Region:North America

Author(s):Rebecca

Product Code:KRAB4121

Pages:96

Published On:October 2025

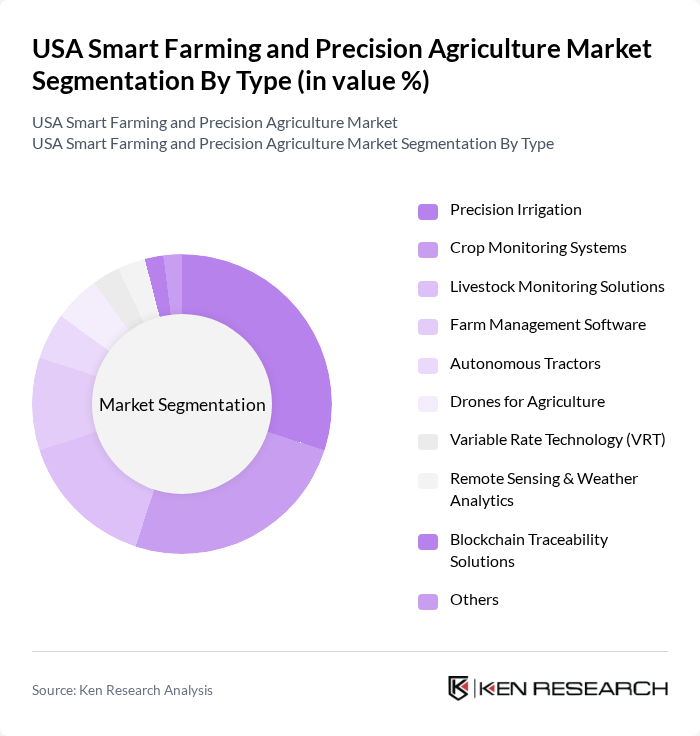

By Type:The market is segmented into various types, including Precision Irrigation, Crop Monitoring Systems, Livestock Monitoring Solutions, Farm Management Software, Autonomous Tractors, Drones for Agriculture, Variable Rate Technology (VRT), Remote Sensing & Weather Analytics, Blockchain Traceability Solutions, and Others. Among these, Precision Irrigation and Crop Monitoring Systems are leading subsegments due to their critical role in enhancing water efficiency and crop health monitoring, respectively. The increasing focus on resource conservation, yield maximization, and sustainability drives the demand for these technologies. Adoption of automation and control systems, as well as GNSS/GPS-enabled solutions, is accelerating as farms seek to optimize input use and improve real-time decision-making .

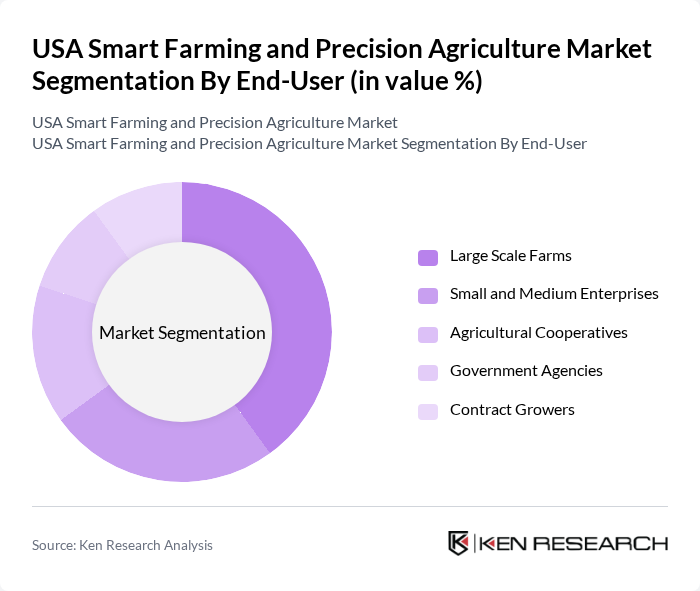

By End-User:The end-user segmentation includes Large Scale Farms, Small and Medium Enterprises, Agricultural Cooperatives, Government Agencies, and Contract Growers. Large Scale Farms are the dominant segment, driven by their capacity to invest in advanced technologies and the need for efficient resource management. These farms often operate on a larger scale, making the adoption of smart farming solutions essential for maintaining competitiveness and sustainability. Government incentives and grants further support technology adoption among large and mid-sized operations .

The USA Smart Farming and Precision Agriculture Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere (Deere & Company), Trimble Inc., AGCO Corporation, Raven Industries, AG Leader Technology, PrecisionHawk, The Climate Corporation (Bayer), Farmers Edge Inc., Topcon Positioning Systems, CNH Industrial, BASF Digital Farming, Bayer Crop Science, Syngenta Group, Hexagon Agriculture, Taranis, AgEagle Aerial Systems Inc., CropX Technologies, Granular (Corteva Agriscience) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA smart farming and precision agriculture market appears promising, driven by technological advancements and increasing consumer demand for sustainable practices. In future, the market is expected to witness a surge in the adoption of vertical farming and drone technology, enhancing crop production efficiency. Additionally, the integration of big data analytics will enable farmers to make informed decisions, optimizing resource allocation and improving yield. As these trends continue, the market will likely evolve, fostering innovation and sustainability in agriculture.

| Segment | Sub-Segments |

|---|---|

| By Type | Precision Irrigation Crop Monitoring Systems Livestock Monitoring Solutions Farm Management Software Autonomous Tractors Drones for Agriculture Variable Rate Technology (VRT) Remote Sensing & Weather Analytics Blockchain Traceability Solutions Others |

| By End-User | Large Scale Farms Small and Medium Enterprises Agricultural Cooperatives Government Agencies Contract Growers |

| By Application | Crop Production Livestock Management Soil Management Yield Monitoring Resource Optimization Supply Chain Traceability |

| By Component | Hardware (Sensors, Drones, GPS Devices, Controllers) Software (Farm Management, Analytics, Mobile Apps) Services (Consulting, Integration, Support) |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Yield Optimization Technologies | 120 | Agronomists, Farm Managers |

| Precision Irrigation Systems | 60 | Irrigation Specialists, Agricultural Engineers |

| Drone and Aerial Imaging Services | 50 | Drone Operators, Crop Consultants |

| Soil Health Monitoring Solutions | 40 | Soil Scientists, Environmental Consultants |

| Smart Livestock Management Tools | 45 | Livestock Farmers, Veterinary Technicians |

The USA Smart Farming and Precision Agriculture Market is valued at approximately USD 5.6 billion, driven by technological advancements, increased food production efficiency, and sustainable agricultural practices.