Region:North America

Author(s):Dev

Product Code:KRAD7711

Pages:86

Published On:December 2025

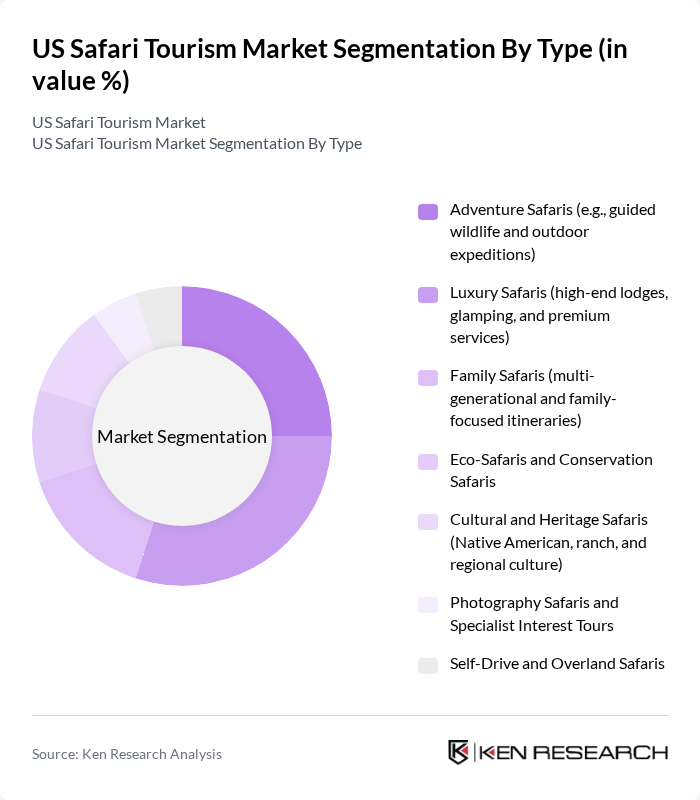

By Type:The market is segmented into various types of safaris, each catering to different consumer preferences and experiences. Adventure safaris, which include guided wildlife and outdoor expeditions such as walking safaris and hot air balloon trips, are popular among thrill-seekers. Luxury safaris offer high-end lodges and premium services, appealing to affluent travelers. Family safaris focus on multi-generational experiences, while eco-safaris emphasize conservation. Cultural and heritage safaris provide insights into local traditions, and photography safaris cater to enthusiasts. Self-drive and overland safaris offer flexibility for independent travelers.

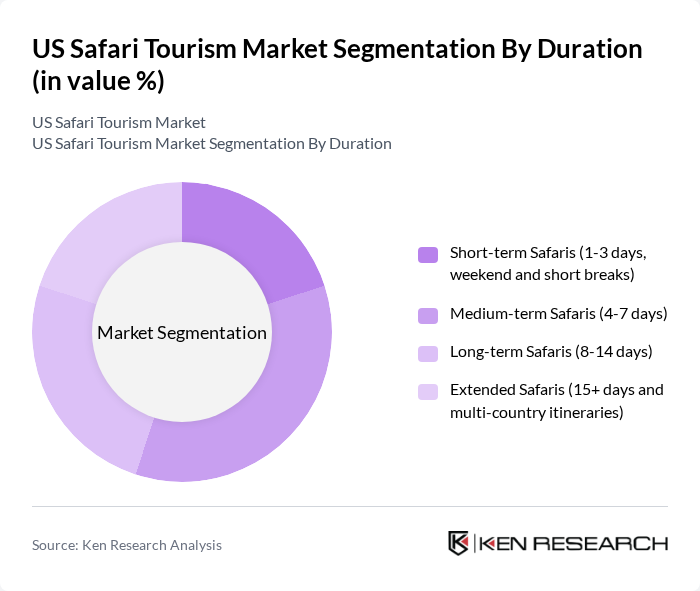

By Duration:The duration of safaris varies significantly, catering to different traveler needs. Short-term safaris, lasting 1-3 days, are ideal for weekend getaways. Medium-term safaris, spanning 4-7 days, allow for more in-depth exploration. Long-term safaris, lasting 8-14 days, provide extensive experiences, while extended safaris, over 15 days, often include multi-country itineraries. The trend shows a growing preference for medium to long-term safaris as travelers seek immersive experiences.

The US Safari Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abercrombie & Kent USA, LLC, Intrepid Travel (Intrepid Group, US operations), G Adventures Inc. (North America), Natural Habitat Adventures, Thomson Safaris, African Travel, Inc., Micato Safaris, Wilderness Safaris (US sales and distribution), Go2Africa (USA Source Market Operations), Travel Beyond, Inc., Ker & Downey® Africa (US sales office and partners), The Africa Adventure Company, Safari Legacy (North American sales representation), The Wild Source, Wayfairer Travel (US-focused safari specialist) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US safari tourism market appears promising, driven by evolving consumer preferences for unique travel experiences and a growing emphasis on sustainability. As travelers increasingly seek personalized and immersive adventures, safari operators are likely to adapt by offering tailored packages that cater to diverse interests. Additionally, the integration of technology in travel planning and marketing will enhance customer engagement, making safari experiences more accessible and appealing to a broader audience in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Adventure Safaris Luxury Safaris Family Safaris Eco-Safaris and Conservation Safaris Cultural and Heritage Safaris Photography Safaris and Specialist Interest Tours Self-Drive and Overland Safaris |

| By Duration | Short-term Safaris Medium-term Safaris Long-term Safaris Extended Safaris |

| By Target Audience | Solo Travelers Couples and Honeymooners Families with Children Affluent and Luxury Travelers Special Interest Groups |

| By Activity Type | Wildlife Viewing and Game Drives Bird Watching and Specialist Natural History Tours Hiking, Trekking, and Walking Safaris Cultural and Community-Based Experiences Marine and Coastal Safaris |

| By Booking Channel | Online Travel Agencies (OTAs) and Marketplaces Direct Online Bookings Traditional Travel Agents and Tour Specialists Corporate, Group, and MICE Channels |

| By Geographic Focus | African Safari Destinations Domestic US Safari and Wildlife Experiences Rest of World Safari Experiences Multi-Destination and Combination Safaris |

| By Price Range | Budget Safaris Mid-range Safaris Luxury Safaris Ultra-Luxury and Private Safaris |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Safari Tour Operators | 60 | Business Owners, Operations Managers |

| Wildlife Conservation Organizations | 50 | Conservation Directors, Program Managers |

| Tourists who have taken Safari Tours | 120 | Recent Safari Participants, Travel Enthusiasts |

| Travel Agencies specializing in Safari Packages | 40 | Travel Agents, Sales Managers |

| State Park Officials | 40 | Park Managers, Wildlife Biologists |

The US Safari Tourism Market is valued at approximately USD 10.5 billion, reflecting a growing interest in wildlife experiences, adventure travel, and eco-tourism among consumers.