Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4454

Pages:94

Published On:October 2025

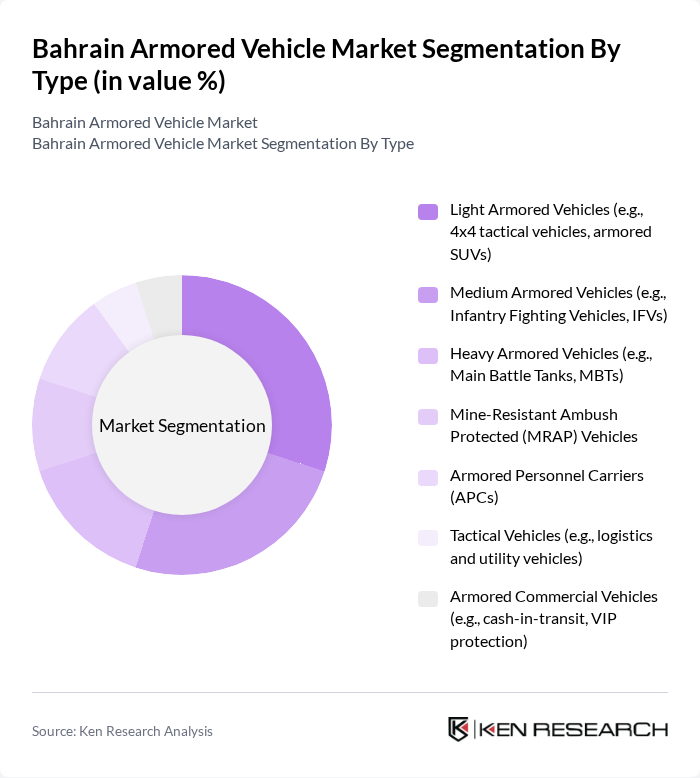

By Type:The market is segmented into various types of armored vehicles, including Light Armored Vehicles, Medium Armored Vehicles, Heavy Armored Vehicles, Mine-Resistant Ambush Protected (MRAP) Vehicles, Armored Personnel Carriers (APCs), Tactical Vehicles, and Armored Commercial Vehicles. Each type serves specific operational needs, with light and medium armored vehicles being particularly popular due to their versatility, rapid deployment capabilities, and adaptability in urban and mixed-terrain environments. The integration of advanced protection systems and modular designs is increasingly influencing procurement decisions .

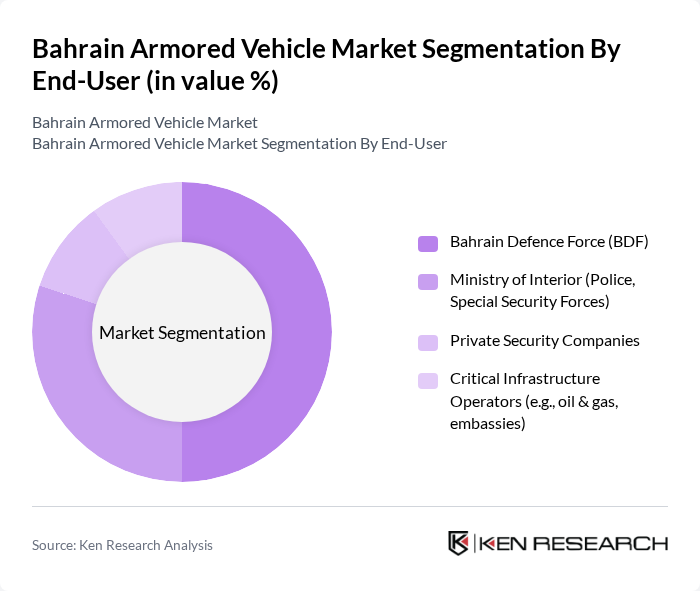

By End-User:The end-user segmentation includes the Bahrain Defence Force (BDF), Ministry of Interior (Police, Special Security Forces), Private Security Companies, and Critical Infrastructure Operators such as oil and gas sectors and embassies. The BDF and Ministry of Interior are the primary consumers, driven by national security needs, modernization initiatives, and the protection of critical infrastructure. Private security companies and infrastructure operators are increasingly investing in armored vehicles for asset and personnel protection amid evolving threat landscapes .

The Bahrain Armored Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as BAE Systems, General Dynamics Land Systems, Rheinmetall AG, Oshkosh Defense, Nexter Systems, Thales Group, Leonardo S.p.A., Elbit Systems, AM General, Textron Systems, IVECO Defence Vehicles, KNDS (Krauss-Maffei Wegmann + Nexter Defense Systems), Navistar Defense, ST Engineering, Patria, Lockheed Martin, Alpine Armoring Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain armored vehicle market appears promising, driven by ongoing investments in defense and security. As the government continues to prioritize military modernization, the demand for advanced armored vehicles is expected to rise. Additionally, the integration of AI and automation technologies will likely enhance operational efficiency. Public-private partnerships may also emerge as a key strategy, fostering innovation and collaboration between local and international manufacturers, ultimately strengthening the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Armored Vehicles (e.g., 4x4 tactical vehicles, armored SUVs) Medium Armored Vehicles (e.g., Infantry Fighting Vehicles, IFVs) Heavy Armored Vehicles (e.g., Main Battle Tanks, MBTs) Mine-Resistant Ambush Protected (MRAP) Vehicles Armored Personnel Carriers (APCs) Tactical Vehicles (e.g., logistics and utility vehicles) Armored Commercial Vehicles (e.g., cash-in-transit, VIP protection) |

| By End-User | Bahrain Defence Force (BDF) Ministry of Interior (Police, Special Security Forces) Private Security Companies Critical Infrastructure Operators (e.g., oil & gas, embassies) |

| By Application | Combat Operations Reconnaissance and Surveillance Troop and Cargo Transport Civilian Protection and VIP Transport |

| By Sales Channel | Direct Government Procurement Authorized Distributors/Dealers International Defense Contractors |

| By Distribution Mode | Domestic Distribution Foreign Military Sales (FMS)/International Distribution |

| By Price Range | Entry-Level/Budget Mid-Range Premium/High-End |

| By Technology | Conventional (Diesel, Standard Armor) Advanced (Active Protection, Composite Armor, C4ISR Integration) Hybrid/Electric Propulsion |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Strategies | 100 | Defense Procurement Officers, Military Strategists |

| Local Armored Vehicle Manufacturing | 60 | Manufacturing Managers, Operations Directors |

| Defense Technology Suppliers | 50 | Sales Executives, Product Managers |

| International Defense Collaborations | 40 | Policy Analysts, Defense Attachés |

| Market Trends and Forecasts | 70 | Market Analysts, Research Directors |

The Bahrain Armored Vehicle Market is valued at approximately USD 1.1 billion, driven by increased defense budgets, regional security concerns, and military modernization efforts. This growth reflects the rising demand for armored vehicles in both military and civilian sectors.