Region:North America

Author(s):Geetanshi

Product Code:KRAA7861

Pages:89

Published On:September 2025

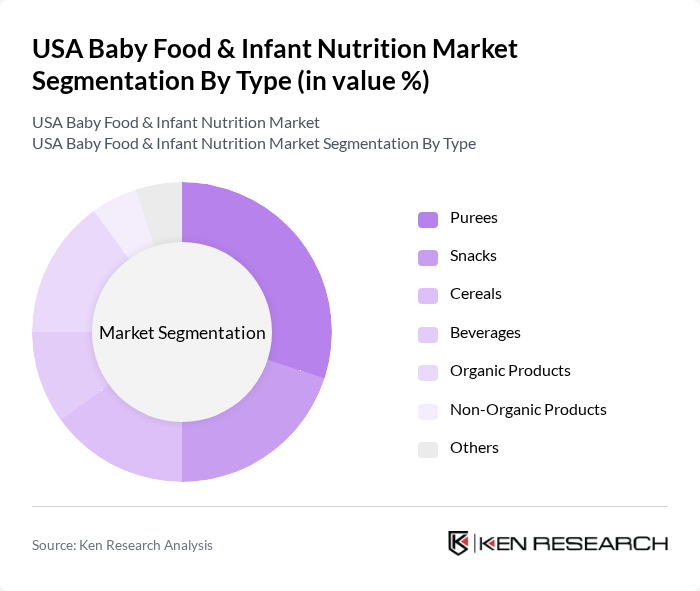

By Type:The market is segmented into various types of baby food products, including purees, snacks, cereals, beverages, organic products, non-organic products, and others. Among these, purees and organic products are particularly popular due to their convenience and perceived health benefits. The demand for organic baby food has surged as parents increasingly seek natural options free from artificial additives.

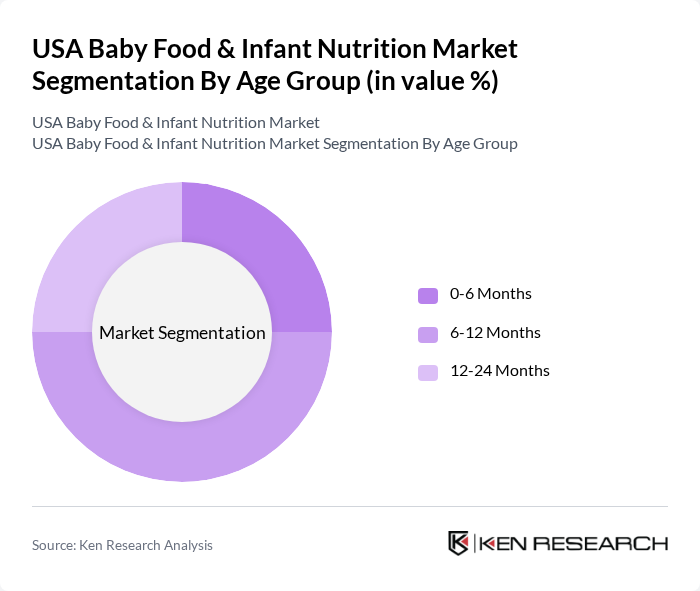

By Age Group:The market is also segmented by age group, including 0-6 months, 6-12 months, and 12-24 months. The 6-12 months age group is the most significant segment, as this is the period when infants transition to solid foods. Parents are particularly focused on providing balanced nutrition during this critical growth phase, leading to increased demand for a variety of baby food products tailored to this age group.

The USA Baby Food & Infant Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gerber Products Company, Nestlé S.A., Hain Celestial Group, Inc., Beech-Nut Nutrition Company, Plum Organics, Earth's Best Organic, Happy Family Organics, Sprout Organic Foods, Parent's Choice, Little Spoon, Yumi, Once Upon a Farm, Baby Gourmet Foods, Ella's Kitchen, Nurture Life contribute to innovation, geographic expansion, and service delivery in this space.

The USA baby food and infant nutrition market is poised for significant evolution, driven by changing consumer preferences and technological advancements. As parents increasingly seek transparency in product sourcing and nutritional content, brands that prioritize clean labels and sustainable practices will likely thrive. Additionally, the integration of technology in product development, such as personalized nutrition solutions, is expected to reshape the market landscape. Companies that adapt to these trends will be well-positioned to capture emerging opportunities and enhance customer loyalty in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Purees Snacks Cereals Beverages Organic Products Non-Organic Products Others |

| By Age Group | 6 Months 12 Months 24 Months |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores |

| By Packaging Type | Jars Pouches Tubs Cans |

| By Nutritional Content | High Protein Low Sugar Fortified All-Natural |

| By Brand Type | National Brands Private Labels Regional Brands |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Food Sales | 150 | Store Managers, Category Buyers |

| Online Baby Food Purchases | 100 | eCommerce Managers, Digital Marketing Specialists |

| Health and Nutrition Insights | 80 | Pediatricians, Nutrition Experts |

| Consumer Preferences in Baby Food | 120 | Parents, Caregivers |

| Market Trends and Innovations | 90 | Product Development Managers, R&D Specialists |

The USA Baby Food & Infant Nutrition Market is valued at approximately USD 8.5 billion, reflecting a significant growth trend driven by increasing health consciousness among parents and a rising demand for organic and natural food products.