Region:North America

Author(s):Dev

Product Code:KRAA5400

Pages:90

Published On:September 2025

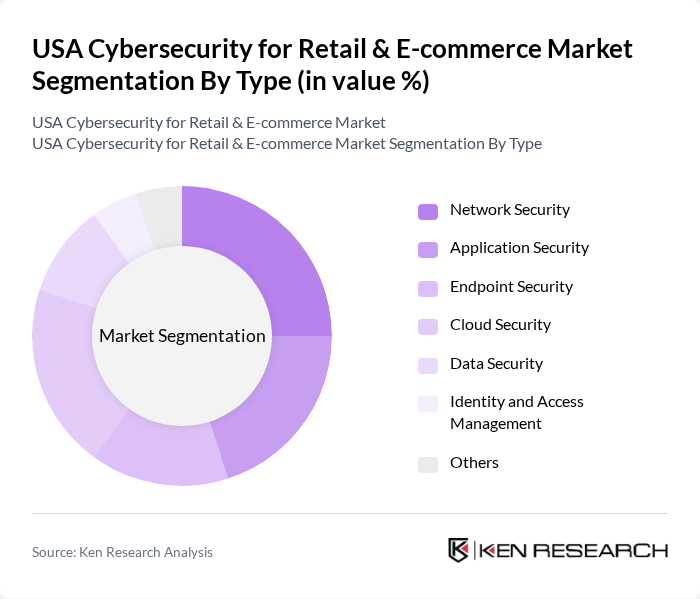

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these segments plays a crucial role in safeguarding retail and e-commerce operations from cyber threats.

The leading subsegment in the cybersecurity market is Network Security, which accounts for a significant portion of the market share. This dominance is attributed to the increasing number of cyber threats targeting network infrastructures, particularly in retail and e-commerce sectors. As businesses expand their online presence, the need for robust network security solutions becomes paramount to protect against data breaches and unauthorized access. The growing trend of remote work and cloud services further amplifies the demand for effective network security measures.

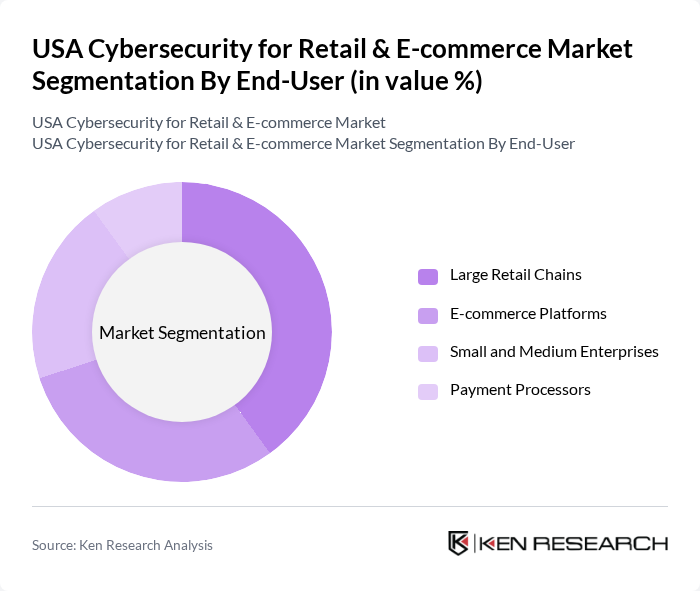

By End-User:The end-user segmentation includes Large Retail Chains, E-commerce Platforms, Small and Medium Enterprises, and Payment Processors. Each of these user categories has distinct cybersecurity needs based on their operational scale and the nature of their business.

Large Retail Chains dominate the end-user segment, accounting for a substantial market share. This is primarily due to their extensive customer bases and the vast amounts of sensitive data they handle. As these chains increasingly adopt digital solutions for customer engagement and sales, the need for comprehensive cybersecurity measures becomes critical. E-commerce Platforms also represent a significant portion of the market, driven by the rapid growth of online shopping and the associated risks of cyber threats.

The USA Cybersecurity for Retail & E-commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Fortinet, CrowdStrike, Check Point Software Technologies, Cisco Systems, IBM Security, McAfee, Trend Micro, FireEye, Splunk, RSA Security, Proofpoint, CyberArk, Zscaler, Mimecast contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA cybersecurity market for retail and e-commerce is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt cloud-based solutions and artificial intelligence, the demand for innovative cybersecurity measures will rise. Additionally, the growing emphasis on data privacy and protection will compel retailers to enhance their security frameworks, ensuring compliance with stringent regulations while safeguarding customer trust and loyalty in an increasingly digital marketplace.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Large Retail Chains E-commerce Platforms Small and Medium Enterprises Payment Processors |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Deployment Mode | On-Premises Cloud-Based |

| By Service Type | Managed Security Services Professional Services |

| By Industry Vertical | Fashion Retail Electronics Retail Grocery Retail Health and Beauty Retail |

| By Compliance Requirement | PCI Compliance GDPR Compliance CCPA Compliance HIPAA Compliance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cybersecurity in Large Retail Chains | 100 | IT Security Managers, Chief Information Officers |

| Cybersecurity Solutions for E-commerce Platforms | 80 | eCommerce Directors, Cybersecurity Analysts |

| Consumer Perceptions of Online Security | 150 | Online Shoppers, Digital Marketing Managers |

| Regulatory Compliance in Retail Cybersecurity | 70 | Compliance Officers, Risk Management Executives |

| Emerging Cyber Threats in E-commerce | 90 | Cybersecurity Consultants, Incident Response Teams |

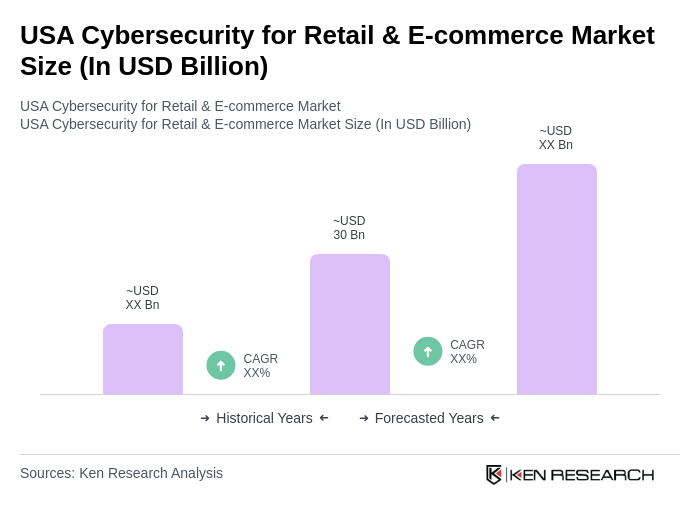

The USA Cybersecurity for Retail & E-commerce Market is valued at approximately USD 30 billion, reflecting significant growth driven by increasing cyber threats, the rise of e-commerce, and heightened consumer awareness regarding data privacy.