Region:North America

Author(s):Geetanshi

Product Code:KRAD4838

Pages:94

Published On:December 2025

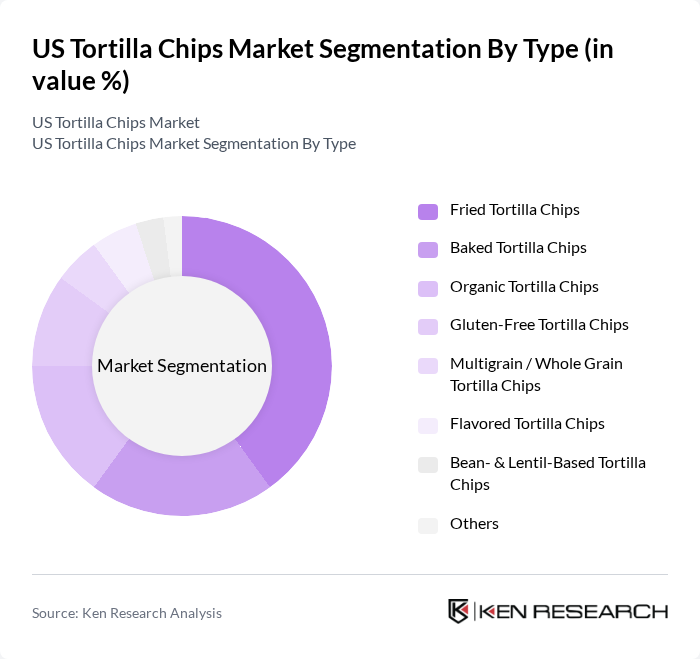

By Type:The tortilla chips market is segmented into various types, including Fried Tortilla Chips, Baked Tortilla Chips, Organic Tortilla Chips, Gluten-Free Tortilla Chips, Multigrain / Whole Grain Tortilla Chips, Flavored Tortilla Chips, Bean- & Lentil-Based Tortilla Chips, and Others. Among these, Fried Tortilla Chips dominate the market due to their traditional appeal, familiar taste, and widespread consumption through both retail and foodservice channels. However, the demand for healthier options like Baked, Organic, Multigrain / Whole Grain, and Gluten-Free Tortilla Chips is steadily increasing as consumers become more health-conscious and look for reduced-fat, clean-label, and plant-based snacking alternatives.

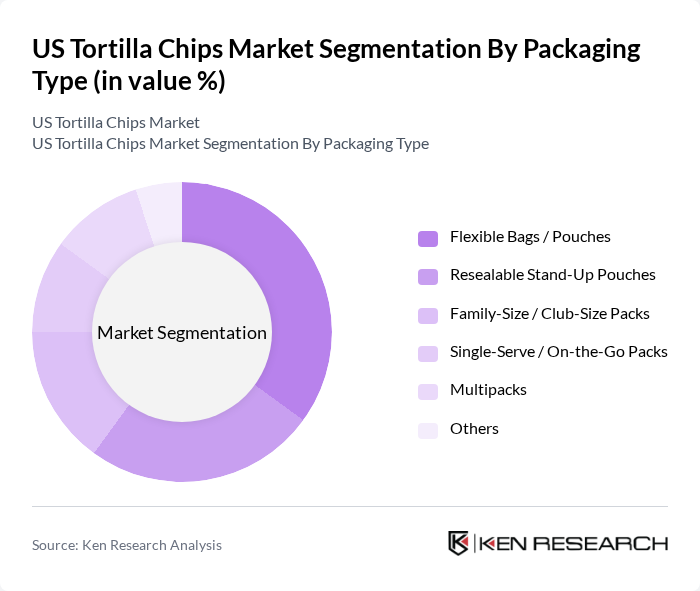

By Packaging Type:The packaging segment includes Flexible Bags / Pouches, Resealable Stand-Up Pouches, Family-Size / Club-Size Packs, Single-Serve / On-the-Go Packs, Multipacks, and Others. Flexible Bags / Pouches are the most popular packaging type due to their convenience, shelf-efficiency, and cost-effectiveness in mass retail formats. However, Resealable Stand-Up Pouches and family-size formats are gaining traction as they offer better product protection, portion control, and freshness retention, aligning with on-the-go consumption and at-home sharing occasions.

The US Tortilla Chips Market is characterized by a dynamic mix of regional and international players. Leading participants such as Frito-Lay North America (PepsiCo), Tostitos (PepsiCo), Santitas (Frito-Lay), Late July Snacks (Campbell Soup Company), Garden of Eatin' (Hain Celestial Group), Xochitl, Inc., Snak King Corporation (El Sabroso), Mission Foods (Gruma, S.A.B. de C.V.), On The Border Mexican Grill & Cantina Chips (UTZ / Utz Brands), Private Label / Store Brands (e.g., Kirkland Signature, Great Value), Simply 7 Snacks, Beanitos LLC, Que Pasa (Nature's Path Foods), Siete Family Foods, Food Should Taste Good (General Mills) contribute to innovation, geographic expansion, and service delivery in this space.

The US tortilla chips market is poised for continued growth, driven by evolving consumer preferences and innovative product offerings. As health-conscious snacking becomes more prevalent, manufacturers are likely to focus on developing healthier options, including organic and gluten-free varieties. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility for consumers, allowing brands to reach a wider audience. These trends indicate a dynamic market landscape, with opportunities for brands to differentiate themselves through unique flavors and sustainable practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Fried Tortilla Chips Baked Tortilla Chips Organic Tortilla Chips Gluten-Free Tortilla Chips Multigrain / Whole Grain Tortilla Chips Flavored Tortilla Chips Bean- & Lentil-Based Tortilla Chips Others |

| By Packaging Type | Flexible Bags / Pouches Resealable Stand-Up Pouches Family-Size / Club-Size Packs Single-Serve / On-the-Go Packs Multipacks Others |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience Stores Club & Warehouse Stores Online Retail & Direct-to-Consumer Specialty & Natural Food Stores Food Service & On-Premise Others |

| By Consumer Demographics | Age Group (Children, Teens, Adults, Seniors) Income Level (Low, Medium, High) Lifestyle (Health-Conscious, Indulgent, Convenience-Seeking) Ethnicity / Hispanic vs Non-Hispanic Consumers Others |

| By Flavor Profile | Plain / Salted Cheese-Based Flavors Spicy & Chili Flavors Lime & Citrus Flavors Herb & Seasoned (e.g., Ranch, Taco, Nacho) Others |

| By Region | Northeast Midwest South West |

| By Health Claims | Low-Fat / Reduced-Fat High-Protein / Added Protein Organic / Non-GMO No Artificial Ingredients / Clean Label Gluten-Free Plant-Based / Vegan Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Grocery Chains | 120 | Category Managers, Purchasing Agents |

| Snack Food Distributors | 90 | Sales Directors, Distribution Managers |

| Consumer Focus Groups | 60 | Health-Conscious Consumers, Snack Enthusiasts |

| Food Service Operators | 70 | Restaurant Owners, Menu Planners |

| Market Analysts | 40 | Industry Experts, Market Researchers |

The US Tortilla Chips Market is valued at approximately USD 10.5 billion, reflecting a robust growth trend driven by increasing snacking habits and the popularity of Mexican cuisine among American consumers.