Region:Middle East

Author(s):Shubham

Product Code:KRAA8789

Pages:89

Published On:November 2025

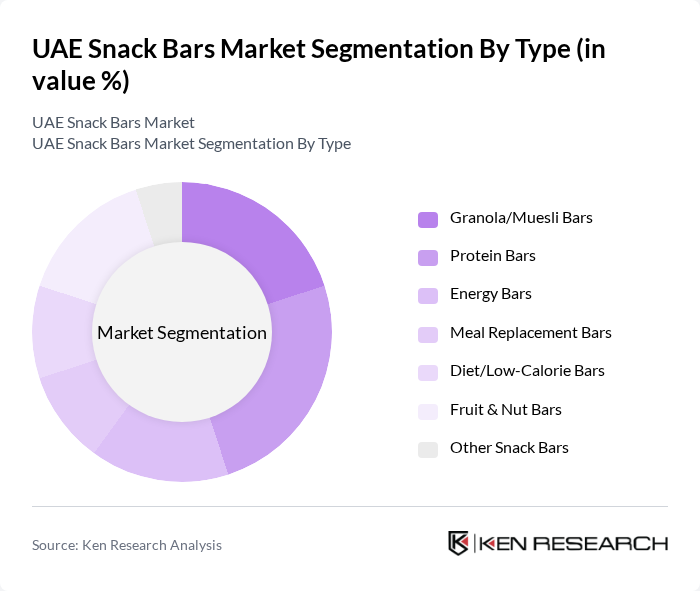

By Type:The snack bars market can be segmented into various types, including Granola/Muesli Bars, Protein Bars, Energy Bars, Meal Replacement Bars, Diet/Low-Calorie Bars, Fruit & Nut Bars, and Other Snack Bars. Each of these sub-segments caters to different consumer preferences and dietary needs, reflecting the diverse landscape of the snack bar industry.

The Protein Bars sub-segment is currently dominating the market due to the increasing number of health-conscious consumers and fitness enthusiasts seeking convenient, high-protein snacks. This trend is further fueled by the growing awareness of the benefits of protein in muscle recovery and weight management. As a result, brands are innovating with flavors and formulations to cater to this demand, making protein bars a preferred choice among various consumer groups. Granola/Muesli Bars remain popular for their balanced nutritional profile and broad consumer appeal .

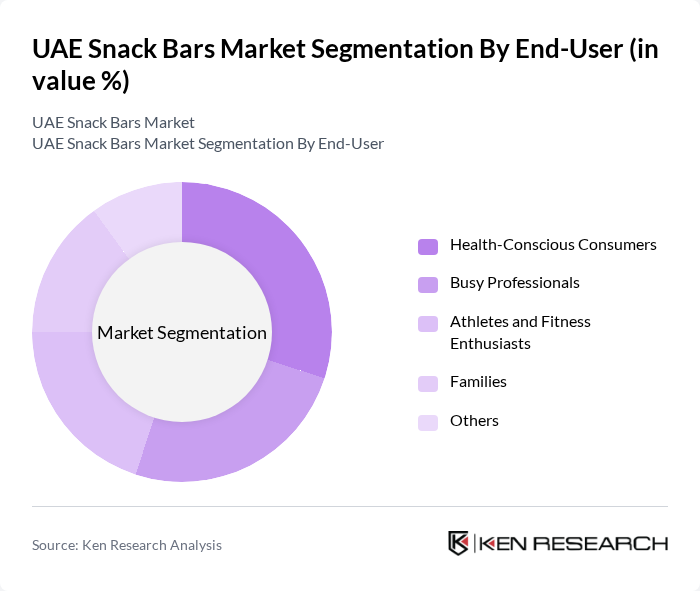

By End-User:The end-user segmentation includes Health-Conscious Consumers, Busy Professionals, Athletes and Fitness Enthusiasts, Families, and Others. Each group has distinct preferences and consumption patterns, influencing the types of snack bars that are popular in the market.

Health-Conscious Consumers represent the largest segment, driven by a growing trend towards healthier eating habits and the desire for convenient, nutritious snacks. This demographic is increasingly seeking products that align with their dietary goals, such as low-sugar, high-protein, and organic options. Brands are responding by developing innovative products that cater to these preferences, solidifying the dominance of this segment in the market. Busy Professionals and Athletes and Fitness Enthusiasts are also key drivers, with demand for quick, energy-boosting snacks on the rise .

The UAE Snack Bars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Nestlé Middle East, Mars GCC, Mondelez International, General Mills, Kellogg's Middle East, Sunbulah Group, Emirates Snack Foods, Hunter Foods, Almarai, Tiffany (IFFCO Group), Bayara, Best Food Company LLC, Bateel International, Al Watania Food contribute to innovation, geographic expansion, and service delivery in this space.

The UAE snack bars market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, manufacturers are likely to innovate with functional ingredients and sustainable packaging. Additionally, the integration of digital platforms for marketing and sales will enhance consumer engagement. The anticipated growth in e-commerce and the introduction of personalized snack options will further shape the market landscape, creating new avenues for growth and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Granola/Muesli Bars Protein Bars Energy Bars Meal Replacement Bars Diet/Low-Calorie Bars Fruit & Nut Bars Other Snack Bars |

| By End-User | Health-Conscious Consumers Busy Professionals Athletes and Fitness Enthusiasts Families Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience/Grocery Stores Specialty Health Food Stores Online Retail Stores Other Distribution Channels |

| By Flavor | Chocolate Fruit Nut Vanilla Others |

| By Packaging Type | Single-Serve Packs Multi-Packs Bulk Packaging Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Nutritional Content | High-Protein Low-Sugar Gluten-Free Organic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Snack Bars | 120 | Store Managers, Category Buyers |

| Consumer Preferences for Snack Bars | 140 | Health-Conscious Consumers, Fitness Enthusiasts |

| Market Trends in E-commerce Snack Sales | 100 | E-commerce Managers, Digital Marketing Specialists |

| Product Development Insights | 80 | R&D Managers, Product Development Leads |

| Supply Chain Dynamics for Snack Bars | 70 | Logistics Coordinators, Supply Chain Analysts |

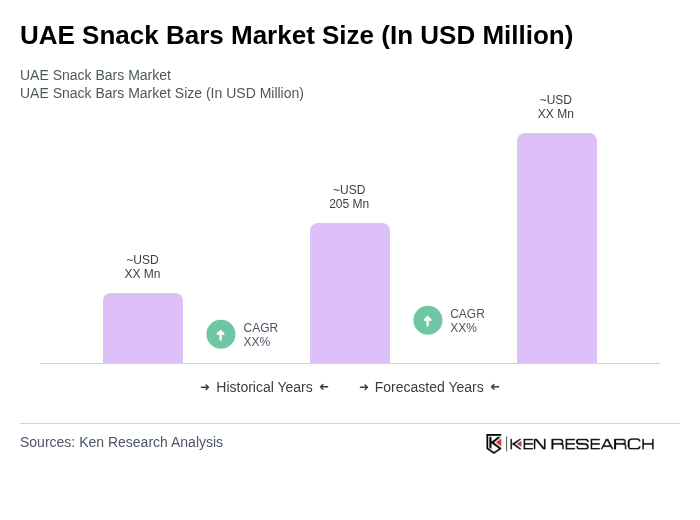

The UAE Snack Bars Market is valued at approximately USD 205 million, reflecting a significant growth trend driven by increasing health consciousness and the demand for convenient, nutritious snack options among consumers.