Region:Middle East

Author(s):Dev

Product Code:KRAD3246

Pages:86

Published On:November 2025

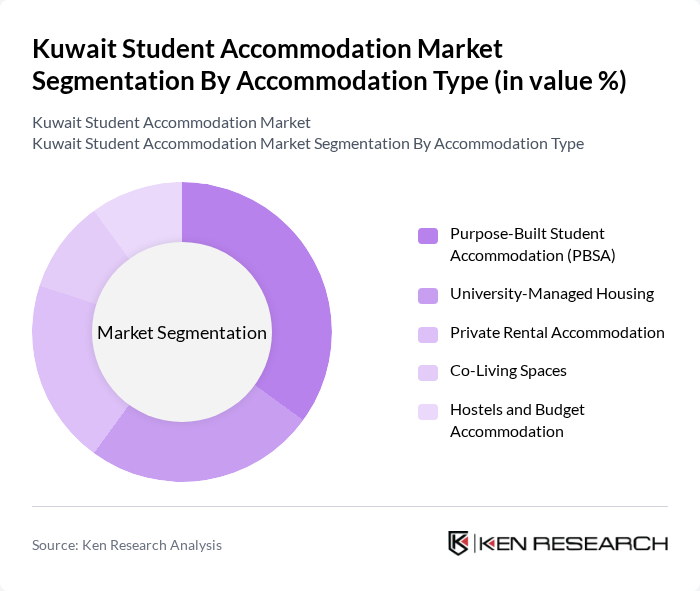

By Accommodation Type:The accommodation type segment includes various options catering to the diverse needs of students. Purpose-Built Student Accommodation (PBSA) is gaining traction due to its tailored amenities and services, offering modern living spaces with high-speed internet, security systems, communal spaces, and study areas. University-Managed Housing remains popular among students seeking convenience and proximity to campus. Private Rental Accommodation offers flexibility, while Co-Living Spaces are emerging as a trendy option for social interaction. Hostels and Budget Accommodation cater to cost-conscious students, ensuring a wide range of choices.

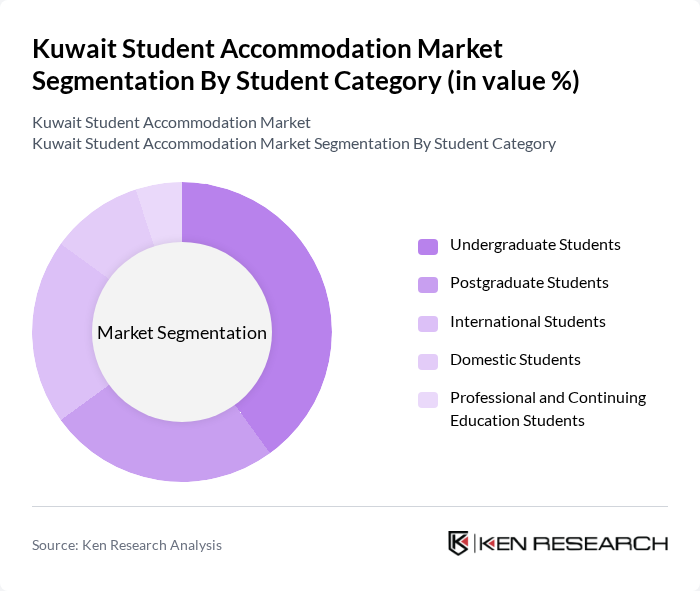

By Student Category:This segment categorizes students based on their educational pursuits. Undergraduate Students form the largest group, driven by the increasing enrollment in universities. Postgraduate Students are also significant, seeking specialized housing options and representing a fastest-growing segment in the global market. International Students are a growing demographic, often requiring specific amenities and demonstrating higher willingness to pay for premium accommodations. Domestic Students prefer accommodations that offer a balance of cost and comfort, while Professional and Continuing Education Students look for flexible housing arrangements that cater to their busy schedules.

The Kuwait Student Accommodation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mapletree Investments Pte Ltd, Al-Diwan Real Estate Company, Al-Hamra Real Estate Development, Al-Manshar Real Estate, Al-Qabas Real Estate, Al-Salam International Real Estate, Al-Masar Real Estate Development, Al-Fawaz Real Estate Company, Al-Nasr Real Estate, Al-Khalij Real Estate Group, Al-Majed Real Estate, Al-Shaheen Real Estate Company, Al-Bahar Real Estate Development, Al-Jazeera Real Estate, Al-Muhaidib Real Estate Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait student accommodation market appears promising, driven by increasing enrollment and a focus on quality housing. As the government continues to invest in educational infrastructure, the demand for student housing is expected to rise. Additionally, the integration of smart technologies and sustainable practices will likely become standard, enhancing the living experience for students. Providers who adapt to these trends will be well-positioned to capitalize on emerging opportunities in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Accommodation Type | Purpose-Built Student Accommodation (PBSA) University-Managed Housing Private Rental Accommodation Co-Living Spaces Hostels and Budget Accommodation |

| By Student Category | Undergraduate Students Postgraduate Students International Students Domestic Students Professional and Continuing Education Students |

| By Location | Urban Areas (Kuwait City, Salmiya) Suburban Areas Proximity to Major Universities (Kuwait University, PAAET) Others |

| By Amenities Offered | High-Speed Internet and Smart Technologies Study Areas and Communal Lounges Recreational and Fitness Facilities /7 Security and Safety Features Meal Plans and Dining Services Furnished vs. Unfurnished |

| By Pricing Model | Fixed Monthly Rent Semester-Based Pricing Flexible Lease Models Premium vs. Budget Segments |

| By Duration of Stay | Short-term Rentals (1-3 months) Semester-Based Rentals (4-6 months) Long-term Rentals (9-12 months) Academic Year Contracts |

| By Management Type | University-Managed Facilities Privately Managed PBSA Public-Private Partnerships (PPP) Individual Landlord Rentals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| University Housing Administrators | 40 | Housing Directors, Student Affairs Officers |

| Current Students | 120 | Undergraduate and Graduate Students |

| Landlords and Property Managers | 50 | Real Estate Owners, Property Management Executives |

| International Students | 60 | Exchange Students, Full-time International Students |

| Real Estate Analysts | 45 | Market Researchers, Economic Analysts |

The Kuwait Student Accommodation Market is valued at approximately USD 1.3 billion, reflecting a significant growth driven by the increasing number of international students and the demand for quality housing options that cater to their needs.