United States Table Linen Market Overview

- The United States Table Linen Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by robust demand for home décor, increased disposable incomes, and evolving consumer preferences for premium, aesthetically pleasing dining environments. The market has seen a notable rise in consumer spending on quality table linens, with a strong shift toward products that enhance both functionality and visual appeal in residential and hospitality settings.

- Key players in this market include major metropolitan areas such as New York, Los Angeles, and Chicago. These cities dominate due to their large populations, vibrant dining scenes, and a high concentration of hospitality businesses. The presence of numerous restaurants, hotels, and event venues in these urban centers drives the demand for table linens, making them critical hubs for market activity.

- In 2023, the U.S. government implemented regulations aimed at promoting sustainable practices in the textile industry. The “Textile Fiber Products Identification Act” (administered by the Federal Trade Commission, last amended 2023) mandates clear labeling of fiber content and encourages the use of eco-friendly materials. Manufacturers must comply with requirements for accurate disclosure of sustainable sourcing and production methods, supporting reduced environmental impact and responsible consumption.

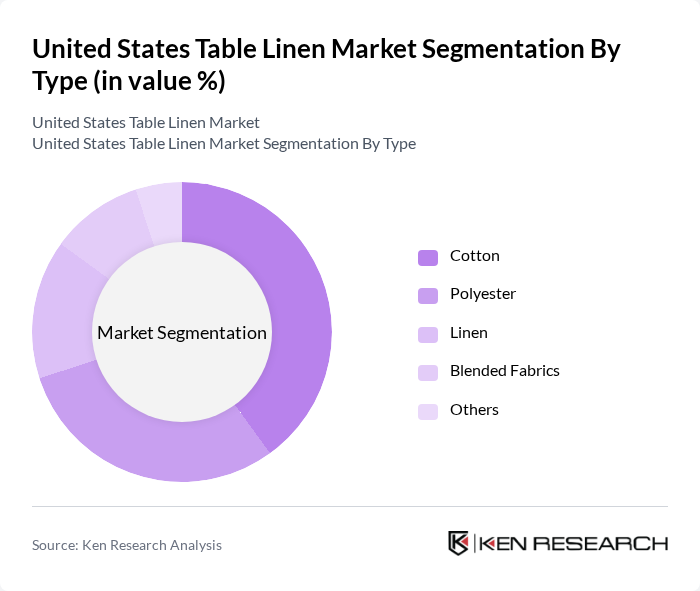

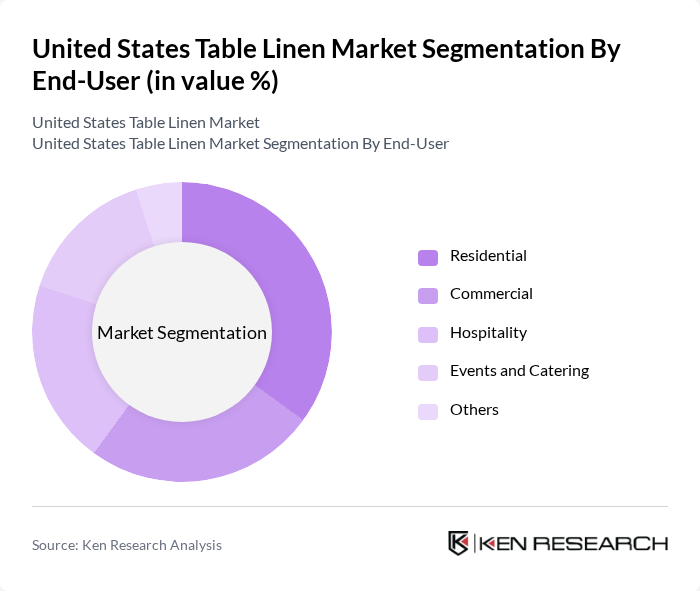

United States Table Linen Market Segmentation

By Type:The table linen market can be segmented into various types, including cotton, polyester, linen, blended fabrics, and others. Each type caters to different consumer preferences and usage scenarios, with cotton and polyester remaining the most popular due to their durability, ease of care, and affordability. The demand for eco-friendly and organic materials is rising, with linen and recycled fibers gaining traction among environmentally conscious consumers.

By End-User:The end-user segmentation includes residential, commercial, hospitality, events and catering, and others. The residential segment is witnessing significant growth as consumers increasingly invest in home aesthetics and everyday dining experiences. The hospitality sector, comprising hotels, restaurants, and event venues, continues to be a major driver for premium and durable table linen products, reflecting the sector’s emphasis on guest experience and brand image.

United States Table Linen Market Competitive Landscape

The United States Table Linen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Williams Sonoma, Inc., Bed Bath & Beyond Inc., Pottery Barn, Sur La Table, Crate and Barrel, Target Corporation, Wayfair Inc., Amazon.com, Inc., Macy's, Inc., IKEA, The Home Depot, Inc., JCPenney Company, Inc., West Elm, Anthropologie, Overstock.com, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

United States Table Linen Market Industry Analysis

Growth Drivers

- Increasing Demand for Home Decor:The home decor market in the United States is projected to reach $200 billion in future, driven by a growing interest in interior design. This trend is reflected in the rising sales of table linens, which are essential for enhancing dining aesthetics. As consumers invest more in their living spaces, the demand for high-quality, stylish table linens is expected to increase significantly, contributing to market growth.

- Growth in the Hospitality Sector:The U.S. hospitality industry is anticipated to generate $1 trillion in revenue in future, with a notable increase in dining establishments. This growth directly influences the table linen market, as hotels and restaurants seek premium linens to enhance guest experiences. The demand for table linens in this sector is expected to rise, driven by the need for quality and presentation in food service.

- Trend Towards Sustainable and Eco-Friendly Products:The U.S. market for sustainable textiles is projected to reach $150 billion in future, reflecting a significant shift in consumer preferences. As awareness of environmental issues grows, consumers are increasingly opting for eco-friendly table linens made from organic or recycled materials. This trend not only supports sustainability but also drives innovation in product offerings, enhancing market growth.

Market Challenges

- Intense Competition:The table linen market in the U.S. is characterized by a high level of competition, with numerous brands vying for market share. This saturation can lead to price wars, reducing profit margins for manufacturers. In future, it is estimated that over 500 companies will operate in this space, making differentiation through quality and design crucial for survival in a crowded marketplace.

- Fluctuating Raw Material Prices:The volatility of raw material prices, particularly cotton and synthetic fibers, poses a significant challenge for table linen manufacturers. In future, cotton prices are projected to fluctuate between $0.80 and $1.20 per pound, impacting production costs. This unpredictability can lead to increased prices for consumers and reduced profitability for manufacturers, complicating market dynamics.

United States Table Linen Market Future Outlook

The future of the U.S. table linen market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to innovate with eco-friendly materials and production methods. Additionally, the integration of smart textiles may enhance functionality, catering to health-conscious consumers. The market is expected to adapt to these trends, ensuring continued relevance and growth in the coming years.

Market Opportunities

- Expansion into Online Retail:The online retail sector is projected to account for 25% of total table linen sales in future. This shift presents a significant opportunity for manufacturers to reach a broader audience. By enhancing e-commerce platforms and utilizing digital marketing strategies, companies can capitalize on the growing trend of online shopping, increasing their market presence.

- Customization and Personalization Trends:The demand for personalized products is on the rise, with consumers willing to pay up to 20% more for customized table linens. This trend offers manufacturers a unique opportunity to differentiate their offerings. By providing options for customization, brands can attract a niche market segment, enhancing customer loyalty and driving sales growth.