Region:North America

Author(s):Shubham

Product Code:KRAD2477

Pages:89

Published On:January 2026

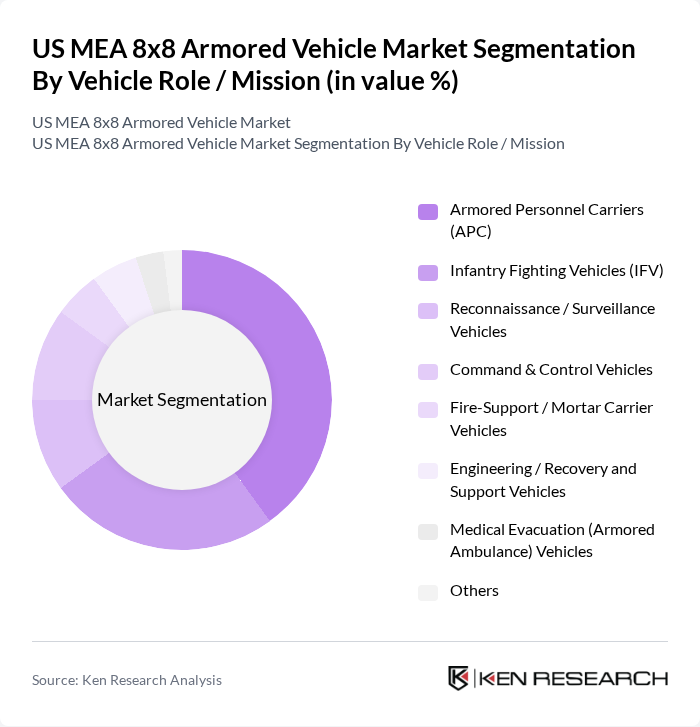

By Vehicle Role / Mission:The vehicle role or mission segmentation includes various types of armored vehicles designed for specific operational tasks. The dominant sub-segment in this category is Armored Personnel Carriers (APC), which are widely used for troop transport and protection in combat zones and internal security operations, and are recognized as a key revenue-generating category within the wider armored vehicle market. The increasing focus on troop safety, survivability against improvised explosive devices, and the need for versatile vehicles that can operate in diverse environments have led to a surge in demand for APCs. Other notable sub-segments include Infantry Fighting Vehicles (IFV) and Command & Control Vehicles, which are also gaining traction due to their critical roles in modern, network-centric warfare and combined-arms operations.

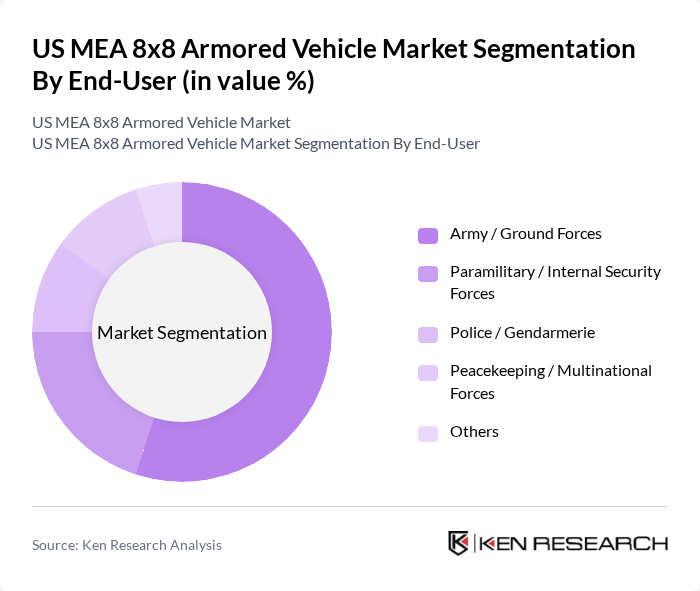

By End-User:The end-user segmentation highlights the various entities utilizing 8x8 armored vehicles, with the Army / Ground Forces being the leading segment, reflecting the fact that defense forces remain the primary buyers of armored vehicles globally. This dominance is attributed to the increasing need for ground forces to have reliable and versatile armored vehicles for combat, deterrence, and peacekeeping missions in high-threat environments. Paramilitary and Internal Security Forces also represent a significant portion of the market, driven by the need for enhanced security measures in urban environments and border security roles, while demand from Police / Gendarmerie and Peacekeeping / Multinational Forces is growing as well, reflecting the evolving security landscape and the use of wheeled armored vehicles in stabilization and UN missions.

The US MEA 8x8 Armored Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Dynamics Land Systems, BAE Systems, Oshkosh Defense, Rheinmetall, Lockheed Martin, Northrop Grumman, Textron Systems, AM General, L3Harris Technologies, Elbit Systems, Leonardo DRS, Thales Group, Navistar Defense, KNDS (KMW + Nexter Defense Systems), Iveco Defence Vehicles contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US MEA 8x8 armored vehicle market appears promising, driven by ongoing military modernization efforts and technological innovations. As defense budgets continue to rise, manufacturers are likely to focus on developing advanced, modular designs that enhance operational flexibility. Additionally, the integration of AI and automation technologies will play a crucial role in shaping the next generation of armored vehicles, ensuring they meet the evolving demands of modern warfare while maintaining cost-effectiveness and compliance with regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Role / Mission | Armored Personnel Carriers (APC) Infantry Fighting Vehicles (IFV) Reconnaissance / Surveillance Vehicles Command & Control Vehicles Fire-Support / Mortar Carrier Vehicles Engineering / Recovery and Support Vehicles Medical Evacuation (Armored Ambulance) Vehicles Others |

| By End-User | Army / Ground Forces Paramilitary / Internal Security Forces Police / Gendarmerie Peacekeeping / Multinational Forces Others |

| By Protection Level (STANAG 4569) | Level 1–2 Level 3 Level 4 and Above Others |

| By Weight Class | Light (< 20 t) Medium (20–30 t) Heavy (> 30 t) Others |

| By Power Source | Diesel Hybrid-Electric Fully Electric Others |

| By Mobility / Drivetrain | High-Mobility Off-Road Amphibious-Capable Desert-Optimized Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| U.S. Army Procurement Officers | 60 | Defense Acquisition Managers, Program Directors |

| Defense Contractors and Suppliers | 50 | Business Development Managers, Sales Directors |

| Military Operations Personnel | 40 | Field Commanders, Tactical Operations Officers |

| Defense Analysts and Consultants | 40 | Market Analysts, Defense Policy Experts |

| Research and Development Teams | 40 | Engineers, Product Development Managers |

The US MEA 8x8 Armored Vehicle Market is valued at approximately USD 1.1 billion, reflecting a significant investment in defense capabilities and modernization of military fleets in response to rising geopolitical tensions.