Region:North America

Author(s):Rebecca

Product Code:KRAB5266

Pages:91

Published On:October 2025

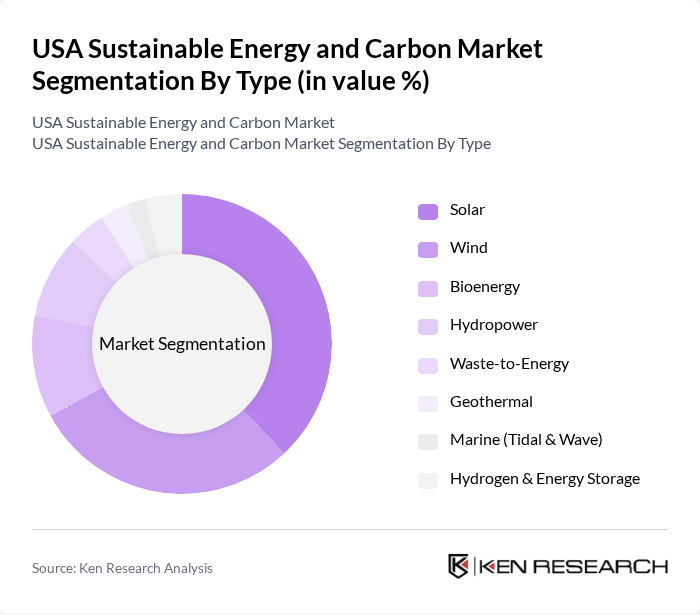

By Type:The market is segmented into various types of sustainable energy sources, including solar, wind, bioenergy, hydropower, waste-to-energy, geothermal, marine (tidal & wave), and hydrogen & energy storage. Each of these segments plays a crucial role in the overall energy mix, withsolar and windbeing the most prominent due to their scalability, rapid deployment, and decreasing costs. Battery storage is increasingly vital for grid stability and maximizing renewable integration .

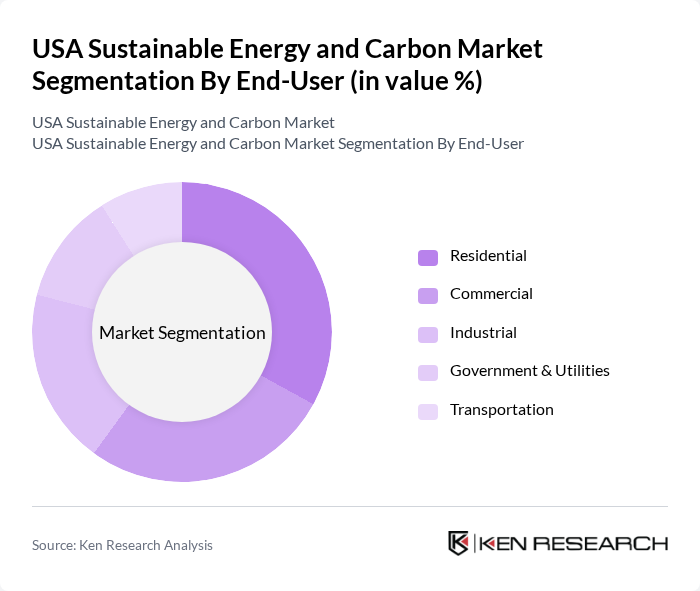

By End-User:The market is segmented by end-users, including residential, commercial, industrial, government & utilities, and transportation. Each segment has unique energy needs and consumption patterns, withresidential and commercial sectorsleading demand for distributed renewable energy solutions. Industrial and transportation sectors are increasingly adopting electrification and decarbonization strategies, while government and utilities focus on grid modernization and large-scale renewables .

The USA Sustainable Energy and Carbon Market is characterized by a dynamic mix of regional and international players. Leading participants such as NextEra Energy, Inc., Duke Energy Corporation, Dominion Energy, Inc., Enphase Energy, Inc., First Solar, Inc., Ørsted A/S, Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, Brookfield Renewable Partners L.P., Canadian Solar Inc., AES Clean Energy, 8minute Solar Energy, Clearway Energy, Inc., Pattern Energy Group Inc., TerraForm Power, Inc., Invenergy LLC, Constellation Energy Corporation, Vistra Corp., Exelon Corporation, Tesla, Inc. (Energy Division) contribute to innovation, geographic expansion, and service delivery in this space.

The USA sustainable energy and carbon market is poised for transformative growth, driven by increasing investments in renewable technologies and a shift towards decarbonization. As electric vehicle adoption accelerates, the demand for charging infrastructure will rise, creating new business opportunities. Additionally, advancements in smart grid technologies will enhance energy efficiency and reliability, further supporting the transition to a sustainable energy ecosystem. The focus on circular economy practices will also drive innovation and resource optimization across industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Geothermal Marine (Tidal & Wave) Hydrogen & Energy Storage |

| By End-User | Residential Commercial Industrial Government & Utilities Transportation |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Carbon Capture & Storage |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Carbon Credits |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Auction-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Project Developers | 70 | Project Managers, Business Development Executives |

| Carbon Credit Traders | 50 | Traders, Financial Analysts, Compliance Officers |

| Energy Policy Experts | 40 | Regulatory Affairs Specialists, Policy Advisors |

| Environmental NGOs | 40 | Program Directors, Advocacy Coordinators |

| Utility Companies | 50 | Energy Managers, Sustainability Officers |

The USA Sustainable Energy and Carbon Market is valued at approximately USD 1.3 trillion, driven by significant investments in renewable energy technologies, government incentives, and increased awareness of climate change impacts.