Region:Middle East

Author(s):Geetanshi

Product Code:KRAA7910

Pages:98

Published On:September 2025

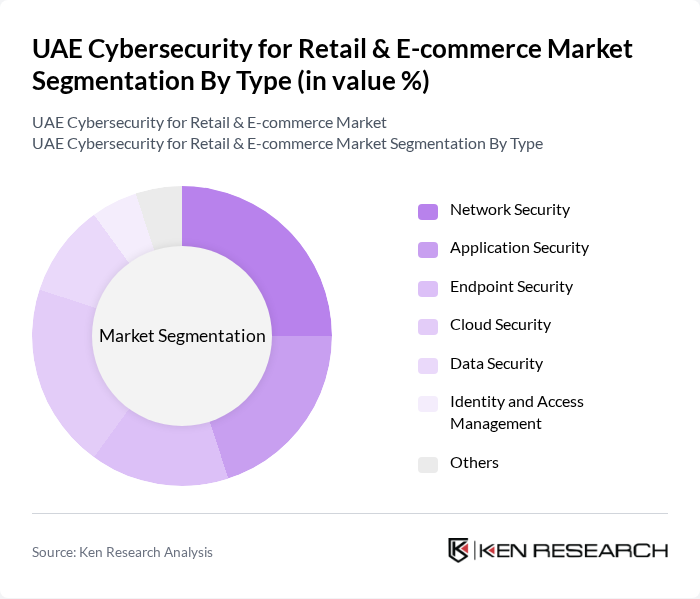

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these sub-segments plays a crucial role in addressing specific security challenges faced by retail and e-commerce businesses.

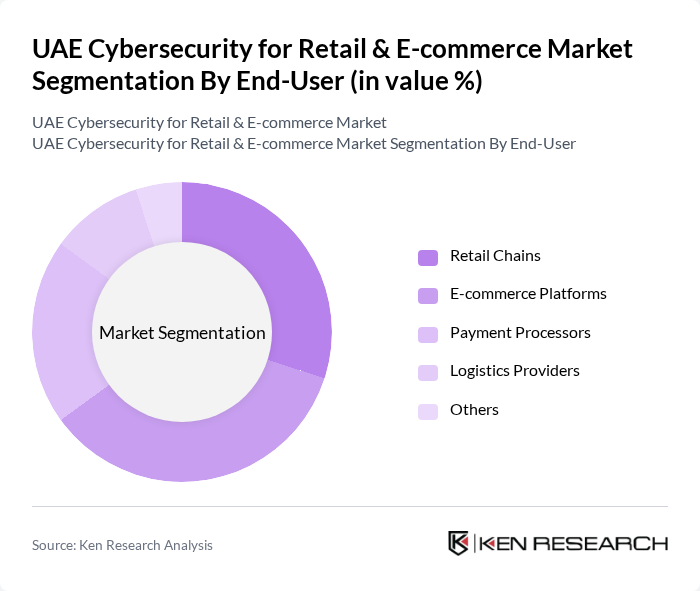

By End-User:The end-user segmentation includes Retail Chains, E-commerce Platforms, Payment Processors, Logistics Providers, and Others. Each segment has unique cybersecurity needs based on their operational models and the types of data they handle.

The UAE Cybersecurity for Retail & E-commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as DarkMatter, Help AG, Paladion Networks, CyberKnight Technologies, Secureworks, Fortinet, Check Point Software Technologies, Cisco Systems, IBM Security, McAfee, Trend Micro, Palo Alto Networks, FireEye, Symantec, CrowdStrike contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE cybersecurity market for retail and e-commerce is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt digital solutions, the demand for innovative cybersecurity measures will intensify. The integration of artificial intelligence and machine learning into security protocols will enhance threat detection capabilities. Additionally, the growing emphasis on data privacy will compel organizations to prioritize compliance, fostering a more secure online environment for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Retail Chains E-commerce Platforms Payment Processors Logistics Providers Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Security Services Incident Response Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Industry Vertical | Fashion Retail Electronics Retail Grocery Retail Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cybersecurity Strategies | 100 | IT Security Managers, Risk Assessment Officers |

| E-commerce Platform Security Measures | 80 | Chief Technology Officers, Cybersecurity Analysts |

| Consumer Awareness of Cyber Threats | 150 | Online Shoppers, Digital Consumers |

| Impact of Cybersecurity Regulations | 70 | Compliance Officers, Legal Advisors |

| Investment Trends in Cybersecurity Solutions | 90 | Financial Officers, Procurement Managers |

The UAE Cybersecurity for Retail & E-commerce Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitalization and rising cyber threats that necessitate robust security measures to protect customer data and maintain trust in online transactions.