Region:Global

Author(s):Rebecca

Product Code:KRAC2599

Pages:82

Published On:October 2025

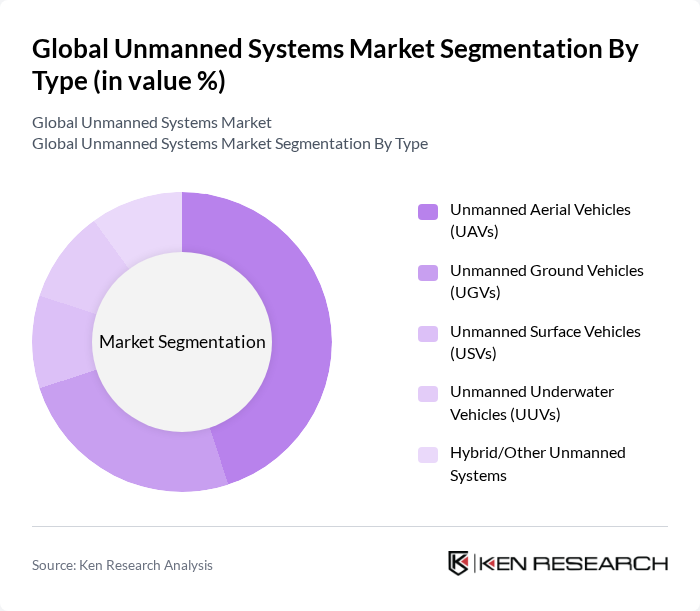

By Type:The market is segmented into Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), Unmanned Surface Vehicles (USVs), Unmanned Underwater Vehicles (UUVs), and Hybrid/Other Unmanned Systems. UAVs are the most dominant segment, driven by extensive applications in defense, commercial, and industrial sectors. The surge in UAV adoption for aerial photography, precision agriculture, logistics, infrastructure inspection, and emergency response has solidified their market leadership .

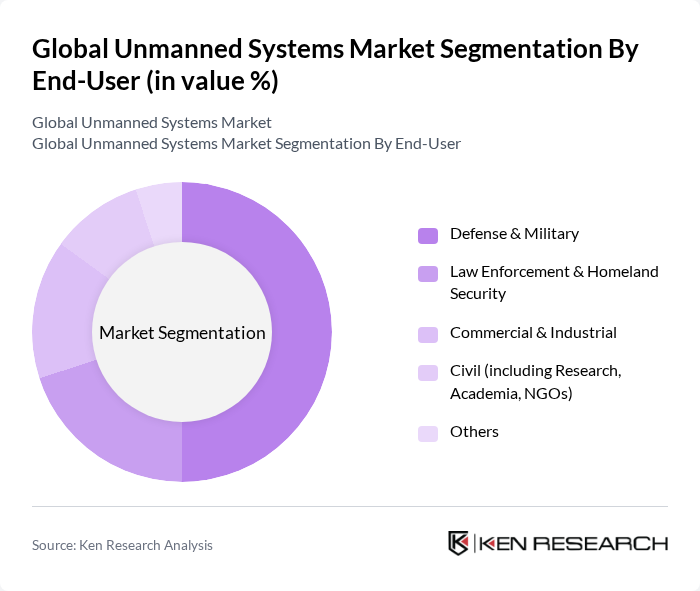

By End-User:The end-user segmentation includes Defense & Military, Law Enforcement & Homeland Security, Commercial & Industrial, Civil (including Research, Academia, NGOs), and Others. The Defense & Military segment holds the largest share, driven by the need for advanced surveillance, reconnaissance, and threat-response capabilities. Heightened focus on national security, border protection, and cost-effective mission execution has led to increased investments in unmanned systems by military organizations globally .

The Global Unmanned Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., Parrot Drones S.A., Northrop Grumman Corporation, General Atomics Aeronautical Systems, Inc., AeroVironment, Inc., Textron Inc., Boeing Defense, Space & Security, Lockheed Martin Corporation, Elbit Systems Ltd., Thales Group, Insitu Inc., Teledyne FLIR LLC, Yuneec International Co., Ltd., Skydio, Inc., Delair SAS, BAE Systems plc, General Dynamics Mission Systems, Inc., Draganfly Inc., Red Cat Holdings, Inc., ZenaTech, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the unmanned systems market appears promising, driven by technological advancements and increasing applications across various sectors. As industries continue to embrace automation, the integration of AI and machine learning will enhance operational efficiencies and data analytics capabilities. Furthermore, the expansion into emerging markets, particularly in Asia and Africa, is expected to create new growth avenues. These trends indicate a robust evolution of unmanned systems, positioning them as essential tools in modern operations across multiple industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Unmanned Aerial Vehicles (UAVs) Unmanned Ground Vehicles (UGVs) Unmanned Surface Vehicles (USVs) Unmanned Underwater Vehicles (UUVs) Hybrid/Other Unmanned Systems |

| By End-User | Defense & Military Law Enforcement & Homeland Security Commercial & Industrial Civil (including Research, Academia, NGOs) Others |

| By Application | Intelligence, Surveillance, and Reconnaissance (ISR) Logistics & Delivery Agriculture & Environmental Monitoring Infrastructure Inspection & Maintenance Search & Rescue / Disaster Response Mapping & Surveying Others |

| By Component | Airframe/Chassis Payloads (Sensors, Cameras, Weapons, etc.) Ground/Control Stations Communication & Navigation Systems Power Systems (Batteries, Engines, Fuel Cells) Software (Autonomy, AI, Data Processing) Others |

| By Distribution Channel | Direct Sales Distributors & System Integrators Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Price Range | Low-End Systems Mid-Range Systems High-End Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Drones | 60 | Agronomists, Farm Managers |

| Defense UAVs | 50 | Military Procurement Officers, Defense Analysts |

| Logistics and Delivery Drones | 45 | Logistics Managers, Supply Chain Executives |

| Inspection and Surveillance UGVs | 40 | Facility Managers, Security Directors |

| Commercial Drone Services | 55 | Business Development Managers, Operations Directors |

The Global Unmanned Systems Market is valued at approximately USD 28 billion, driven by advancements in artificial intelligence, sensor technology, and increasing demand for automation across various sectors, including defense, commercial, and industrial applications.