Region:North America

Author(s):Shubham

Product Code:KRAE0423

Pages:84

Published On:December 2025

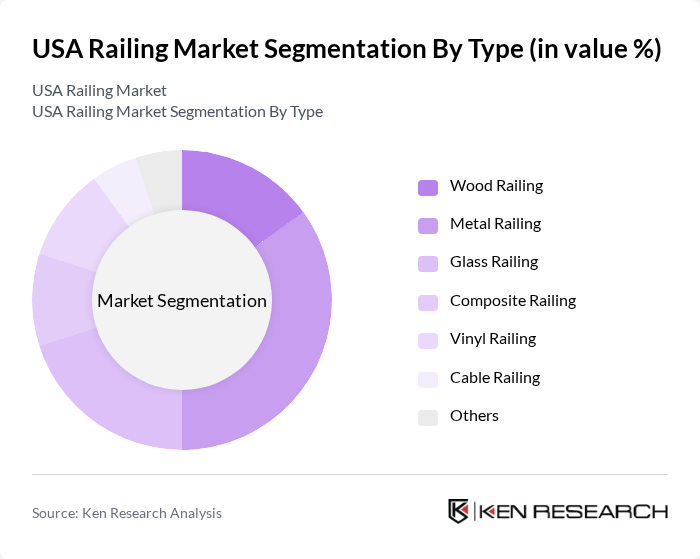

By Type:The railing market is segmented into various types, including wood, metal, glass, composite, vinyl, cable, and others. Among these, metal railing is currently the most dominant segment due to its durability, low maintenance, and aesthetic appeal. The increasing trend of modern architecture and urbanization has led to a higher preference for metal railings in both residential and commercial applications.

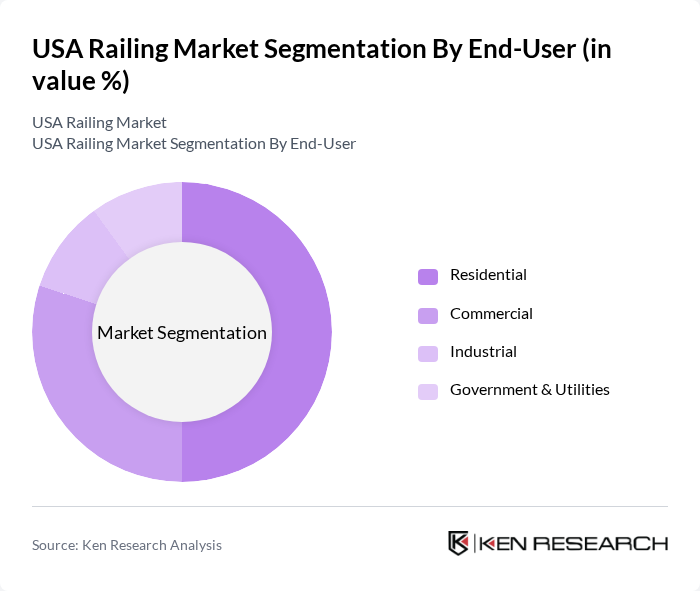

By End-User:The market is segmented based on end-users, including residential, commercial, industrial, and government & utilities. The residential segment is the largest due to the increasing number of housing projects and renovations. Homeowners are increasingly investing in stylish and safe railing solutions, which drives the demand in this segment.

The USA Railing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trex Company, Inc., Fortress Building Products, Railing Dynamics, Inc., CertainTeed Corporation, TimberTech, Westbury Aluminum Railing, Deckorators, Azek Building Products, Peak Products, Barrette Outdoor Living, Superior Plastic Products, Alumi-Guard, DuraLife Decking, Railing & Decking Solutions, Veranda contribute to innovation, geographic expansion, and service delivery in this space.

The USA railing market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization accelerates, the demand for innovative and customizable railing solutions is expected to rise. Additionally, the integration of smart technologies into railing systems will enhance safety and functionality, appealing to tech-savvy consumers. Companies that adapt to these trends and invest in sustainable materials will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Wood Railing Metal Railing Glass Railing Composite Railing Vinyl Railing Cable Railing Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Material | Aluminum Steel Wood Composite Glass Others |

| By Application | Balconies Decks Stairs Walkways Pool Areas Others |

| By Installation Type | New Construction Renovation DIY Installations Professional Installations |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Distributors Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Railing Installations | 150 | Homeowners, Contractors, Interior Designers |

| Commercial Railing Solutions | 100 | Facility Managers, Architects, Project Managers |

| Industrial Railing Applications | 80 | Safety Officers, Operations Managers, Engineers |

| Regulatory Compliance in Railing | 70 | Building Inspectors, Compliance Officers, Legal Advisors |

| Innovative Railing Materials | 90 | Product Developers, Material Scientists, Sustainability Experts |

The USA Railing Market is valued at approximately USD 6.5 billion, driven by robust construction and infrastructure development, alongside increasing demand in both residential and commercial sectors.