Region:Middle East

Author(s):Dev

Product Code:KRAC2045

Pages:84

Published On:October 2025

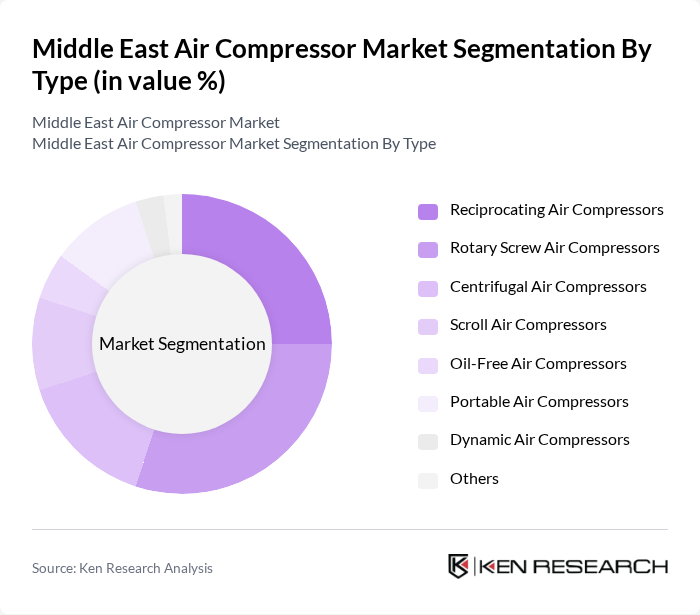

By Type:The market is segmented into various types of air compressors, including reciprocating, rotary screw, centrifugal, scroll, oil-free, portable, dynamic, and others. Each type serves different applications and industries, catering to specific needs based on efficiency, power, and operational requirements. Rotary screw compressors are widely used in manufacturing and oil & gas due to their high efficiency and reliability, while portable compressors are gaining traction in construction and mining for their flexibility and ease of deployment .

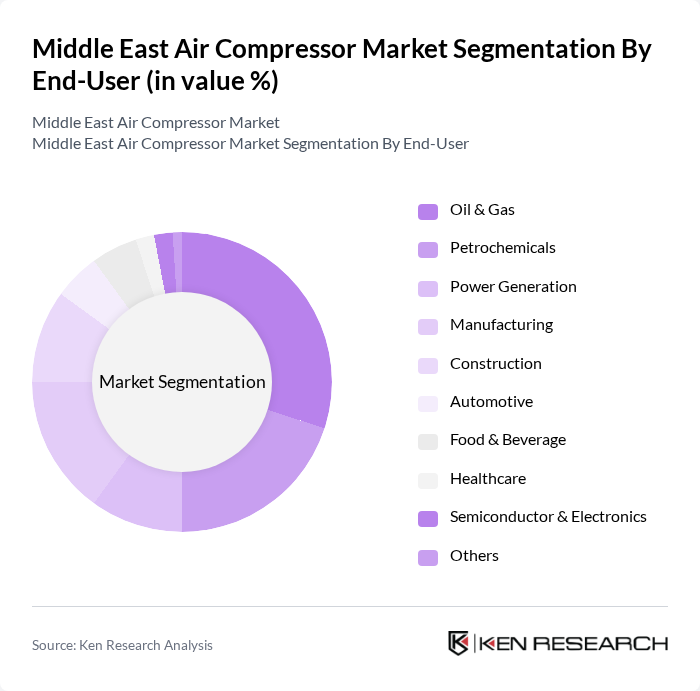

By End-User:The end-user segmentation includes various industries such as oil and gas, petrochemicals, power generation, manufacturing, construction, automotive, food and beverage, healthcare, semiconductor and electronics, and others. Each sector has unique requirements for air compressors, influencing the demand and market dynamics. Oil and gas, manufacturing, and construction remain the leading end-users, driven by ongoing industrialization, energy sector investments, and infrastructure projects across the region .

The Middle East Air Compressor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlas Copco, Ingersoll Rand, KAESER KOMPRESSOREN, Hitachi Global Air Power US, LLC, BOGE KOMPRESSOREN, ELGi Equipments, BAUER COMPRESSORS, INC., Kaishan Group, SEIZE AIR, Burckhardt Compression, CompAir, Doosan Portable Power, Chicago Pneumatic, Gardner Denver, Siemens AG, and Baker Hughes contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East air compressor market appears promising, driven by ongoing industrialization and a strong push for energy efficiency. As governments continue to invest in infrastructure and renewable energy projects, the demand for advanced air compressor technologies is expected to rise. Furthermore, the integration of IoT and automation in manufacturing processes will likely enhance operational efficiency, creating new avenues for growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Reciprocating Air Compressors Rotary Screw Air Compressors Centrifugal Air Compressors Scroll Air Compressors Oil-Free Air Compressors Portable Air Compressors Dynamic Air Compressors Others |

| By End-User | Oil & Gas Petrochemicals Power Generation Manufacturing Construction Automotive Food & Beverage Healthcare Semiconductor & Electronics Others |

| By Application | Pneumatic Tools Spray Painting Material Handling HVAC Systems Food Processing Pipeline Transportation LNG Production Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Rental & Leasing Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range |

| By Component | Compressors Air Receivers Filters Regulators Motors & Drives Others |

| By Service Type | Maintenance Services Repair Services Installation Services Consulting Services Rental Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Air Compressor Users | 120 | Plant Managers, Maintenance Supervisors |

| Construction Sector Equipment Buyers | 90 | Procurement Managers, Project Engineers |

| Automotive Manufacturing Facilities | 70 | Operations Managers, Quality Control Inspectors |

| HVAC System Integrators | 60 | Technical Directors, Installation Managers |

| Research and Development Departments | 50 | R&D Managers, Product Development Engineers |

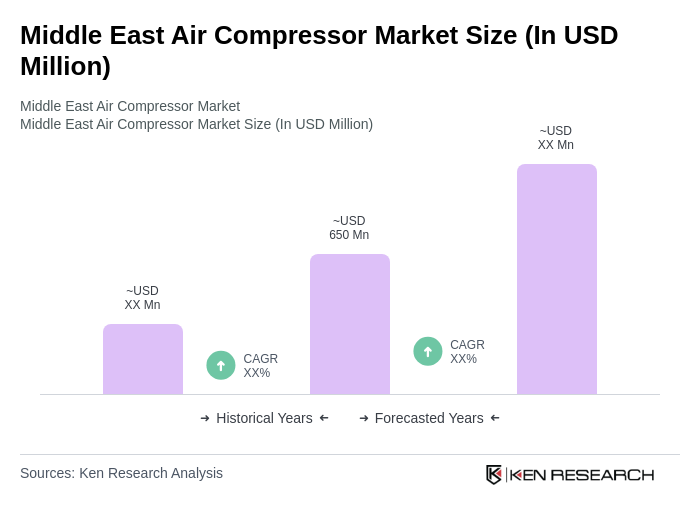

The Middle East Air Compressor Market is valued at approximately USD 650 million, driven by increasing industrial activities, infrastructure development, and the expansion of sectors such as oil and gas, manufacturing, and construction.