Region:North America

Author(s):Geetanshi

Product Code:KRAB5717

Pages:87

Published On:October 2025

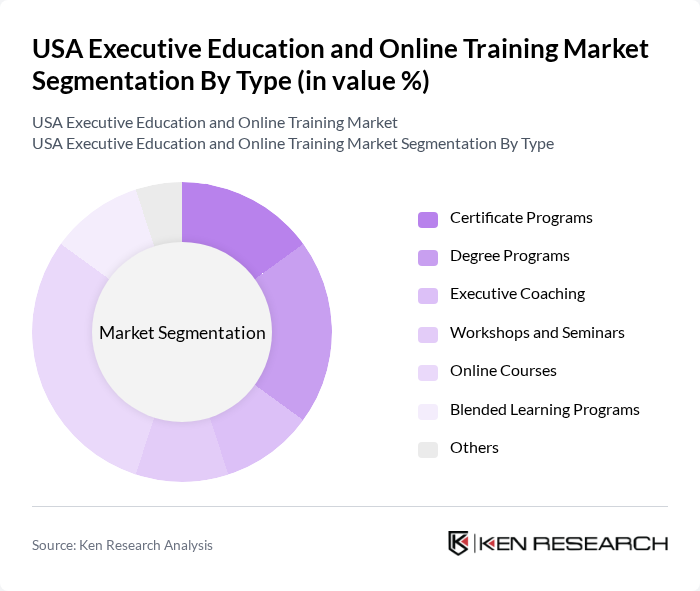

By Type:The market is segmented into various types of educational offerings, including Certificate Programs, Degree Programs, Executive Coaching, Workshops and Seminars, Online Courses, Blended Learning Programs, and Others. Among these, Online Courses have emerged as the dominant segment due to their flexibility and accessibility, catering to a wide range of professionals seeking to enhance their skills without the constraints of traditional classroom settings. The growing trend of remote work and the expansion of digital platforms have further accelerated demand for online learning solutions, with online and e-learning delivery modes now representing a significant share of the market .

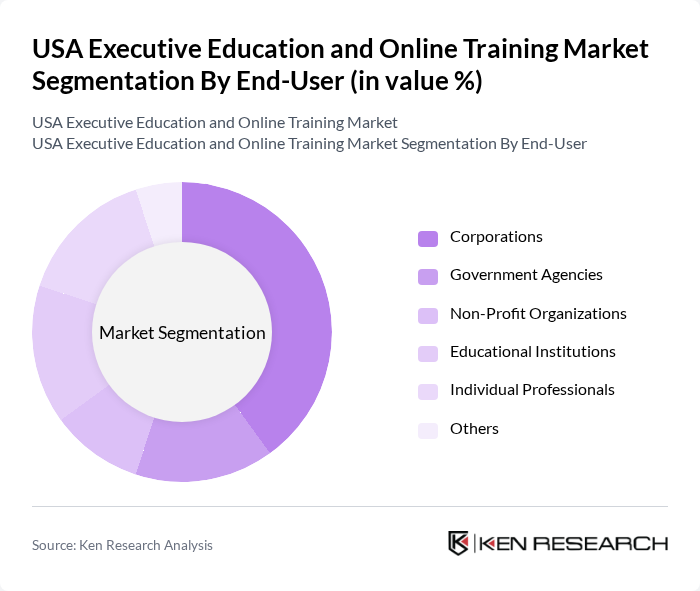

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individual Professionals, and Others. Corporations represent the largest segment, driven by the need for continuous employee development and leadership training. Companies are increasingly investing in executive education to maintain a competitive edge in the market, leading to a significant rise in demand for tailored training programs that align with organizational goals. The corporate segment is further supported by the prevalence of company-specific in-house executive training programs, which account for a notable share of the market .

The USA Executive Education and Online Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harvard Business School Executive Education, Wharton Executive Education (University of Pennsylvania), Stanford Graduate School of Business Executive Education, MIT Sloan School of Management Executive Education, Columbia Business School Executive Education, University of Chicago Booth School of Business Executive Education, Northwestern University Kellogg School of Management Executive Education, Duke Corporate Education, Cornell University Executive Education, UCLA Anderson School of Management Executive Education, University of Michigan Ross School of Business Executive Education, Yale School of Management Executive Education, University of California, Berkeley Executive Education, Georgetown University Executive Education, Emeritus (online executive education partner), Coursera for Business, edX for Business (2U, Inc.), LinkedIn Learning, Udemy for Business, General Assembly contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA executive education and online training market appears promising, driven by ongoing technological advancements and a growing emphasis on lifelong learning. As organizations increasingly recognize the importance of upskilling their workforce, the demand for tailored training solutions is expected to rise. Additionally, the integration of artificial intelligence and data analytics will enhance personalized learning experiences, making education more accessible and effective for diverse learner demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Degree Programs Executive Coaching Workshops and Seminars Online Courses Blended Learning Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individual Professionals Others |

| By Delivery Mode | Online Learning In-Person Training Hybrid Learning Mobile Learning Others |

| By Duration | Short-Term Courses Long-Term Programs Modular Courses Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Development Units (PDUs) Others |

| By Industry Focus | Business Management Technology and IT Healthcare Finance Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 120 | Training Managers, Learning & Development Directors |

| Online Training Platforms | 100 | Product Managers, Marketing Executives |

| Industry-Specific Training Needs | 80 | HR Managers, Department Heads |

| Workforce Upskilling Initiatives | 70 | Chief Learning Officers, Talent Development Specialists |

| Participant Feedback on Training Programs | 90 | Program Graduates, Current Participants |

The USA Executive Education and Online Training Market is valued at approximately USD 50 billion, reflecting revenues from university-based programs, corporate providers, and online platforms catering to U.S. executives, driven by the demand for upskilling and reskilling among professionals.