Region:Middle East

Author(s):Shubham

Product Code:KRAA8519

Pages:87

Published On:November 2025

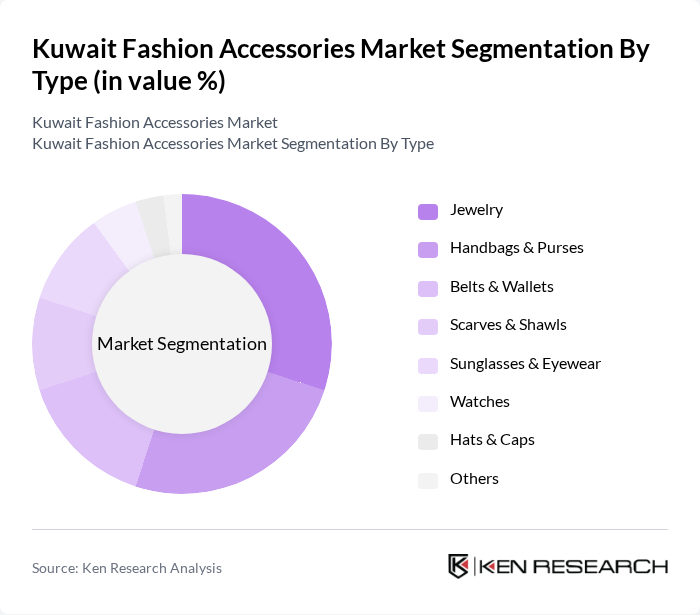

By Type:The market is segmented into various types of fashion accessories, including Jewelry, Handbags & Purses, Belts & Wallets, Scarves & Shawls, Sunglasses & Eyewear, Watches, Hats & Caps, and Others. Among these, Jewelry is the leading segment, driven by cultural significance and consumer preference for unique designs. Handbags & Purses also hold a substantial share, reflecting the growing trend of functional yet stylish accessories.

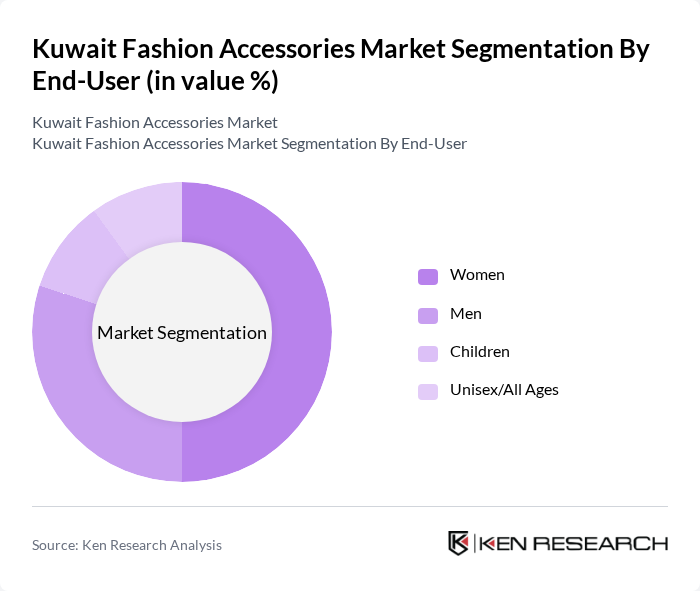

By End-User:The end-user segmentation includes Women, Men, Children, and Unisex/All Ages. Women represent the largest consumer group, driven by a strong inclination towards fashion and accessories. The growing awareness of fashion trends among men is also notable, contributing to a significant market share. Children’s accessories are gaining traction as parents increasingly invest in stylish options for their kids.

The Kuwait Fashion Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alshaya Group, Chalhoub Group, Al Yasra Fashion, Trafalgar Company, Al Ostoura International Company, Al Tayer Group, Landmark Group, Al Futtaim Group, Al Mulla Group, Al Zayani Group, The Sultan Center (TSC), Ounass, Farfetch, Thrift Kuwait, Boutique N contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait fashion accessories market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to adopt eco-friendly practices, appealing to environmentally conscious consumers. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement. With a growing expatriate population and increased tourism, the demand for diverse fashion accessories will likely continue to rise, creating a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Jewelry Handbags & Purses Belts & Wallets Scarves & Shawls Sunglasses & Eyewear Watches Hats & Caps Others |

| By End-User | Women Men Children Unisex/All Ages |

| By Distribution Channel | Online Retail (E-commerce, Marketplaces, Social Media Platforms) Department Stores Specialty Stores Supermarkets/Hypermarkets Brand-owned Stores Others |

| By Material | Metal Leather Fabric/Textile Plastic/Resin Sustainable/Recycled Materials Others |

| By Price Range | Premium/Luxury Mid-range Budget Others |

| By Occasion | Casual Formal Sports/Activewear Traditional/Cultural Others |

| By Region | Kuwait City Hawalli Salmiya Farwaniya Ahmadi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Fashion Accessories | 120 | Fashion-conscious Consumers, Trendsetters |

| Retailer Insights on Sales Trends | 45 | Store Managers, Retail Buyers |

| Supplier Perspectives on Market Dynamics | 50 | Manufacturers, Distributors |

| Influencer Impact on Fashion Choices | 40 | Fashion Influencers, Stylists |

| Online Shopping Behavior Analysis | 95 | E-commerce Shoppers, Digital Marketing Professionals |

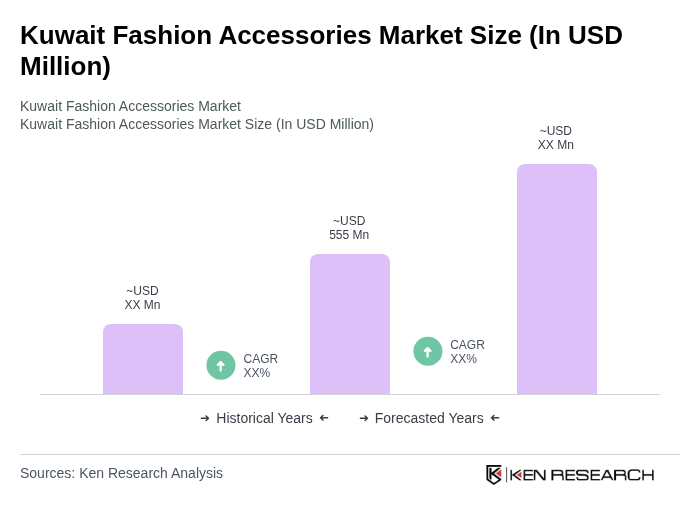

The Kuwait Fashion Accessories Market is valued at approximately USD 555 million, reflecting a significant growth trend driven by increasing disposable incomes and a rising fashion consciousness among consumers.