Region:North America

Author(s):Geetanshi

Product Code:KRAD6061

Pages:97

Published On:December 2025

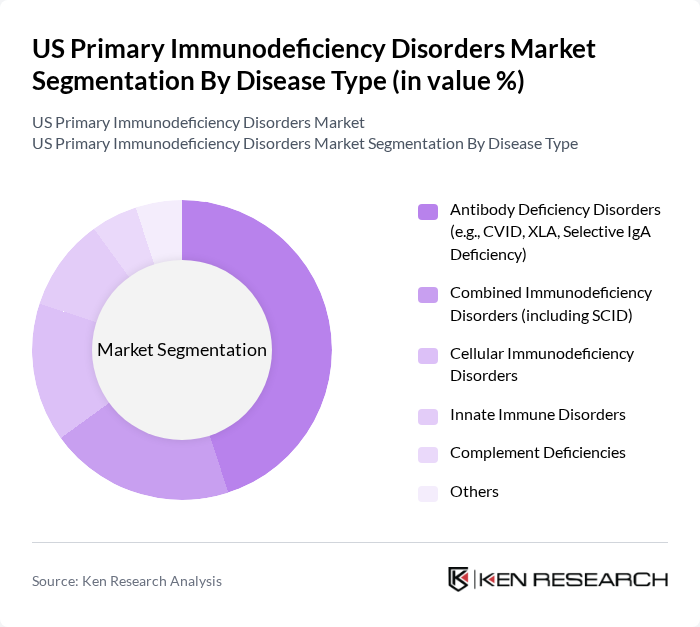

By Disease Type:The primary immunodeficiency disorders can be categorized into several types, each with unique characteristics and treatment requirements. The most prevalent types include Antibody Deficiency Disorders, Combined Immunodeficiency Disorders, Cellular Immunodeficiency Disorders, Innate Immune Disorders, Complement Deficiencies, and Others. Among these, Antibody Deficiency Disorders, such as Common Variable Immunodeficiency (CVID) and X-Linked Agammaglobulinemia (XLA), dominate the market due to their higher incidence rates and the established treatment protocols available. The increasing diagnosis rates and the growing awareness of these disorders contribute to their market leadership.

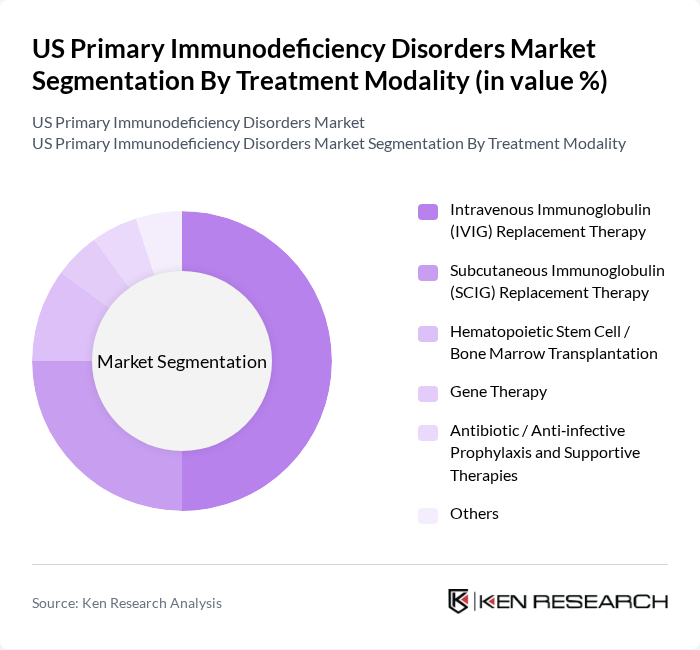

By Treatment Modality:The treatment modalities for primary immunodeficiency disorders include various approaches such as Intravenous Immunoglobulin (IVIG) Replacement Therapy, Subcutaneous Immunoglobulin (SCIG) Replacement Therapy, Hematopoietic Stem Cell / Bone Marrow Transplantation, Gene Therapy, Antibiotic / Anti-infective Prophylaxis and Supportive Therapies, and Others. IVIG Replacement Therapy is the leading treatment modality due to its widespread use and effectiveness in managing antibody deficiency disorders. The increasing adoption of SCIG therapy is also notable, as it offers patients more flexibility and convenience in their treatment regimens.

The US Primary Immunodeficiency Disorders Market is characterized by a dynamic mix of regional and international players. Leading participants such as CSL Behring, Takeda Pharmaceutical Company (including Shire / Baxalta legacy portfolio), Grifols, Octapharma, Kedrion Biopharma, ADMA Biologics, Bio Products Laboratory (BPL), Pfizer, Sanofi, AstraZeneca (including Alexion), Orchard Therapeutics, bluebird bio, Rocket Pharmaceuticals, X4 Pharmaceuticals, ImmunoTek Bio Centers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. primary immunodeficiency disorders market appears promising, driven by ongoing advancements in treatment modalities and diagnostic technologies. As the healthcare landscape evolves, there is a growing emphasis on personalized medicine and patient-centric care models. Additionally, the integration of telemedicine is expected to enhance access to specialized care, particularly for underserved populations. These trends indicate a shift towards more efficient and effective management of PIDs, ultimately improving patient outcomes and market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Disease Type | Antibody Deficiency Disorders (e.g., CVID, XLA, Selective IgA Deficiency) Combined Immunodeficiency Disorders (including SCID) Cellular Immunodeficiency Disorders Innate Immune Disorders Complement Deficiencies Others |

| By Treatment Modality | Intravenous Immunoglobulin (IVIG) Replacement Therapy Subcutaneous Immunoglobulin (SCIG) Replacement Therapy Hematopoietic Stem Cell / Bone Marrow Transplantation Gene Therapy Antibiotic / Anti?infective Prophylaxis and Supportive Therapies Others |

| By Age Group | Pediatric Adult |

| By Distribution Channel | Hospital Pharmacies Specialty / Infusion Centers & Specialty Pharmacies Retail Pharmacies Online Pharmacies |

| By US Region | Northeast Midwest South West |

| By End User | Hospitals Immunology & Specialty Clinics Homecare Settings Academic & Research Centers Others |

| By Route of Administration (Immunoglobulin Therapies) | Intravenous Subcutaneous Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Immunologists, Pediatricians, General Practitioners |

| Pharmaceutical Stakeholders | 100 | Product Managers, Market Access Specialists |

| Patient Advocacy Groups | 80 | Advocacy Leaders, Patient Support Coordinators |

| Clinical Researchers | 70 | Clinical Trial Managers, Research Scientists |

| Health Insurance Representatives | 60 | Policy Analysts, Claims Managers |

The US Primary Immunodeficiency Disorders Market is valued at approximately USD 2.9 billion, driven by the increasing prevalence of primary immunodeficiency diseases and advancements in treatment modalities, including immunoglobulin therapies and innovative biologics.