Region:North America

Author(s):Rebecca

Product Code:KRAD1541

Pages:92

Published On:November 2025

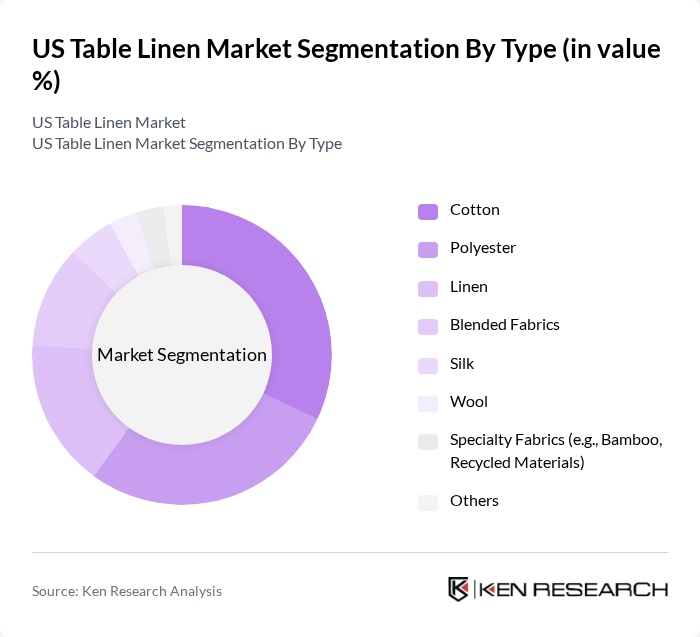

By Type:The market is segmented into various types of table linens, including cotton, polyester, linen, blended fabrics, silk, wool, specialty fabrics, and others. Cotton remains the most popular choice due to its durability and ease of care, while polyester is favored for its affordability and stain resistance. Linen is appreciated for its luxurious feel, and blended fabrics offer a balance of quality and cost. Specialty fabrics, such as bamboo and recycled materials, are gaining traction as consumers become more environmentally conscious and seek sustainable alternatives .

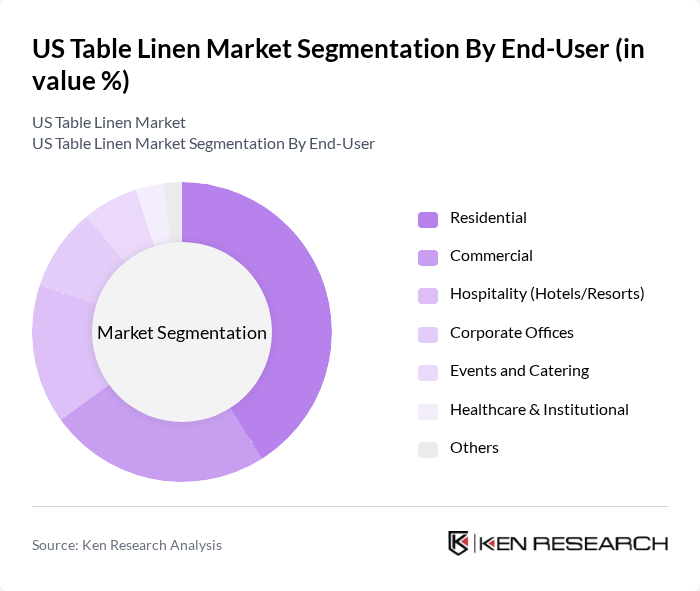

By End-User:The end-user segmentation includes residential, commercial, hospitality, corporate offices, events and catering, healthcare & institutional, and others. The residential segment is the largest, driven by the growing trend of home dining and entertaining, as well as increased focus on home aesthetics. The hospitality sector also plays a significant role, as hotels and restaurants require high-quality linens to enhance guest experiences. Events and catering services are increasingly investing in diverse table linen options to meet client demands. The commercial and institutional segments are also expanding, reflecting broader adoption across offices and healthcare facilities .

The US Table Linen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Williams Sonoma, Inc., Bed Bath & Beyond Inc., Sur La Table, Inc., Pottery Barn (a Williams-Sonoma brand), Crate and Barrel Holdings, Inc., Target Corporation, Wayfair Inc., Amazon.com, Inc., IKEA North America Services, LLC, The Home Depot, Inc., Macy's, Inc., JCPenney Company, Inc., Anthropologie (URBN Brands), West Elm (a Williams-Sonoma brand), Overstock.com, Inc. (now part of Beyond, Inc.), Sferra Fine Linens, LLC, Garnier-Thiebaut Inc., Milliken & Company, Frette North America, Inc., Aramark Uniform & Linen Services contribute to innovation, geographic expansion, and service delivery in this space.

The US table linen market is poised for significant evolution, driven by trends in sustainability and digital engagement. As consumers increasingly prioritize eco-friendly products, manufacturers are likely to innovate with sustainable materials. Additionally, the rise of e-commerce platforms will facilitate broader access to diverse product offerings, enhancing consumer choice. The integration of technology in marketing strategies will also play a crucial role in reaching target demographics effectively, ensuring that brands remain competitive in a dynamic marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Cotton Polyester Linen Blended Fabrics Silk Wool Specialty Fabrics (e.g., Bamboo, Recycled Materials) Others |

| By End-User | Residential Commercial Hospitality (Hotels/Resorts) Corporate Offices Events and Catering Healthcare & Institutional Others |

| By Product Category | Tablecloths Napkins (Cloth & Disposable) Table Runners (Decorative & Functional) Placemats & Coasters Table Skirting Others (Table Covers, Centerpieces) |

| By Design | Printed Solid Colors Embroidered Textured Seasonal & Themed Others |

| By Distribution Channel | Hypermarkets/Supermarkets Specialty Stores Online Retailers Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material Sustainability | Organic Recycled Conventional Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Table Linen Sales | 100 | Store Managers, Merchandising Directors |

| Wholesale Distribution Channels | 80 | Wholesale Buyers, Supply Chain Managers |

| Consumer Preferences in Table Linens | 120 | Homeowners, Interior Designers |

| Online Retail Trends for Table Linens | 90 | E-commerce Managers, Digital Marketing Specialists |

| Manufacturing Insights on Table Linen Production | 60 | Production Managers, Quality Control Supervisors |

The US Table Linen Market is valued at approximately USD 5.0 billion, reflecting a robust demand driven by home décor trends, increased disposable incomes, and a rise in social gatherings and events.