Region:North America

Author(s):Geetanshi

Product Code:KRAB5752

Pages:97

Published On:October 2025

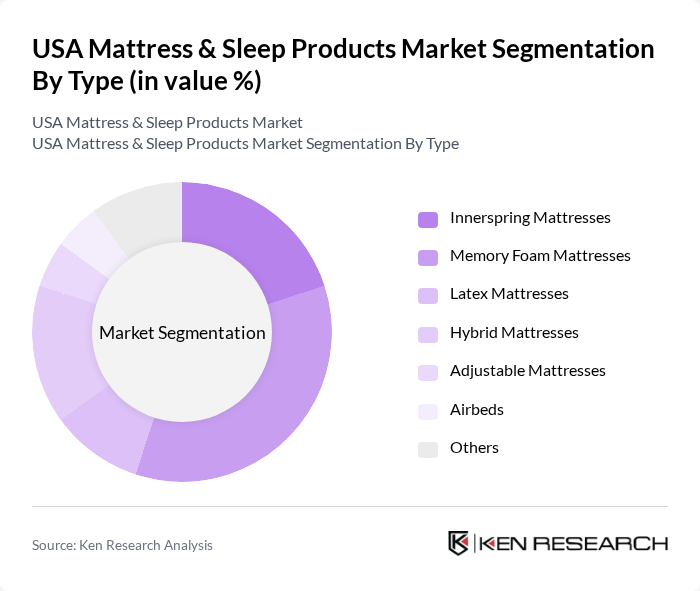

By Type:The mattress and sleep products market can be segmented into various types, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Mattresses, Airbeds, and Others. Among these, Memory Foam Mattresses have gained significant popularity due to their comfort and support, catering to a wide range of consumer preferences. The trend towards personalized sleep solutions has further propelled the demand for these products.

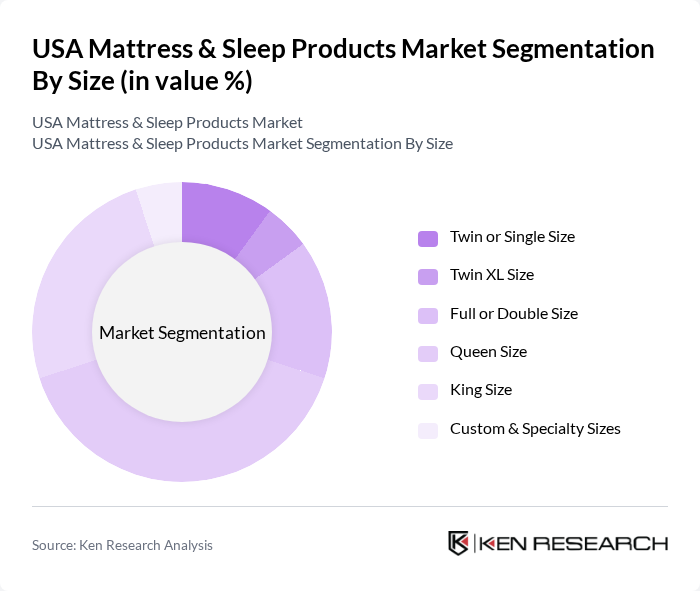

By Size:The market is also segmented by size, including Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size, and Custom & Specialty Sizes. The Queen Size mattresses are particularly popular among consumers due to their balance of space and comfort, making them a preferred choice for couples and individuals alike.

The USA Mattress & Sleep Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Serta Simmons Bedding, LLC, Purple Innovation, Inc., Sleep Number Corporation, Saatva LLC, Stearns & Foster, Tuft & Needle, Avocado Green Mattress, Zinus, Inc., Leesa Sleep, Inc., Bear Mattress, Helix Sleep, DreamCloud, WinkBeds, Nolah Sleep, Casper Sleep Inc., Brooklyn Bedding, Kingsdown, Inc., Southerland Sleep, Spring Air International contribute to innovation, geographic expansion, and service delivery in this space.

The USA mattress and sleep products market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The demand for smart mattresses, which integrate sleep tracking and comfort customization, is expected to rise sharply. Additionally, the trend towards subscription-based services is likely to reshape purchasing behaviors, offering consumers flexibility and convenience. As health and wellness continue to gain prominence, the market will increasingly focus on products that enhance sleep quality and overall well-being.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Mattresses Airbeds Others |

| By Size | Twin or Single Size Twin XL Size Full or Double Size Queen Size King Size Custom & Specialty Sizes |

| By End-User | Residential Commercial Hospitality Healthcare |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct-to-Consumer |

| By Price Range | Budget Mid-Range Premium |

| By Material | Foam Fabric Metal Wood |

| By Brand Positioning | Luxury Brands Value Brands Eco-Friendly Brands |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 120 | Homeowners, Renters aged 25-55 |

| Retail Sales Insights | 100 | Store Managers, Sales Associates in mattress retail |

| Sleep Health Professionals | 80 | Sleep Therapists, Chiropractors, Health Coaches |

| Online Shopping Behavior | 120 | Frequent online shoppers, E-commerce users |

| Product Satisfaction Surveys | 90 | Recent mattress buyers, Sleep product users |

The USA Mattress & Sleep Products Market is valued at approximately USD 9 billion, reflecting a significant growth trend driven by increased consumer awareness of sleep health, rising disposable incomes, and the popularity of online shopping for home goods.