Region:North America

Author(s):Dev

Product Code:KRAD7663

Pages:82

Published On:December 2025

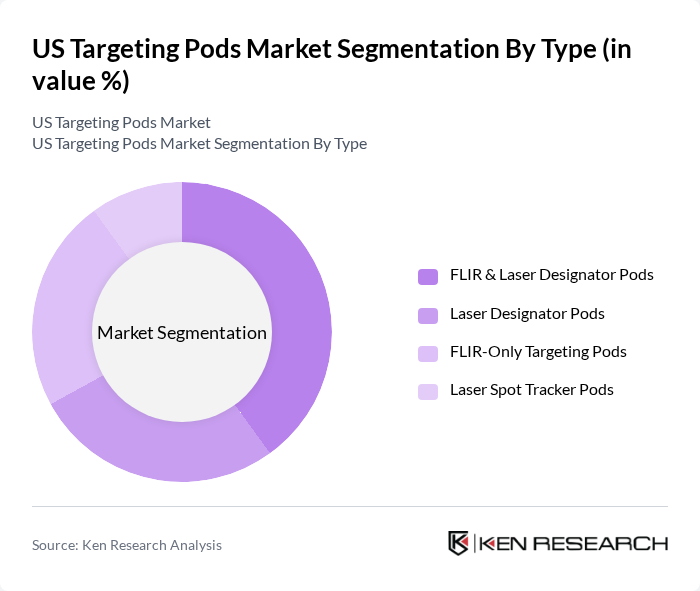

By Type:The segmentation by type includes various categories of targeting pods that cater to different operational needs. The subsegments are FLIR & Laser Designator Pods, Laser Designator Pods, FLIR-Only Targeting Pods, and Laser Spot Tracker Pods. Among these, FLIR & Laser Designator Pods dominate the market due to their ability to combine high?resolution forward-looking infrared imaging, laser designation, and range-finding in a single system, enabling accurate target acquisition and engagement in both day and night operations and under adverse weather conditions.

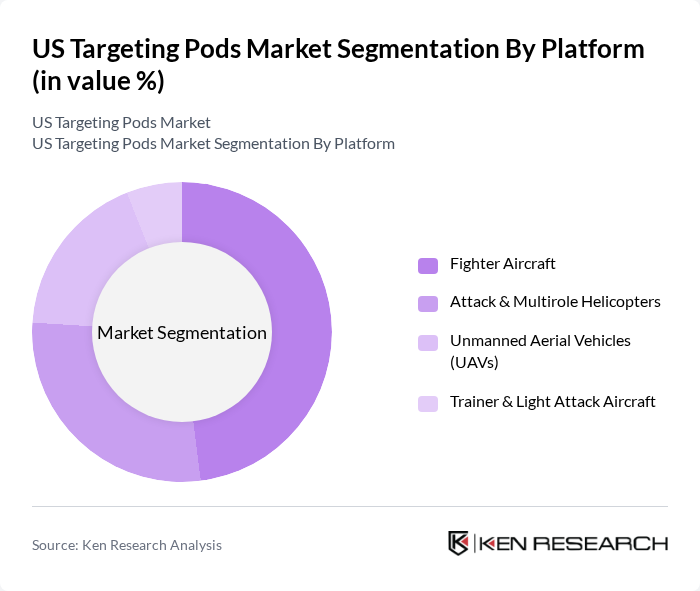

By Platform:The segmentation by platform includes Fighter Aircraft, Attack & Multirole Helicopters, Unmanned Aerial Vehicles (UAVs), and Trainer & Light Attack Aircraft. Fighter Aircraft are the leading platform for targeting pods due to their central role in air superiority, deep strike, and close air support missions, where advanced pods are required for long?range detection, identification, and precision engagement of ground and maritime targets.

The US Targeting Pods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation (RTX), L3Harris Technologies, Inc., BAE Systems plc, Thales Group, Safran S.A., Rafael Advanced Defense Systems Ltd., Israel Aerospace Industries Ltd. (IAI), Elbit Systems Ltd., Boeing Defense, Space & Security, General Dynamics Corporation, Leonardo S.p.A., Textron Systems Corporation, ASELSAN A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US targeting pods market appears promising, driven by technological innovations and increasing awareness of sustainable farming practices. As farmers seek to enhance productivity and reduce environmental impact, the integration of advanced targeting systems will become more prevalent. Additionally, the collaboration between agricultural firms and technology companies is expected to foster the development of more efficient solutions, further propelling market growth and adoption in future.

| Segment | Sub-Segments |

|---|---|

| By Type | FLIR & Laser Designator Pods Laser Designator Pods FLIR-Only Targeting Pods Laser Spot Tracker Pods |

| By Platform | Fighter Aircraft Attack & Multirole Helicopters Unmanned Aerial Vehicles (UAVs) Trainer & Light Attack Aircraft |

| By Application | Target Detection & Identification Close Air Support & Strike Missions Intelligence, Surveillance & Reconnaissance (ISR) Battle Damage Assessment & Others |

| By Technology | EO/IR (Electro-Optical / Infrared) Pods Laser Designation & Rangefinding Multi-Sensor / Modular Pods Next-Generation Pods with AI & Advanced Image Processing |

| By End-User | U.S. Air Force U.S. Navy & Marine Corps U.S. Army Homeland Security & Other Government Agencies |

| By Procurement Type | New Pod Procurement Upgrades & Modernization of Existing Pods Maintenance, Repair & Overhaul (MRO) Leasing & Performance-Based Logistics Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Farm Equipment Manufacturers | 45 | Product Development Managers, Sales Directors |

| Agricultural Consultants | 75 | Field Agronomists, Crop Advisors |

| End-User Farmers | 120 | Large-scale Farmers, Specialty Crop Growers |

| Research Institutions | 55 | Agricultural Researchers, Extension Officers |

| Government Agricultural Agencies | 40 | Policy Makers, Program Managers |

The US Targeting Pods Market is valued at approximately USD 1.15 billion, driven by increased defense budgets and advancements in electro-optical/infrared (EO/IR) technology, as well as the demand for precision-guided munitions.