Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4159

Pages:84

Published On:December 2025

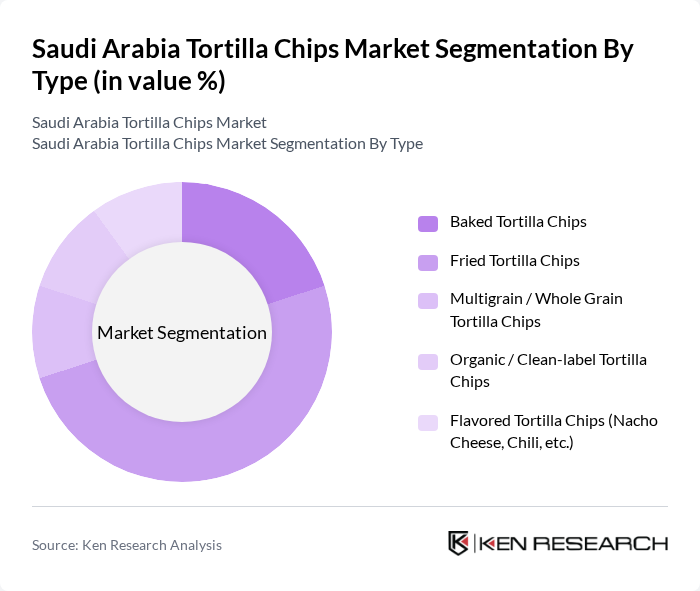

By Type:The market can be segmented into various types of tortilla chips, including Baked Tortilla Chips, Fried Tortilla Chips, Multigrain / Whole Grain Tortilla Chips, Organic / Clean-label Tortilla Chips, and Flavored Tortilla Chips. Fried Tortilla Chips continue to hold the largest share of consumption due to their traditional appeal, strong presence of mainstream brands, and widespread consumer acceptance, in line with global patterns where fried variants dominate volume. The preference for classic flavors and familiar crunchy textures drives their popularity, while the growing trend towards healthier snacking, front-of-pack labelling initiatives, and demand for low-fat, non-GMO, and gluten-free options is steadily increasing the uptake of Baked, Multigrain, and Organic / Clean-label varieties.

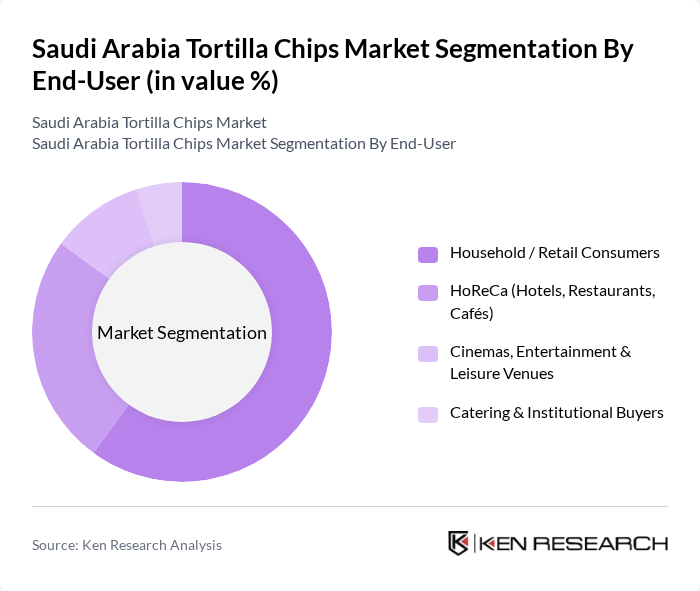

By End-User:The end-user segmentation includes Household / Retail Consumers, HoReCa (Hotels, Restaurants, Cafés), Cinemas, Entertainment & Leisure Venues, and Catering & Institutional Buyers. The Household / Retail Consumers segment leads the market, supported by increased in-home snacking, growth of modern grocery retail, and wider availability of tortilla chips in different pack sizes and flavor variants across supermarkets, hypermarkets, and online channels. The HoReCa segment is also significant, as quick-service restaurants, casual dining outlets, and cafés increasingly incorporate tortilla chips and nacho formats into their menus, while cinemas and entertainment venues use portioned tortilla chip offerings to serve rising demand for convenient, shareable snacks.

The Saudi Arabia Tortilla Chips Market is characterized by a dynamic mix of regional and international players. Leading participants such as PepsiCo / Tasali Snack Foods, Frito-Lay (Doritos, other imported tortilla chips), Mission Foods (Gruma), Mondelez Arabia, Almunajem Foods, Savola Foods Company, Al-Rifai Roastery & Snack Foods, Saudia Dairy & Foodstuff Company (SADAFCO), Halwani Bros. Co., Americana Foods (Kuwait Food Company – Saudi operations), Private Label Brands (e.g., Carrefour, Lulu Hypermarket, Panda), Regional Tex-Mex Restaurant Chains (as bulk tortilla chips buyers), Emerging Local Snack Manufacturers (SMEs), Importers & Distributors of International Tortilla Chips Brands, Online-first Snack Brands & D2C Players contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia tortilla chips market is poised for significant growth, driven by evolving consumer preferences and innovative product offerings. As health-conscious consumers increasingly seek organic and gluten-free options, manufacturers are likely to adapt their product lines accordingly. Additionally, the rise of e-commerce platforms is expected to enhance market accessibility, allowing brands to reach a broader audience. Collaborations with local eateries may also create new avenues for growth, further solidifying the market's expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Baked Tortilla Chips Fried Tortilla Chips Multigrain / Whole Grain Tortilla Chips Organic / Clean-label Tortilla Chips Flavored Tortilla Chips (Nacho Cheese, Chili, etc.) |

| By End-User | Household / Retail Consumers HoReCa (Hotels, Restaurants, Cafés) Cinemas, Entertainment & Leisure Venues Catering & Institutional Buyers |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores & Small Groceries (Bakalah) Online Grocery & E-commerce Platforms Wholesale & Cash-and-Carry Specialty & Gourmet Stores |

| By Packaging Type | Single-serve Bags Family-size / Multi-serve Bags Bulk / Foodservice Packs Assorted / Multipack Formats |

| By Flavor Profile | Salted / Original Chili & Spicy Variants Cheese-based Flavors Lime & Herb / Regional-inspired Flavors Other Experimental & Limited-edition Flavors |

| By Price Range | Economy Mainstream / Mid-Range Premium & Imported |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Al Khobar, Dhahran) Northern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Regular Snack Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 100 | Wholesalers, Distributors |

| Market Trends Evaluation | 80 | Food Industry Analysts, Market Researchers |

| Product Innovation Feedback | 70 | Culinary Experts, Food Product Developers |

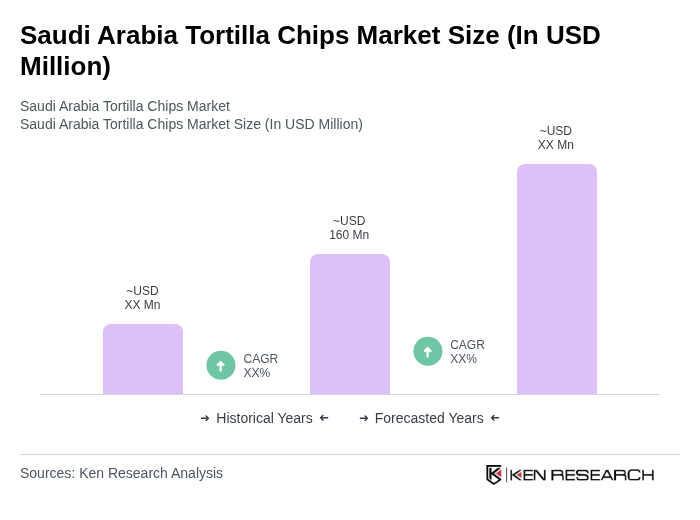

The Saudi Arabia Tortilla Chips Market is valued at approximately USD 160 million, reflecting a growing demand for snack foods driven by urbanization and changing consumer preferences towards convenience and healthier options.