Region:North America

Author(s):Dev

Product Code:KRAD3387

Pages:88

Published On:November 2025

By Product:The product segmentation of the market includes various categories such as implants, prosthetics & orthotics, anatomical models, masks, and others. Among these,implantsare the leading sub-segment, driven by the increasing need for customized solutions in surgical procedures and the rapid adoption of 3D-printed implants in veterinary orthopedics. The demand for prosthetics & orthotics is also significant, as pet owners seek advanced options for their animals' mobility and quality of life. The anatomical models segment is gaining traction for educational and training purposes in veterinary practices, supporting pre-surgical planning and veterinary education .

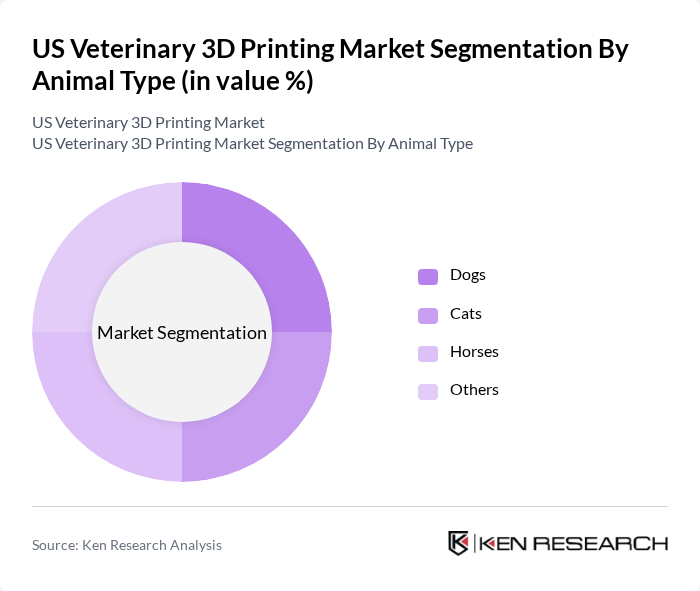

By Animal Type:The animal type segmentation includes dogs, cats, horses, and others.Dogsrepresent the largest segment due to their high population and the increasing trend of pet ownership, as well as the higher frequency of orthopedic and reconstructive procedures conducted in canines. The demand for 3D printed solutions for cats is also notable, as owners seek specialized care for their feline companions. Horses, while a smaller segment, are significant in the context of veterinary care, particularly in sports and performance-related injuries. The “others” category, including exotic pets and livestock, is experiencing growth as 3D printing applications expand to a wider range of species .

The US Veterinary 3D Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3D Systems Corporation, Stratasys Ltd., Materialise NV, Protolabs Inc., Formlabs Inc., EnvisionTEC (now Desktop Metal, Inc.), WhiteClouds, Med Dimensions, Movora (Vimian Group), Vet 3D, 3D Pets (DiveDesign), CABIOMEDE Vet, Novus Life Sciences, M3D ILAB Ltd, and Wimba contribute to innovation, geographic expansion, and service delivery in this space .

The future of the US veterinary 3D printing market appears promising, driven by technological advancements and increasing demand for personalized veterinary care. As more veterinary clinics adopt 3D printing technologies, the market is likely to expand, fostering innovation in treatment options. Additionally, the integration of artificial intelligence and machine learning into 3D printing processes is expected to enhance efficiency and accuracy, further propelling the market forward. The focus on sustainable practices will also shape future developments, aligning with broader environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Product | Implants Prosthetics & Orthotics Anatomical Models Masks Others |

| By Animal Type | Dogs Cats Horses Others |

| By Application | Orthopedic applications Surgical planning & training models Dental applications Therapeutic applications Others |

| By Material | Metals (e.g., titanium, stainless steel) Ceramics Polymers/Plastics Composites Others |

| By End-Use | Veterinary hospitals Specialty clinics Academic & research institutions Others |

| By Region | Northeast Midwest South West |

| By Policy Support | Government grants for veterinary innovation Tax incentives for 3D printing technology Research funding for veterinary applications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics Utilizing 3D Printing | 100 | Veterinarians, Clinic Owners |

| Pet Prosthetics and Orthotics Providers | 60 | Product Managers, Veterinary Surgeons |

| Veterinary Technology Developers | 50 | R&D Managers, Product Development Leads |

| Veterinary Supply Chain Managers | 40 | Supply Chain Directors, Procurement Officers |

| Veterinary Educational Institutions | 40 | Academic Researchers, Curriculum Developers |

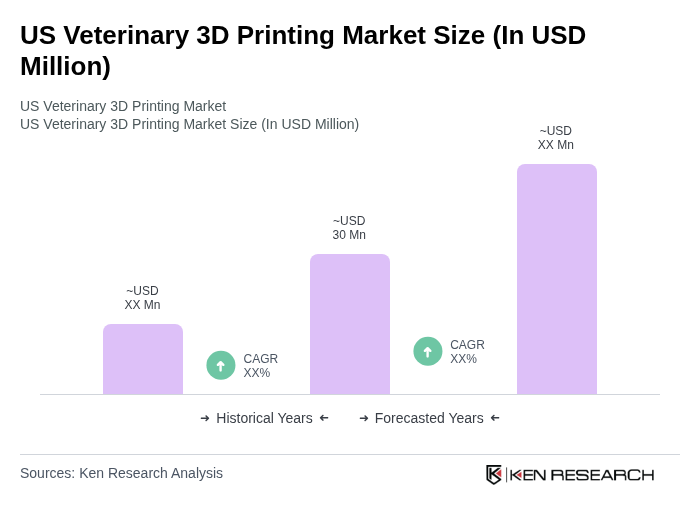

The US Veterinary 3D Printing Market is valued at approximately USD 30 million, reflecting a growing trend driven by advancements in technology and increasing demand for customized veterinary solutions.