Region:North America

Author(s):Shubham

Product Code:KRAA1892

Pages:100

Published On:August 2025

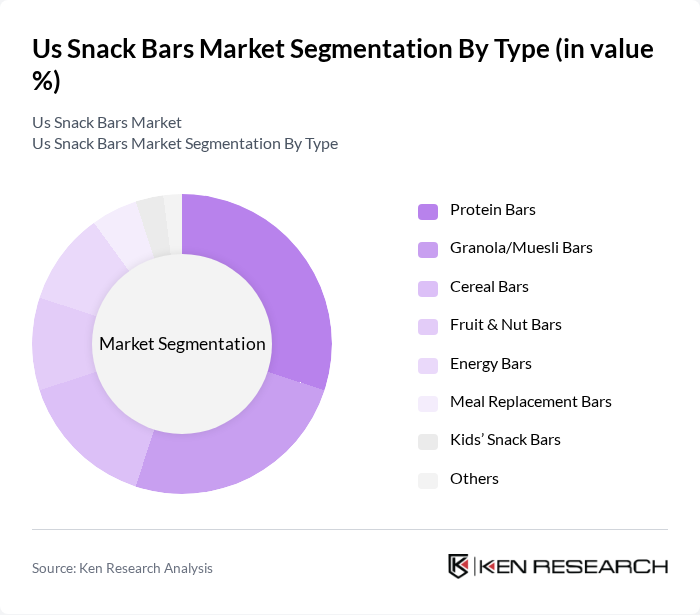

By Type:The snack bars market can be segmented into various types, including Protein Bars, Granola/Muesli Bars, Cereal Bars, Fruit & Nut Bars, Energy Bars, Meal Replacement Bars, Kids’ Snack Bars, and Others. Each of these subsegments caters to different consumer preferences and dietary needs, contributing to the overall growth of the market. Protein-forward and cereal/granola formats remain leading styles in the United States, supported by consumer priorities for convenience, satiety, and permissible indulgence .

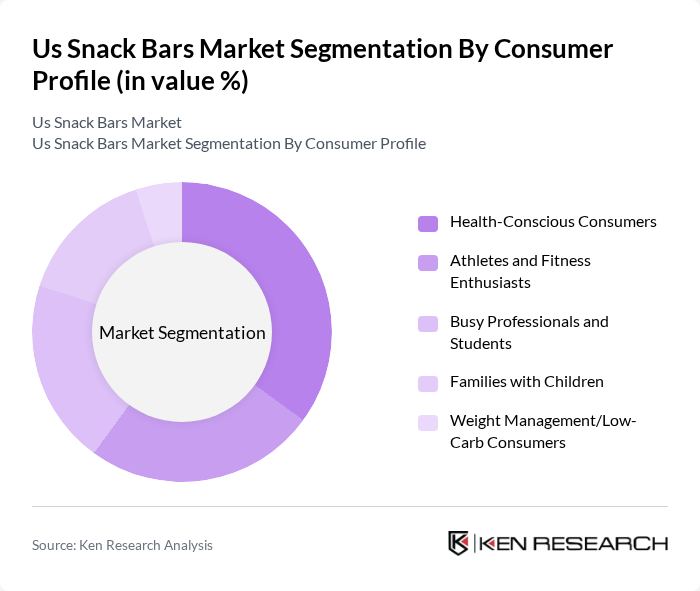

By Consumer Profile:The consumer profile segmentation includes Health-Conscious Consumers, Athletes and Fitness Enthusiasts, Busy Professionals and Students, Families with Children, and Weight Management/Low-Carb Consumers. Each group has distinct preferences and purchasing behaviors that influence the types of snack bars they choose. Health-conscious and fitness-oriented consumers prioritize protein and lower sugar, while families and busy professionals seek convenient formats, minis/portion control, and familiar flavors in cereal/granola styles .

The Us Snack Bars Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Mills, Inc. (Nature Valley, Fiber One), Clif Bar & Company (a Mars, Incorporated brand), Kellogg Company (Kellanova; brands: Kashi, Special K), The Simply Good Foods Company (Atkins Nutritionals, Inc.; Quest Nutrition, LLC), KIND LLC (a Mars, Incorporated brand), RXBAR (a Kellogg Company brand), Nature’s Bakery, LLC (a Mars, Incorporated subsidiary), Bobo’s Oat Bars (Bobo’s), GoMacro, LLC, Health Warrior (a PepsiCo brand; under The Better Nutrition Company), One Brands, LLC (a The Hershey Company brand), J.M. Smucker Co. (Sahale Snacks; snack bars portfolio), Post Consumer Brands (PowerBar; Premier Protein bars via BellRing Brands relationship), Mars, Incorporated (parent of KIND, CLIF; various bar portfolios), PepsiCo, Inc. (Quaker Chewy, Pure Protein via acquisitions/partnerships) contribute to innovation, geographic expansion, and service delivery in this space .

The U.S. snack bar market is poised for continued growth, driven by evolving consumer preferences and innovative product offerings. As health consciousness rises, brands are expected to focus on functional ingredients and plant-based options, aligning with the increasing demand for nutritious snacks. Additionally, the expansion of e-commerce and subscription services will enhance accessibility, allowing brands to reach a broader audience. Companies that adapt to these trends will likely thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Bars Granola/Muesli Bars Cereal Bars Fruit & Nut Bars Energy Bars Meal Replacement Bars Kids’ Snack Bars Others |

| By Consumer Profile | Health-Conscious Consumers Athletes and Fitness Enthusiasts Busy Professionals and Students Families with Children Weight Management/Low-Carb Consumers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Club/Wholesale (e.g., Costco, Sam’s Club) Specialty & Health Food Stores |

| By Price Range | Premium Mid-Range Budget |

| By Claim/Ingredient | Organic Non-GMO Gluten-Free Plant-Based/Vegan High-Protein/Low-Sugar |

| By Packaging Type | Single-Serve Bars Multi-Pack Boxes Club-Size/Bulk Packs |

| By Flavor Profile | Chocolate Fruit Nutty Savory |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Snack Bar Sales | 120 | Store Managers, Category Buyers |

| Health and Fitness Consumer Insights | 90 | Fitness Trainers, Health Coaches |

| Snack Bar Product Development | 70 | R&D Managers, Product Innovators |

| Consumer Preferences in Snack Bars | 110 | Health-Conscious Consumers, Dietitians |

| Market Trends and Innovations | 80 | Industry Analysts, Market Researchers |

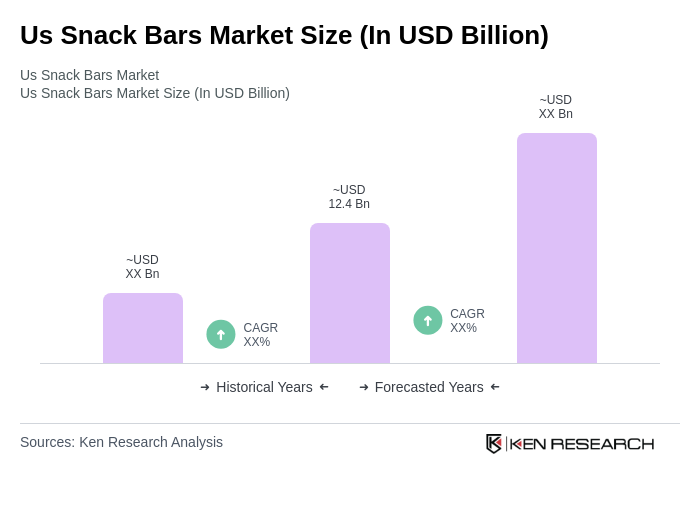

The US Snack Bars Market is valued at approximately USD 12.4 billion, reflecting strong consumer demand for convenient and nutritious snack options. This growth is driven by trends favoring health-conscious eating and on-the-go consumption.