Region:North America

Author(s):Geetanshi

Product Code:KRAD4769

Pages:96

Published On:December 2025

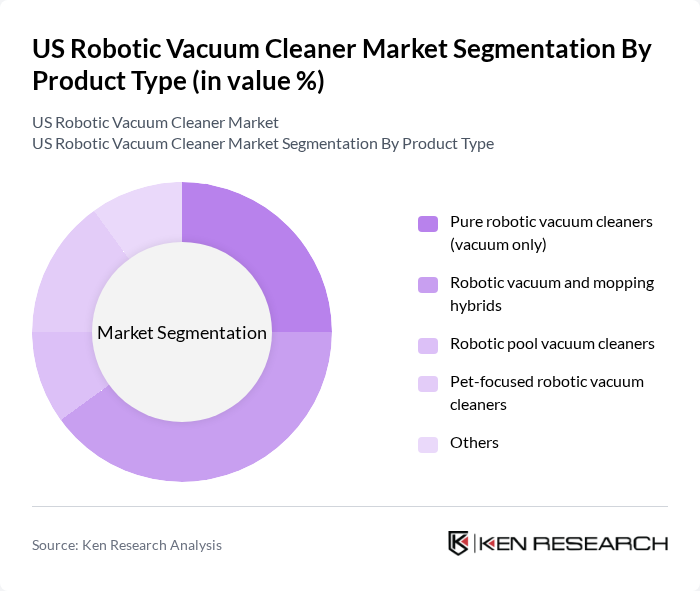

By Product Type:The product type segmentation includes various categories such as pure robotic vacuum cleaners, robotic vacuum and mopping hybrids, robotic pool vacuum cleaners, pet-focused robotic vacuum cleaners, and others. Robotic vacuum and mopping hybrids are gaining significant traction due to their multifunctionality and advanced navigation, appealing to consumers looking for comprehensive hard?floor and carpet cleaning solutions in a single device. The ability to combine sweeping, vacuuming, and mopping, often with app control and automated docking, is driving their popularity, especially in urban households and apartments where space optimization, time savings, and low maintenance are key priorities.

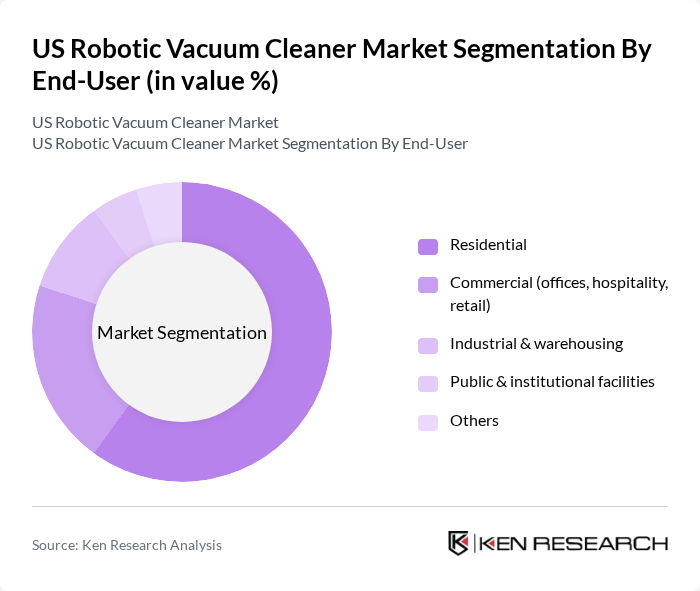

By End-User:The end-user segmentation encompasses residential, commercial, industrial & warehousing, public & institutional facilities, and others. The residential segment is the largest, driven by the increasing adoption of smart home technologies, higher penetration of Wi?Fi and voice assistants, and the growing number of dual-income households seeking efficient, low?touch cleaning solutions. The convenience offered by robotic vacuums, including scheduled cleaning, self?charging, and integration with smart home platforms, aligns well with the busy lifestyles of modern consumers, making this segment a key driver of market growth.

The US Robotic Vacuum Cleaner Market is characterized by a dynamic mix of regional and international players. Leading participants such as iRobot Corporation (Roomba), SharkNinja Operating LLC, Roborock Technology Co., Ltd., Ecovacs Robotics Co., Ltd., Anker Innovations Co., Ltd. (Eufy), Samsung Electronics Co., Ltd., LG Electronics Inc., Dyson Limited, Bissell Homecare, Inc., Midea Group Co., Ltd. (Midea / Eureka), Xiaomi Corporation, Panasonic Holdings Corporation, Haier Smart Home Co., Ltd., Cecotec Innovaciones S.L. (Conga), Neato Robotics, Inc. (a Vorwerk company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US robotic vacuum cleaner market appears promising, driven by continuous technological advancements and increasing consumer adoption. As smart home integration becomes more prevalent, manufacturers are likely to focus on enhancing connectivity features. Additionally, the trend towards eco-friendly products is expected to gain momentum, with consumers increasingly seeking sustainable options. These factors will likely shape product development and marketing strategies, fostering a more competitive and innovative market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Pure robotic vacuum cleaners (vacuum only) Robotic vacuum and mopping hybrids Robotic pool vacuum cleaners Pet-focused robotic vacuum cleaners Others |

| By End-User | Residential Commercial (offices, hospitality, retail) Industrial & warehousing Public & institutional facilities Others |

| By Price Range | Budget (Under $200) Mid-range ($200 - $500) Premium (Above $500) Ultra-premium (Above $1,000) |

| By Brand Presence (Selected) | iRobot (Roomba) SharkNinja Roborock Ecovacs Others |

| By Distribution Channel | Online marketplaces (Amazon, Walmart.com, etc.) Brand-owned e-commerce Offline retail (big-box & specialty stores) Institutional/direct sales Others |

| By Navigation & Control Technology | LiDAR / laser-based navigation Camera-based / visual navigation (vSLAM) Gyroscope & sensor-based navigation App-connected & voice-controlled models Others |

| By Customer Segment | Tech-savvy smart home adopters Dual-income and busy households Households with pets or allergies Elderly and assisted-living users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Robotic Vacuums | 120 | Homeowners, Renters |

| Retailer Feedback on Sales Trends | 90 | Store Managers, Sales Representatives |

| Expert Opinions on Market Innovations | 40 | Industry Analysts, Product Developers |

| Consumer Satisfaction Surveys | 130 | Robotic Vacuum Owners |

| Market Trends and Future Outlook | 70 | Home Automation Specialists, Retail Buyers |

The US robotic vacuum cleaner market is valued at approximately USD 2.3 billion, driven by increasing consumer demand for smart home devices and the adoption of AI-driven navigation technologies.