholesale Distributors | 70 | Sales Representatives, Procurement Officers |

The US mannequin head market is valued at approximately USD 250 million, driven by demand from the fashion and beauty industries, as well as the growth of e-commerce and beauty education sectors.