Region:North America

Author(s):Shubham

Product Code:KRAD5364

Pages:92

Published On:December 2025

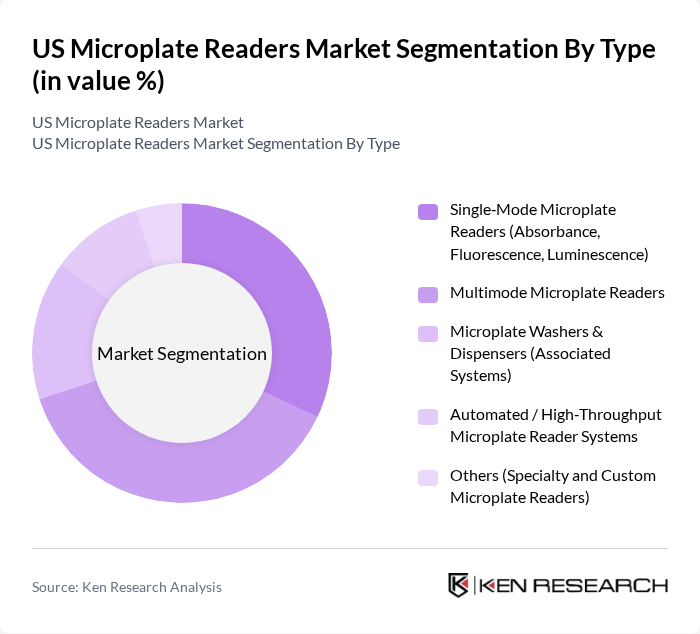

By Type:The market is segmented into various types of microplate readers, each catering to specific applications and user needs. The primary subsegments include Single-Mode Microplate Readers, Multimode Microplate Readers, Microplate Washers & Dispensers, Automated / High-Throughput Microplate Reader Systems, and Others.

The Multimode Microplate Readers segment is currently dominating the market due to their versatility in performing various assays, including absorbance, fluorescence, luminescence, time?resolved fluorescence, fluorescence polarization, and Alpha technology assays. This adaptability makes them highly sought after in both research and clinical laboratories, where diverse testing capabilities and configurable detection modules are essential for cell?based assays, biomarker quantification, and multiplexed screening. The increasing trend towards automation, integration with liquid handling systems, and high?throughput screening in drug discovery and biologics development further propels the demand for these systems, as they can handle multiple assay formats and plate densities simultaneously, thus saving time, labor, and consumable costs.

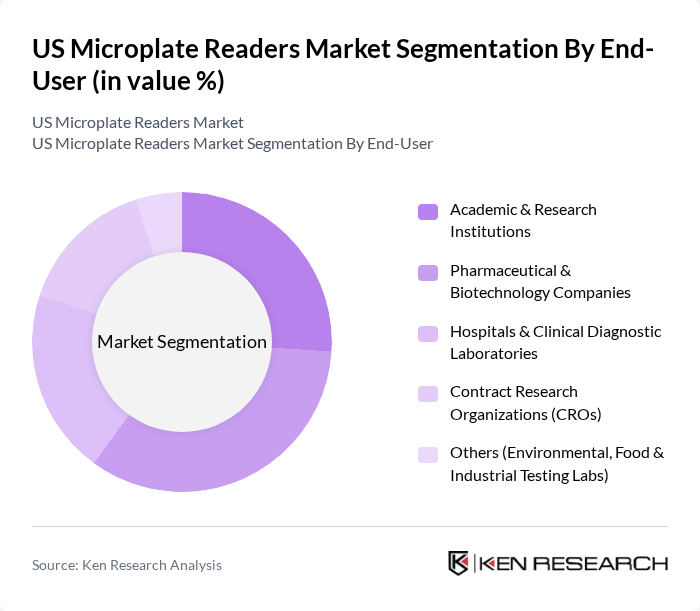

By End-User:The end-user segmentation includes Academic & Research Institutions, Pharmaceutical & Biotechnology Companies, Hospitals & Clinical Diagnostic Laboratories, Contract Research Organizations (CROs), and Others.

Pharmaceutical & Biotechnology Companies are the leading end-users of microplate readers, driven by their critical role in drug discovery, lead optimization, biologics development, and bioprocess monitoring workflows. These companies require advanced analytical tools to conduct high-throughput screening, dose–response studies, enzyme kinetics, and cell viability assays, making microplate readers indispensable in their laboratories. The increasing investment in R&D within the pharmaceutical and biopharmaceutical sectors, growth in biologics and cell and gene therapy pipelines, and the expanding use of outsourced discovery and screening services further solidify the dominance of this segment and support sustained demand from CROs and academic collaborators.

The US Microplate Readers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., PerkinElmer Inc., BMG LABTECH GmbH, Molecular Devices LLC (a Danaher company), Tecan Group Ltd., BioTek Instruments (Agilent Technologies), Bio-Rad Laboratories Inc., Promega Corporation, Corning Incorporated, Eppendorf SE, Sartorius AG, Hudson Robotics Inc., Enzo Life Sciences Inc., Labnet International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US microplate readers market appears promising, driven by ongoing technological advancements and an increasing focus on personalized medicine. As healthcare shifts towards more tailored treatment approaches, the demand for precise diagnostic tools will likely grow. Additionally, the integration of microplate readers with automation systems is expected to enhance laboratory efficiency, further propelling market growth. The emphasis on environmental sustainability will also drive innovation in product design and manufacturing processes, aligning with broader industry trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Single?Mode Microplate Readers (Absorbance, Fluorescence, Luminescence) Multimode Microplate Readers Microplate Washers & Dispensers (Associated Systems) Automated / High?Throughput Microplate Reader Systems Others (Specialty and Custom Microplate Readers) |

| By End-User | Academic & Research Institutions Pharmaceutical & Biotechnology Companies Hospitals & Clinical Diagnostic Laboratories Contract Research Organizations (CROs) Others (Environmental, Food & Industrial Testing Labs) |

| By Application | Drug Discovery & Development (HTS, Lead Optimization) Clinical Diagnostics & Immunoassays (e.g., ELISA) Genomics & Proteomics / Cell?Based Assays Environmental & Food Safety Testing Others (Toxicology, Quality Control, Veterinary, etc.) |

| By Technology | Optical Detection Technologies (UV?Vis, Fluorescence, Luminescence) Imaging?Based Microplate Readers Automated & Robotic Integration / HTS Platforms Software, Data Analysis & Connectivity Solutions Others (Label?Free & Emerging Detection Technologies) |

| By Distribution Channel | Direct Sales (OEM to End User) Authorized Distributors & Value?Added Resellers Online & E?Commerce Channels Others (Group Purchasing Organizations, Tender?Based) |

| By Region | Northeast Midwest South West |

| By Policy Support | Federal & NIH Research Grants Tax Credits & Incentives for R&D and Capital Equipment State & Institutional Research Funding Programs Others (Public–Private Partnerships, Innovation Programs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Academic Research Laboratories | 100 | Lab Managers, Principal Investigators |

| Clinical Diagnostic Labs | 80 | Clinical Lab Directors, Quality Assurance Managers |

| Pharmaceutical Companies | 90 | R&D Managers, Procurement Officers |

| Biotechnology Firms | 70 | Product Development Managers, Regulatory Affairs Specialists |

| Environmental Testing Facilities | 60 | Environmental Scientists, Lab Technicians |

The US Microplate Readers Market is valued at approximately USD 230 million, reflecting a significant growth driven by the increasing demand for high-throughput screening in drug discovery and the rising prevalence of chronic diseases requiring efficient diagnostic tools.