Region:Asia

Author(s):Rebecca

Product Code:KRAD2876

Pages:88

Published On:November 2025

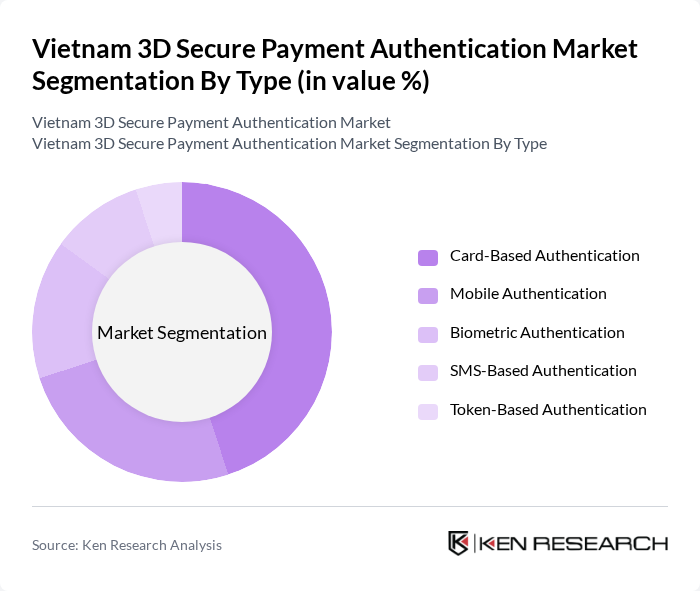

By Type:

The market is segmented into various types of authentication methods, including Card-Based Authentication, Mobile Authentication, Biometric Authentication, SMS-Based Authentication, and Token-Based Authentication. Among these, Card-Based Authentication is the leading sub-segment, primarily due to its widespread acceptance and integration with existing payment systems. Consumers are familiar with card transactions, and the added layer of security provided by 3D Secure technology enhances their confidence in online purchases. Mobile Authentication is also gaining traction, driven by the increasing use of smartphones for transactions. The demand for secure mobile payment solutions is expected to rise as more consumers shift towards mobile commerce, with biometric authentication methods such as fingerprint and facial recognition increasingly integrated to enhance both security and user experience.

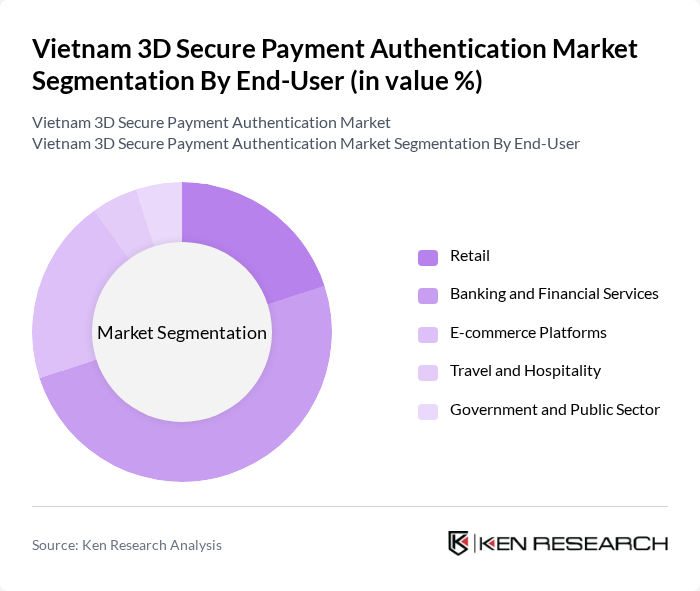

By End-User:

The end-user segmentation includes Retail, Banking and Financial Services, E-commerce Platforms, Travel and Hospitality, and Government and Public Sector. The Banking and Financial Services sector is the dominant segment, as these institutions are required to implement stringent security measures to protect sensitive customer data and transactions. The increasing number of online banking users and the rise in digital transactions have further propelled the demand for secure payment authentication solutions in this sector. E-commerce Platforms are also significant contributors, as they seek to enhance customer trust and reduce fraud in online transactions.

The Vietnam 3D Secure Payment Authentication Market is characterized by a dynamic mix of regional and international players. Leading participants such as VNPay, MoMo, ZaloPay, Payoo, ViettelPay, BIDV (Bank for Investment and Development of Vietnam), Techcombank (Vietnam Technological and Commercial Joint Stock Bank), Sacombank (Saigon Thuong Tin Commercial Joint Stock Bank), Agribank (Vietnam Bank for Agriculture and Rural Development), ACB (Asia Commercial Bank), TPBank (Tien Phong Commercial Joint Stock Bank), VPBank (Vietnam Prosperity Joint Stock Commercial Bank), Maritime Bank (Maritime Commercial Joint Stock Bank), HDBank (Ho Chi Minh City Development Joint Stock Bank), Shinhan Bank Vietnam, Vietcombank (Joint Stock Commercial Bank for Foreign Trade of Vietnam), VietinBank (Vietnam Joint Stock Commercial Bank for Industry and Trade), VIB (Vietnam International Bank), Timo (Timo Digital Bank), K Bank Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

As Vietnam continues to embrace digital transformation, the 3D Secure payment authentication market is poised for significant advancements. The integration of biometric authentication and artificial intelligence in fraud detection will enhance security measures, making online transactions safer. Additionally, the rise of cross-border e-commerce will necessitate robust authentication solutions, further driving demand. With government support and increasing consumer awareness, the market is expected to evolve rapidly, fostering a secure digital payment ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Card-Based Authentication Mobile Authentication Biometric Authentication SMS-Based Authentication Token-Based Authentication |

| By End-User | Retail Banking and Financial Services E-commerce Platforms Travel and Hospitality Government and Public Sector |

| By Payment Method | Credit Cards Debit Cards Digital Wallets Bank Transfers QR Code Payments |

| By Industry Vertical | Retail and E-commerce Telecommunications Government Healthcare Education |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises Financial Institutions |

| By Security Level | Low Security Medium Security High Security Multi-Factor Authentication |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Stakeholders | 60 | Product Managers, Risk Analysts |

| E-commerce Platforms | 50 | Operations Managers, IT Security Officers |

| Payment Service Providers | 40 | Business Development Managers, Compliance Officers |

| Consumer Insights | 150 | Online Shoppers, Digital Payment Users |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

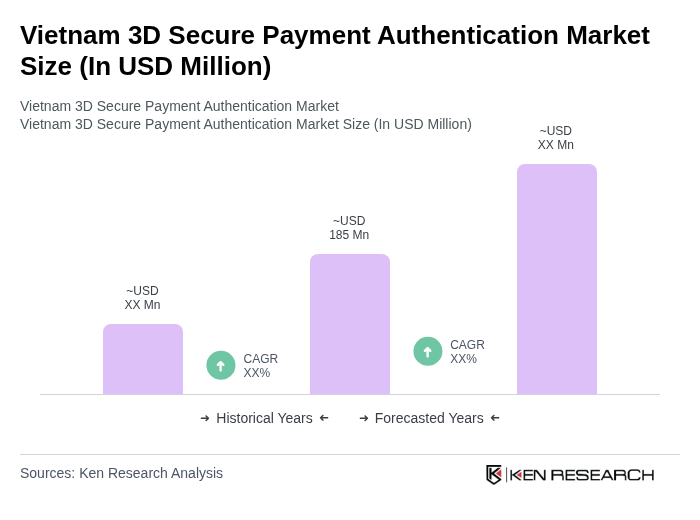

The Vietnam 3D Secure Payment Authentication Market is valued at approximately USD 185 million, reflecting significant growth driven by the increasing adoption of online shopping and digital payment methods, alongside a heightened focus on security in financial transactions.