Region:North America

Author(s):Rebecca

Product Code:KRAB5923

Pages:90

Published On:October 2025

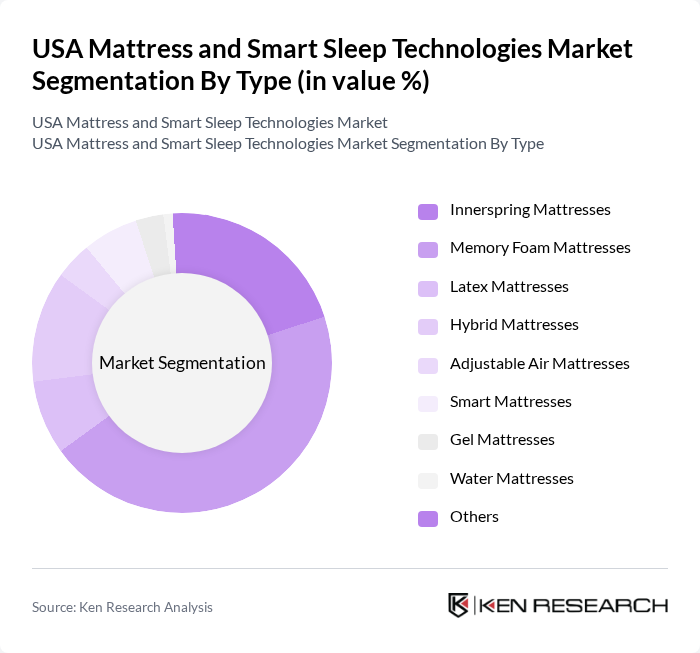

By Type:The mattress market is segmented into various types, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Air Mattresses, Smart Mattresses, Gel Mattresses, Water Mattresses, and Others. Among these, Memory Foam Mattresses have gained significant popularity due to their comfort and support, catering to a wide range of consumer preferences. The increasing demand for personalized sleep solutions has led to a surge in the adoption of Smart Mattresses, which integrate technology for enhanced sleep tracking and comfort adjustments.

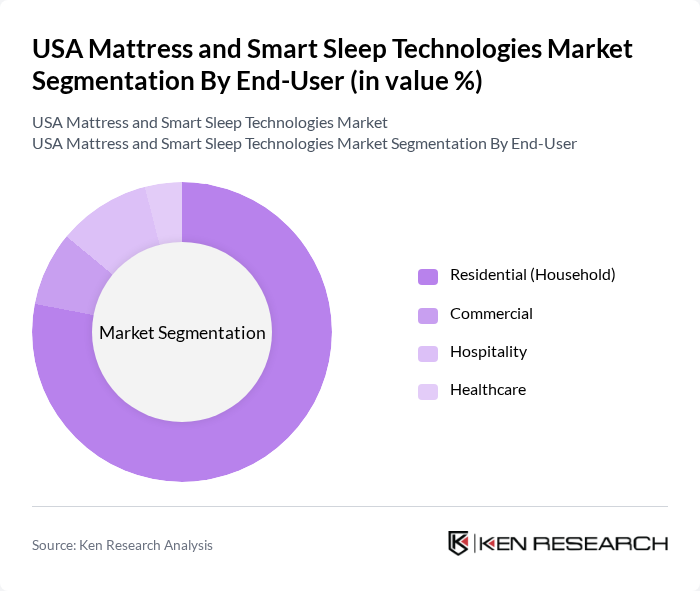

By End-User:The market is segmented by end-user into Residential (Household), Commercial, Hospitality, and Healthcare. The Residential segment dominates the market, driven by the increasing focus on home comfort and wellness. Consumers are investing more in quality sleep solutions, leading to a rise in demand for mattresses that cater to personal preferences and health needs. The Healthcare segment is also growing, as hospitals and care facilities seek specialized mattresses for patient comfort and recovery.

The USA Mattress and Smart Sleep Technologies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Serta Simmons Bedding, LLC, Purple Innovation, LLC, Saatva, Inc., Sleep Number Corporation, Stearns & Foster, Tuft & Needle, Avocado Green Mattress, Helix Sleep, Inc., Bear Mattress, Leesa Sleep, LLC, Zinus, Inc., DreamCloud Sleep, Nest Bedding, Inc., Amerisleep, Casper Sleep Inc., Brooklyn Bedding, Spring Air International, Kingsdown, Inc., Emma Sleep (Emma Sleep GmbH) contribute to innovation, geographic expansion, and service delivery in this space.

The USA mattress and smart sleep technologies market is poised for significant evolution, driven by increasing consumer demand for health-oriented sleep solutions and technological integration. As the market adapts to consumer preferences, innovations in smart home integration and personalized sleep solutions will likely emerge. Additionally, the growing focus on sustainability will push manufacturers to develop eco-friendly products, aligning with consumer values and enhancing market competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Air Mattresses Smart Mattresses Gel Mattresses Water Mattresses Others |

| By End-User | Residential (Household) Commercial Hospitality Healthcare |

| By Sales Channel | Online Retail Offline Retail Direct Sales Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Material | Foam Fabric Metal Wood Natural Fibers |

| By Brand Positioning | Luxury Brands Value Brands Mass Market Brands |

| By Technology Integration | Sleep Tracking Technology Temperature Regulation Technology Smart Home Compatibility Adjustable Firmness Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 120 | Homeowners, Renters, Sleep Enthusiasts |

| Smart Sleep Technology Adoption | 90 | Tech-savvy Consumers, Health-conscious Individuals |

| Retail Insights on Sleep Products | 60 | Store Managers, Sales Representatives |

| Health Professional Perspectives | 50 | Sleep Specialists, General Practitioners |

| Market Trends in Sleep Accessories | 40 | Product Developers, Marketing Managers |

The USA Mattress and Smart Sleep Technologies Market is valued at approximately USD 9 billion, driven by increasing consumer awareness of sleep health, e-commerce growth, and innovations in smart sleep technologies that enhance comfort and user experience.