Region:North America

Author(s):Rebecca

Product Code:KRAD0260

Pages:82

Published On:August 2025

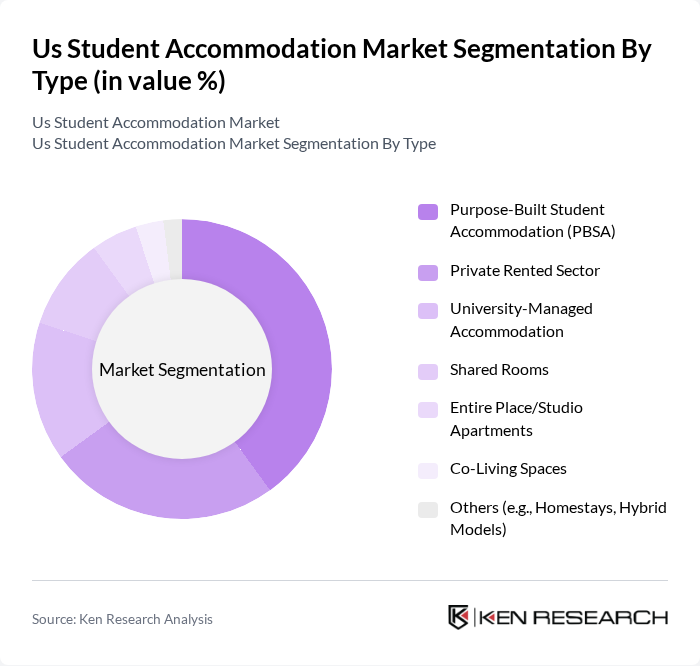

By Type:This segmentation includes various types of accommodations available for students, each catering to different preferences and budgets. The subsegments are Purpose-Built Student Accommodation (PBSA), Private Rented Sector, University-Managed Accommodation, Shared Rooms, Entire Place/Studio Apartments, Co-Living Spaces, and Others (e.g., Homestays, Hybrid Models).Purpose-Built Student Accommodation (PBSA)is currently the leading subsegment, driven by its tailored amenities and services that meet the specific needs of students. Modern PBSA developments emphasize proximity to campus, security, and community-building features, aligning with evolving student expectations .

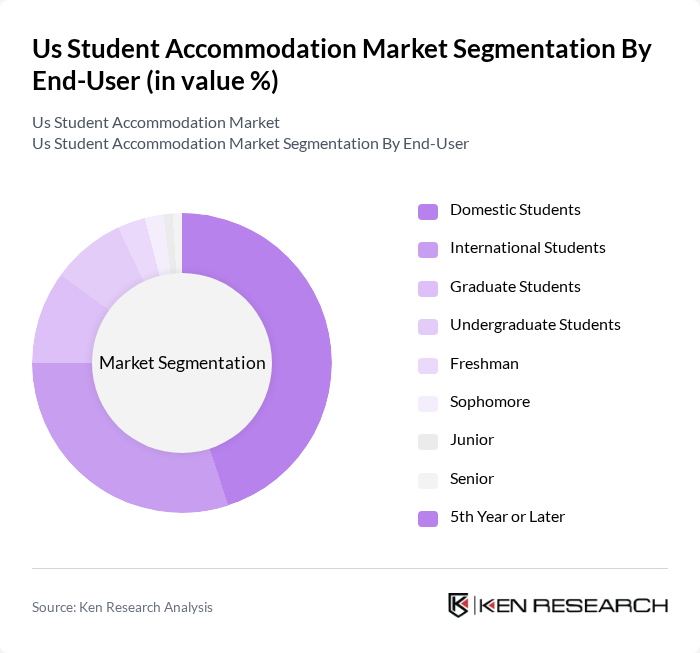

By End-User:This segmentation focuses on the different categories of students utilizing accommodation services. The subsegments include Domestic Students, International Students, Graduate Students, Undergraduate Students, Freshman, Sophomore, Junior, Senior, and 5th Year or Later. TheInternational Studentssubsegment is currently the most significant in terms of revenue impact, reflecting the growing trend of students from abroad seeking education in the US. International students account for a substantial share of market demand, often bringing longer lease tenures and premium rent payments, which help stabilize occupancy and drive higher yields for operators .

The Us Student Accommodation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Greystar Real Estate Partners, American Campus Communities, The Scion Group, Campus Apartments, CA Ventures, The Dinerstein Companies, PeakMade Real Estate, Asset Living, Harrison Street Real Estate Capital, Landmark Properties, Yugo, Campus Living Villages, Core Spaces, Vesper Holdings, Cardinal Group Companies contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. student accommodation market is poised for significant transformation, driven by evolving student preferences and technological advancements. The integration of smart technologies in housing solutions is expected to enhance living experiences, while the shift towards hybrid learning models will influence accommodation needs. Additionally, the focus on health and safety standards will shape future developments, ensuring that student housing meets the expectations of a post-pandemic world, ultimately fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Purpose-Built Student Accommodation (PBSA) Private Rented Sector University-Managed Accommodation Shared Rooms Entire Place/Studio Apartments Co-Living Spaces Others (e.g., Homestays, Hybrid Models) |

| By End-User | Domestic Students International Students Graduate Students Undergraduate Students Freshman Sophomore Junior Senior th Year or Later |

| By Location | Urban Areas Suburban Areas Near Campus (?1.5 miles) Off-Campus (>1.5 miles) Rural Areas |

| By Amenities Offered | Fully Furnished Units On-Site Management Study Lounges Fitness Centers Smart Technology Integration Bed-Bath Parity |

| By Price Range | Budget Accommodation Mid-Range Accommodation Premium Accommodation |

| By Lease Duration | Short-Term Leases Long-Term Leases Semester-Based Leases |

| By Management Type | Managed Properties Self-Managed Properties Franchise Operations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| On-Campus Housing Demand | 100 | University Housing Administrators, Student Affairs Officers |

| Off-Campus Rental Preferences | 90 | Current Students, Recent Graduates |

| International Student Housing Needs | 60 | International Student Advisors, International Students |

| Property Management Insights | 70 | Property Managers, Real Estate Developers |

| Student Satisfaction Surveys | 120 | Undergraduate and Graduate Students |

The US Student Accommodation Market is valued at approximately USD 22.8 billion, reflecting a significant growth trend driven by increasing student enrollment and demand for quality housing options tailored to student needs.