Region:North America

Author(s):Rebecca

Product Code:KRAA9276

Pages:89

Published On:November 2025

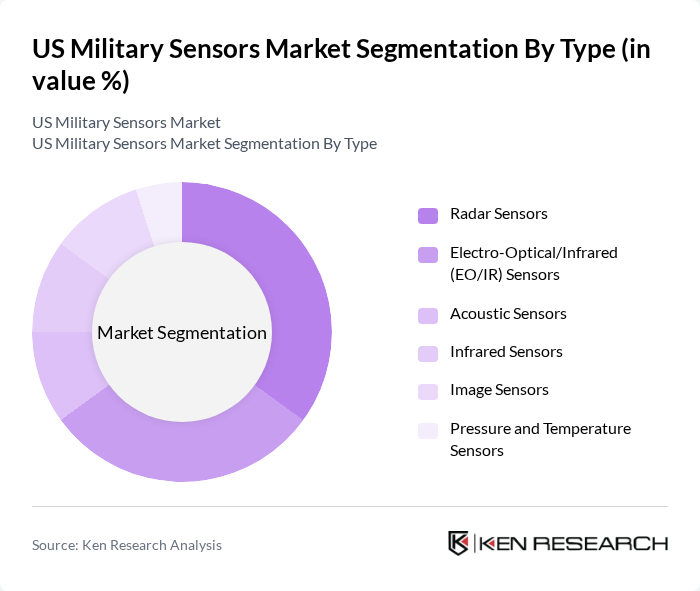

By Type:The market is segmented into various types of sensors, including Radar Sensors, Electro-Optical/Infrared (EO/IR) Sensors, Acoustic Sensors, Infrared Sensors, Image Sensors, and Pressure and Temperature Sensors. Each of these subsegments plays a crucial role in military operations, providing essential data for decision-making and operational effectiveness. Among these, Radar Sensors and EO/IR Sensors are particularly dominant due to their extensive applications in surveillance, reconnaissance, and targeting.

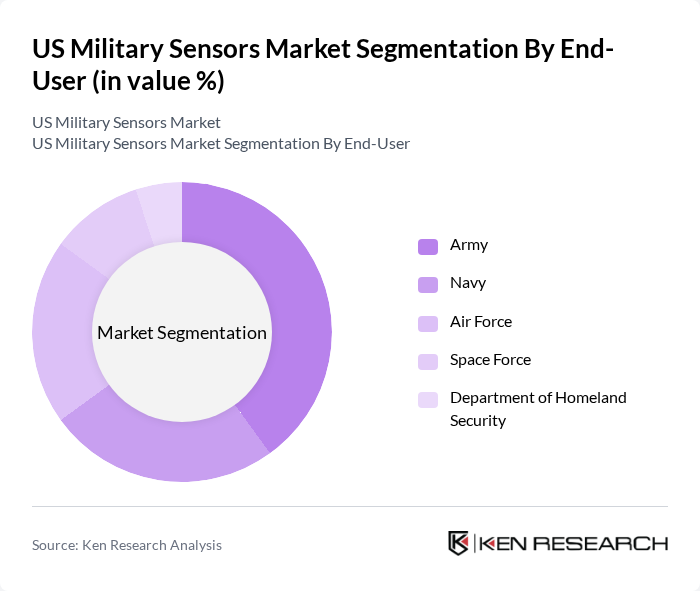

By End-User:The military sensors market is categorized by end-users, including the Army, Navy, Air Force, Space Force, and the Department of Homeland Security. Each branch of the military has unique requirements for sensor technologies, with the Army and Air Force being the largest consumers due to their extensive operational needs. The increasing focus on joint operations among these branches has also led to a rise in demand for integrated sensor systems.

The US Military Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as RTX Corporation (formerly Raytheon Technologies), Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems plc, L3Harris Technologies, Inc., General Dynamics Corporation, Honeywell International Inc., FLIR Systems, Inc. (Teledyne FLIR), Science Applications International Corporation (SAIC), Textron Inc., Elbit Systems Ltd., Leonardo S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. military sensors market is poised for significant transformation, driven by ongoing technological advancements and strategic defense initiatives. As the military increasingly adopts autonomous systems and IoT technologies, the demand for sophisticated sensors will rise. Additionally, the integration of artificial intelligence in data analytics will enhance decision-making capabilities, enabling more effective surveillance and reconnaissance operations. These trends indicate a robust growth trajectory for the sector, emphasizing the importance of innovation and adaptability in meeting emerging defense needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Radar Sensors Electro-Optical/Infrared (EO/IR) Sensors Acoustic Sensors Infrared Sensors Image Sensors Pressure and Temperature Sensors |

| By End-User | Army Navy Air Force Space Force Department of Homeland Security |

| By Application | Intelligence, Surveillance & Reconnaissance (ISR) Combat Operations Electronic Warfare Command & Control Target Recognition and Acquisition |

| By Platform | Land Systems (Armored Vehicles, Tanks) Airborne Platforms (Fighter Jets, Helicopters) Naval Vessels Unmanned Aerial Vehicles (UAVs) Satellites and Space Systems |

| By Technology | Passive Sensors Active Sensors Multi-Sensor Fusion Systems AI-Enabled Sensors |

| By Region | Northeast Midwest South West |

| By Others | Quantum Sensing Solutions Integrated Defense Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Officers | 100 | Defense Acquisition Managers, Contracting Officers |

| Defense Technology Developers | 80 | R&D Engineers, Product Managers |

| Military Operations Personnel | 70 | Field Commanders, Tactical Operations Specialists |

| Defense Industry Analysts | 60 | Market Researchers, Policy Analysts |

| Military Training and Simulation Experts | 50 | Training Coordinators, Simulation Technologists |

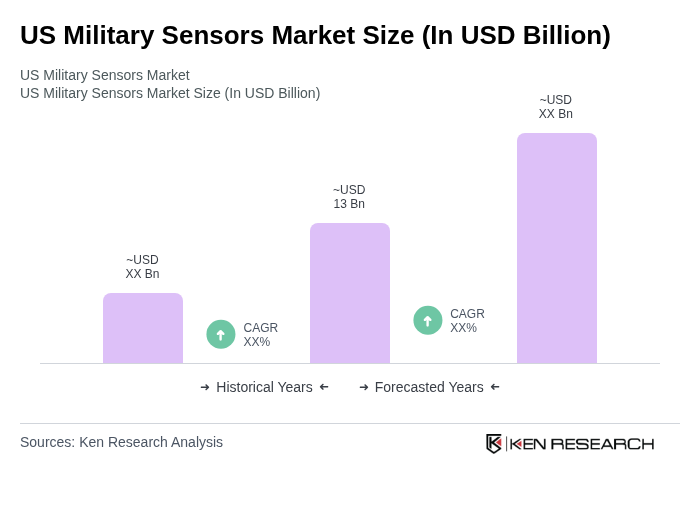

The US Military Sensors Market is valued at approximately USD 13 billion, driven by advancements in technology, increased defense budgets, and the demand for enhanced situational awareness in military operations.