US Ride Hailing Services Market Overview

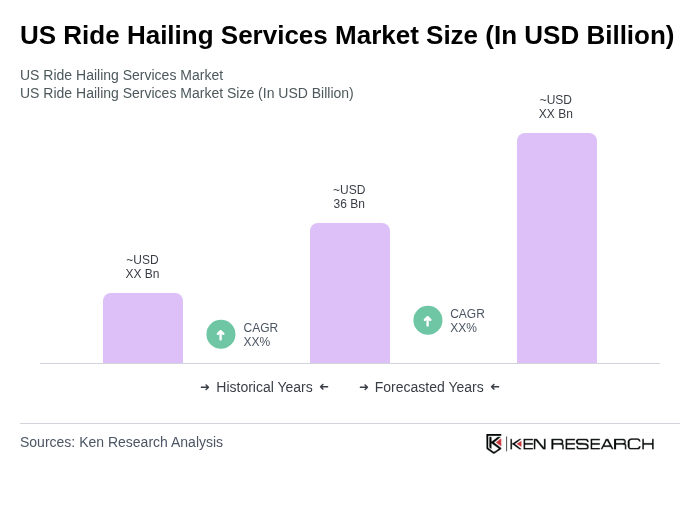

- The US Ride Hailing Services Market is valued at approximatelyUSD 36 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for convenient transportation solutions, rapid urbanization, and the widespread adoption of smartphone technology, which has made ride-hailing services more accessible to consumers. The market has seen a significant rise in user adoption, particularly in metropolitan areas where public transportation options may be limited.

- Key cities dominating the US Ride Hailing Services Market includeNew York City, Los Angeles, and San Francisco. These cities are characterized by high population density, a culture of convenience, and a strong reliance on technology, which collectively contribute to the robust demand for ride-hailing services. The presence of major players and a diverse customer base further solidify their dominance in the market.

- In 2023, the US government implemented regulations requiring ride-hailing companies to provide insurance coverage for drivers and passengers during rides. This regulatory framework is exemplified by the “Transportation Network Company (TNC) Insurance Requirements” established under the Federal Insurance Office and various state-level acts, such as the California Assembly Bill No. 2293 (2014, amended 2023), which mandates minimum insurance coverage for TNC drivers from the moment they log into the app until the completion of a ride. These regulations aim to enhance safety standards and protect consumers, ensuring that all ride-hailing services operate under a framework that prioritizes the well-being of users while promoting accountability among service providers.

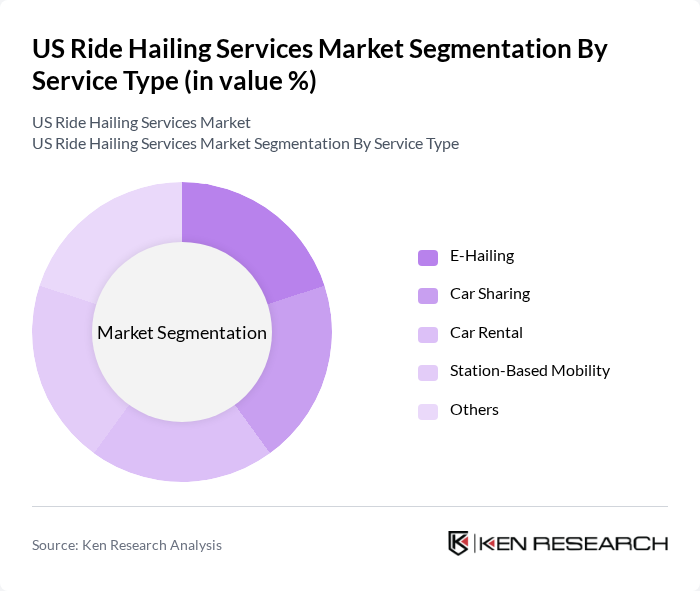

US Ride Hailing Services Market Segmentation

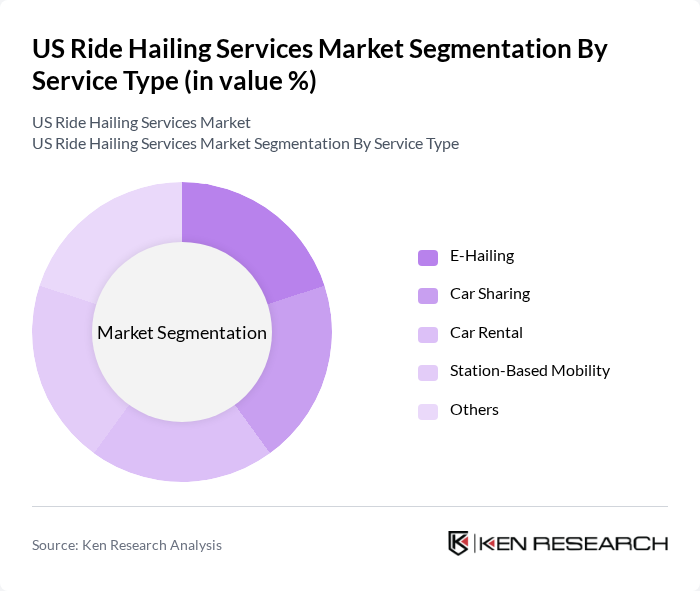

By Service Type:The service type segmentation includes categories such as E-Hailing, Car Sharing, Car Rental, Station-Based Mobility, and Others. Among these,E-Hailingis the dominant segment due to its convenience and user-friendly mobile applications that allow customers to book rides instantly. The growing trend of on-demand services, integration of electric vehicles, and the emergence of autonomous ride options have further propelled the popularity of E-Hailing, making it the preferred choice for consumers seeking quick and efficient transportation solutions.

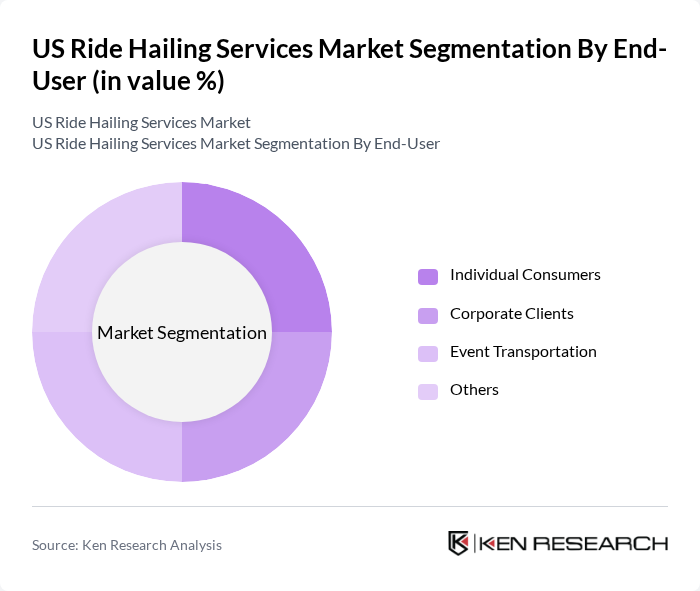

By End-User:The end-user segmentation encompasses Individual Consumers, Corporate Clients, Event Transportation, and Others.Individual Consumersrepresent the largest segment, driven by the increasing preference for ride-hailing services among millennials and urban dwellers who prioritize convenience and cost-effectiveness. The rise in remote work, flexible schedules, and the need for safe, contactless transportation options have also contributed to the growth of this segment, as more individuals seek reliable transportation for daily commutes and leisure activities.

US Ride Hailing Services Market Competitive Landscape

The US Ride Hailing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Lyft, Inc., Via Transportation, Inc., Curb Mobility LLC, Wingz, Inc., Arro, Inc., Z?m Services, Inc., Alto Experience, Inc., Gett, Inc., HopSkipDrive, Inc., Revel Transit Inc., Juno (archived/legacy), RideCo Inc., Safr Technologies, Inc., Summon Mobility contribute to innovation, geographic expansion, and service delivery in this space.

US Ride Hailing Services Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The US urban population is projected to reach approximately 83% in future, up from 83% in 2020, according to the World Bank. This rapid urbanization drives demand for efficient transportation solutions, as urban dwellers often rely on ride-hailing services for their daily commutes. The concentration of jobs, amenities, and services in urban areas further fuels the need for convenient mobility options, making ride-hailing an attractive choice for many consumers.

- Rising Smartphone Penetration:As of future, the smartphone penetration rate in the US is expected to exceed 82%, according to Statista. This widespread adoption of smartphones facilitates easy access to ride-hailing apps, allowing users to book rides with just a few taps. The convenience of mobile technology enhances user experience and encourages more individuals to utilize ride-hailing services, contributing to market growth as more people embrace digital solutions for transportation.

- Shift Towards Shared Mobility:The shared mobility market in the US is anticipated to grow significantly, with an estimated value of $1.3 billion in future, as reported by the International Transport Forum. This shift reflects changing consumer preferences towards cost-effective and sustainable transportation options. Ride-hailing services align with this trend, offering users the ability to share rides, reduce individual transportation costs, and minimize their carbon footprint, thus driving further adoption of these services.

Market Challenges

- Regulatory Compliance Issues:The ride-hailing industry faces stringent regulatory frameworks across various states, with over 30 states implementing specific regulations in future. Compliance with these regulations can be costly and complex, impacting operational efficiency. Companies must navigate licensing requirements, insurance mandates, and local taxation policies, which can hinder growth and create barriers to entry for new market players, ultimately affecting service availability and pricing.

- Driver Retention and Satisfaction:The driver turnover rate in the ride-hailing industry is estimated to be around 30% annually, according to industry reports. High turnover rates can lead to service disruptions and increased operational costs for companies. Factors such as low earnings, lack of benefits, and job insecurity contribute to driver dissatisfaction. Addressing these issues is crucial for maintaining a stable workforce and ensuring consistent service quality for customers.

US Ride Hailing Services Market Future Outlook

The US ride-hailing market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for efficient transportation solutions will rise, prompting companies to innovate. The integration of electric vehicles and autonomous technology will likely reshape service offerings, enhancing sustainability and operational efficiency. Additionally, partnerships with public transport systems may emerge, creating a more cohesive transportation network that meets the needs of urban populations effectively.

Market Opportunities

- Expansion into Suburban Areas:With suburban populations growing, ride-hailing services have the opportunity to expand their reach. By targeting these areas, companies can tap into a new customer base, as residents seek convenient transportation options. This expansion can lead to increased ride requests and revenue growth, particularly as suburban commuters look for alternatives to traditional public transport.

- Integration of Electric Vehicles:The push for sustainability is driving the integration of electric vehicles (EVs) into ride-hailing fleets. In future, it is projected that EVs will account for approximately 7% of new vehicle sales in the US. This shift not only aligns with environmental goals but also reduces operational costs for companies, making ride-hailing services more appealing to eco-conscious consumers and enhancing brand reputation.