Region:Asia

Author(s):Geetanshi

Product Code:KRAC3117

Pages:97

Published On:October 2025

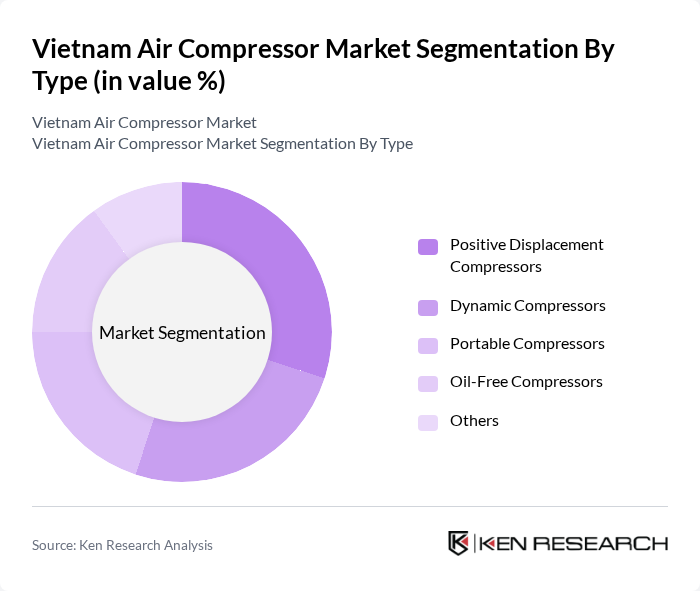

By Type:The market is segmented into various types of air compressors, including Positive Displacement Compressors (such as reciprocating and rotary/screw), Dynamic Compressors (centrifugal), Portable Compressors, Oil-Free Compressors, and Others. Each type serves different applications and industries, catering to specific consumer needs and preferences. Positive displacement compressors, known for their reliability and efficiency, are widely used in manufacturing and construction, where consistent air pressure is critical. The growing trend toward automation and the integration of IoT for real-time monitoring and maintenance are driving demand for advanced, energy-efficient models across all segments. Portable and compact compressors are gaining popularity, especially in small businesses and for mobile applications, reflecting changing consumer preferences and the need for flexibility.

The Positive Displacement Compressors segment leads the market due to their efficiency and reliability in various industrial applications. These compressors are widely used in manufacturing and construction, where consistent air pressure is crucial. The growing trend towards automation and the need for high-performance equipment further bolster the demand for this type of compressor. Additionally, advancements in technology have improved the performance and energy efficiency of positive displacement compressors, making them a preferred choice among consumers.

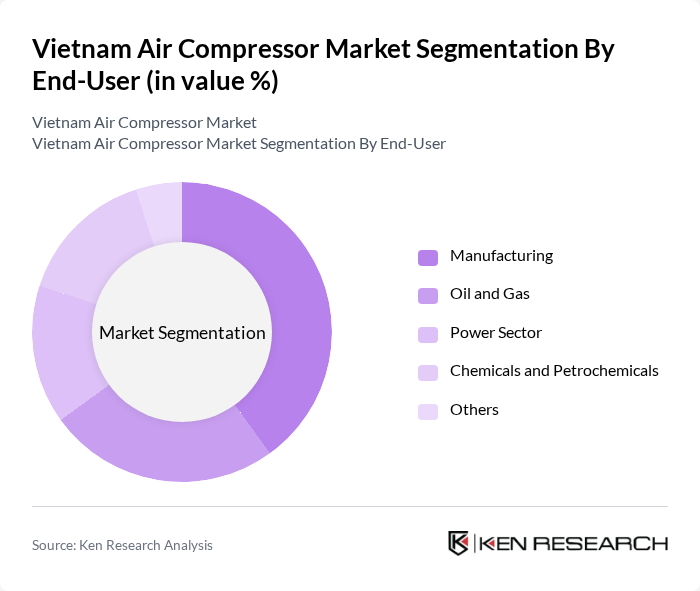

By End-User:The market is segmented based on end-users, including Manufacturing, Oil and Gas, Power Sector, Chemicals and Petrochemicals, and Others. Each end-user segment has distinct requirements and applications for air compressors, influencing their market dynamics. The manufacturing sector remains the largest consumer, driven by the need for pneumatic tools, process control, and air quality management in production environments. The oil and gas sector also represents a significant share, with compressors used for crude oil transportation and refining operations. Other key sectors include food and beverage (for packaging and processing), healthcare (for medical devices and dental equipment), and energy.

The Manufacturing sector is the dominant end-user of air compressors, accounting for a significant portion of the market. This is attributed to the extensive use of air compressors in various manufacturing processes, including assembly lines, pneumatic tools, and material handling. The increasing focus on automation and efficiency in manufacturing operations drives the demand for reliable and high-performance air compressors. Additionally, the growth of the manufacturing sector in Vietnam, fueled by foreign investments and government initiatives, further enhances the market potential.

The Vietnam Air Compressor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco, Ingersoll Rand, Siemens Energy, Mitsubishi Heavy Industries, Doosan Co Ltd, Aerzener Maschinenfabrik GmbH, Kaeser Compressors, Sullair, Boge Compressors, Gardner Denver, Fusheng, Hitachi Industrial Equipment Systems, Elgi Equipments, Chicago Pneumatic, CompAir contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam air compressor market is poised for significant growth, driven by increasing industrialization and a shift towards energy-efficient solutions. As the manufacturing sector expands, particularly in electronics and automotive industries, the demand for advanced air compressor technologies will rise. Additionally, government initiatives aimed at promoting sustainable practices will further enhance market dynamics. The focus on smart and connected compressors will likely reshape the landscape, fostering innovation and efficiency in operations across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Positive Displacement Compressors Dynamic Compressors Portable Compressors Oil-Free Compressors Others |

| By End-User | Manufacturing Oil and Gas Power Sector Chemicals and Petrochemicals Others |

| By Application | Pneumatic Tools Spray Painting Material Handling HVAC Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Trade Shows Others |

| By Price Range | Low-End Compressors Mid-Range Compressors High-End Compressors Others |

| By Component | Compressors Air Dryers Filters Tanks Others |

| By Service Type | Maintenance Services Repair Services Installation Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Air Compressor Usage | 95 | Production Managers, Facility Engineers |

| Construction Industry Equipment Procurement | 75 | Project Managers, Equipment Buyers |

| Automotive Sector Maintenance Practices | 65 | Maintenance Supervisors, Workshop Managers |

| Energy Efficiency Initiatives in Industry | 55 | Sustainability Officers, Operations Directors |

| Distribution Channel Insights | 70 | Sales Managers, Distribution Coordinators |

The Vietnam Air Compressor Market is valued at approximately USD 380 million, reflecting significant growth driven by industrialization, urbanization, and increasing demand from sectors like manufacturing, construction, and automotive.