Region:Europe

Author(s):Geetanshi

Product Code:KRAA6603

Pages:88

Published On:September 2025

By Type:The mattress market is segmented into various types, including Innerspring Mattresses, Memory Foam Mattresses, Latex Mattresses, Hybrid Mattresses, Adjustable Mattresses, Organic Mattresses, and Others. Among these, Memory Foam Mattresses have gained significant popularity due to their comfort and support, appealing to consumers seeking better sleep quality. Innerspring Mattresses remain a traditional choice, while the demand for Organic Mattresses is rising as consumers become more health-conscious.

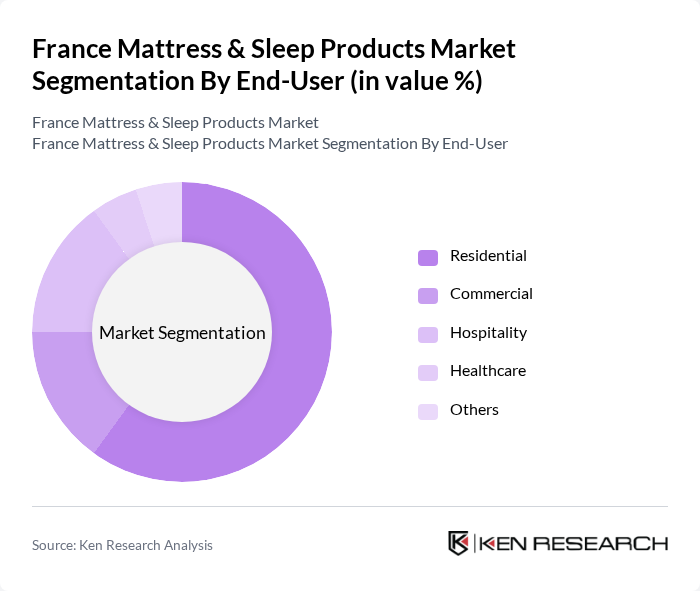

By End-User:The market is segmented by end-user into Residential, Commercial, Hospitality, Healthcare, and Others. The Residential segment dominates the market, driven by increasing consumer spending on home furnishings and a growing focus on sleep quality. The Hospitality sector is also significant, as hotels and resorts invest in high-quality mattresses to enhance guest experiences. The Healthcare segment is emerging, with hospitals and care facilities recognizing the importance of proper sleep for patient recovery.

The France Mattress & Sleep Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., IKEA, Emma Mattress, Hypnos Beds, Dunlopillo, Simmons Bedding Company, Bultex, Treca Interiors Paris, Matelas Nocturne, La Compagnie du Lit, BULTEX, Dodo, Merinos, Matelas Direct, Lits et Matelas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France mattress market appears promising, driven by evolving consumer preferences and technological advancements. As health and wellness trends continue to gain traction, the demand for innovative sleep solutions is expected to rise. Additionally, the integration of smart technology into mattresses will likely attract tech-savvy consumers. Companies that adapt to these trends and focus on sustainability will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Adjustable Mattresses Organic Mattresses Others |

| By End-User | Residential Commercial Hospitality Healthcare Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Foam Fabric Metal Wood Others |

| By Brand | National Brands Private Labels International Brands Others |

| By Customer Segment | First-time Buyers Repeat Customers Corporate Clients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 150 | Homeowners, Renters aged 25-55 |

| Retailer Insights on Sleep Products | 100 | Store Managers, Sales Representatives |

| Health Professionals' Perspectives | 80 | Sleep Specialists, Chiropractors |

| Market Trends and Innovations | 70 | Product Development Managers, Industry Analysts |

| Consumer Preferences and Brand Loyalty | 120 | Frequent Mattress Buyers, Brand Advocates |

The France Mattress & Sleep Products Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by increased consumer awareness of sleep health and rising disposable incomes, which encourage spending on quality sleep products.