Region:North America

Author(s):Dev

Product Code:KRAB5530

Pages:86

Published On:October 2025

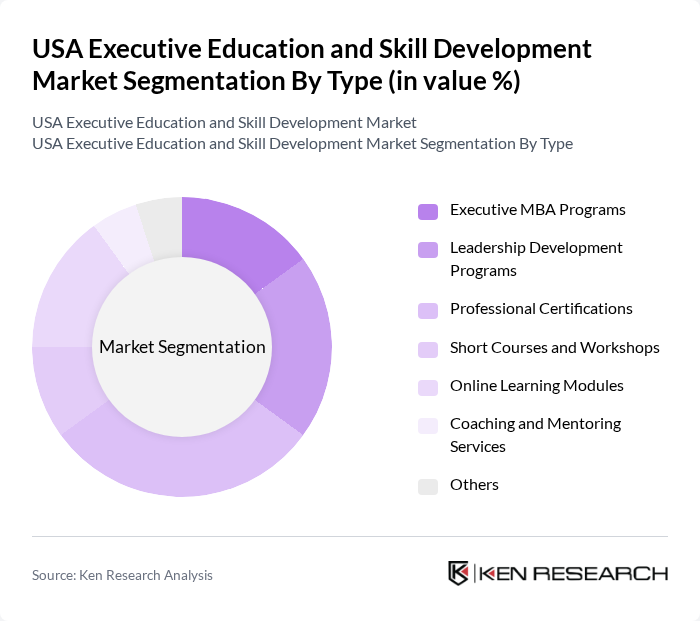

By Type:The market is segmented into various types, including Executive MBA Programs, Leadership Development Programs, Professional Certifications, Short Courses and Workshops, Online Learning Modules, Coaching and Mentoring Services, and Others. Among these, Professional Certifications are currently dominating the market due to the increasing recognition of industry-specific qualifications by employers. Professionals are increasingly seeking certifications to enhance their employability and demonstrate expertise in their respective fields. This trend is further fueled by the rapid pace of technological advancements, necessitating continuous learning and skill enhancement.

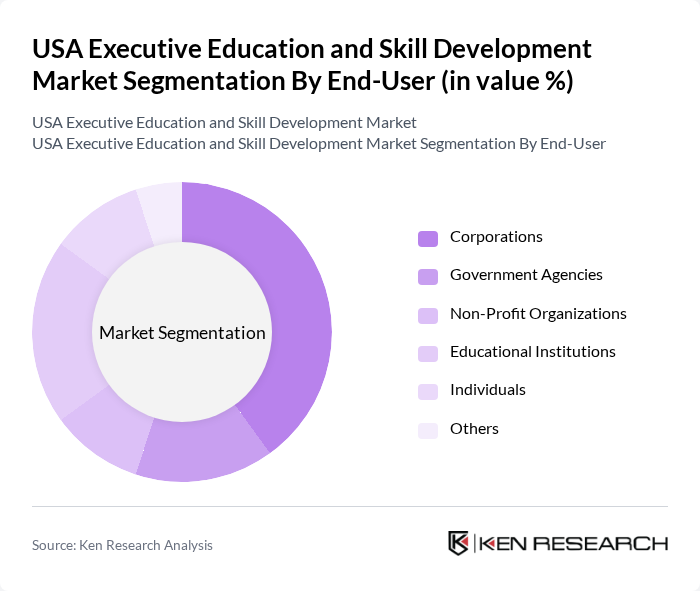

By End-User:The market is segmented by end-users, including Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporations are the leading end-user segment, driven by the need for continuous employee development to maintain competitive advantage. Companies are increasingly investing in executive education to enhance leadership skills and improve overall organizational performance. This trend is particularly evident in industries undergoing rapid transformation, where skilled leadership is crucial for navigating change.

The USA Executive Education and Skill Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harvard Business School, Wharton School of the University of Pennsylvania, Stanford Graduate School of Business, MIT Sloan School of Management, Columbia Business School, INSEAD, Northwestern University's Kellogg School of Management, University of Chicago Booth School of Business, Duke University's Fuqua School of Business, University of California, Berkeley - Haas School of Business, Yale School of Management, University of Michigan - Ross School of Business, University of Virginia - Darden School of Business, University of Southern California - Marshall School of Business, Cornell University - Johnson Graduate School of Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA executive education and skill development market appears promising, driven by the increasing emphasis on personalized learning experiences and the integration of advanced technologies. As organizations prioritize employee development, the demand for innovative training solutions will continue to grow. Additionally, the focus on lifelong learning will encourage professionals to seek continuous education, further expanding the market. The evolution of hybrid learning models will also play a crucial role in shaping the landscape, providing flexible options for learners.

| Segment | Sub-Segments |

|---|---|

| By Type | Executive MBA Programs Leadership Development Programs Professional Certifications Short Courses and Workshops Online Learning Modules Coaching and Mentoring Services Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Learning Blended Learning Mobile Learning Others |

| By Duration | Short-Term Programs (Less than 3 months) Medium-Term Programs (3 to 6 months) Long-Term Programs (More than 6 months) Others |

| By Industry Focus | Technology Healthcare Finance Manufacturing Others |

| By Certification Type | Professional Certifications Academic Degrees Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Sponsorship Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | HR Managers, Learning & Development Directors |

| Skill Development Initiatives in Tech | 100 | Training Coordinators, IT Managers |

| Leadership Development Workshops | 80 | Program Participants, Executive Coaches |

| Industry-Specific Skill Training | 70 | Industry Experts, Training Providers |

| Online Learning Platforms for Executives | 90 | Product Managers, Marketing Directors |

The USA Executive Education and Skill Development Market is valued at approximately USD 55 billion, reflecting a significant demand for upskilling and reskilling among professionals as organizations adapt to rapid technological changes.