Region:Asia

Author(s):Geetanshi

Product Code:KRAD7341

Pages:90

Published On:December 2025

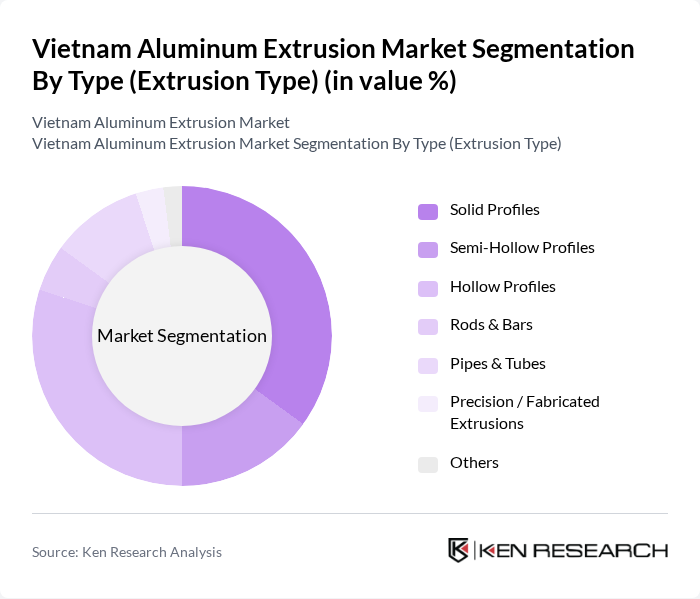

By Type (Extrusion Type):The market is segmented into various types of aluminum extrusions, including solid profiles, semi-hollow profiles, hollow profiles, rods & bars, pipes & tubes, precision/fabricated extrusions, and others. This classification is consistent with common processing?type breakdowns used in Vietnam’s aluminum industry, where extruded profiles and fabricated sections form the core of construction and industrial applications. Among these, solid profiles and hollow profiles are the most prominent due to their extensive applications in residential and commercial buildings, infrastructure, transportation equipment, and industrial machinery. Solid profiles are widely used for structural and framing applications such as door and window systems, mullions, beams, and industrial frames, while hollow profiles are favored for their combination of lightweight and high stiffness, making them ideal for facades, curtain walls, vehicle body structures, and modular assembly systems.

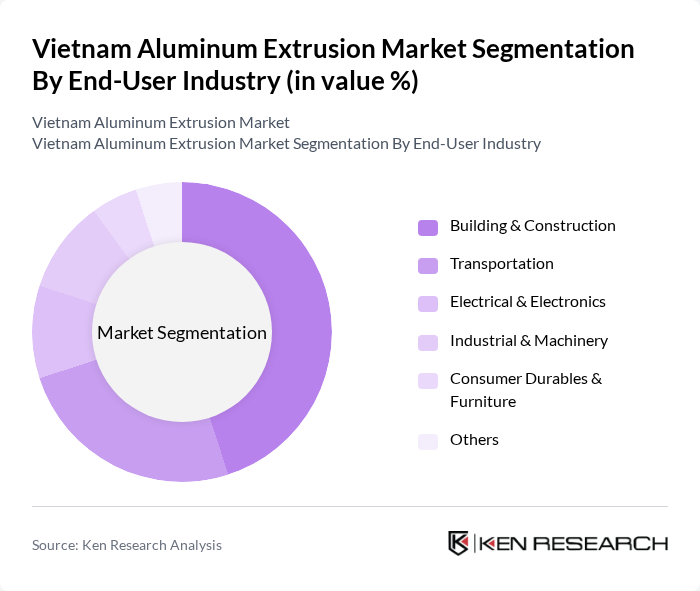

By End-User Industry:The aluminum extrusion market is further segmented by end-user industries, including building & construction, transportation, electrical & electronics, industrial & machinery, consumer durables & furniture, and others. This structure aligns with how leading Vietnam aluminum market studies classify demand across construction, transport, electrical, and machinery segments. The building & construction sector is the largest consumer of aluminum extrusions, supported by strong investment in housing, commercial real estate, and infrastructure, and by wider use of aluminum window frames, curtain walls, roofing, and formwork systems as developers target better thermal performance and lower maintenance. The transportation sector also shows significant growth due to the rising use of lightweight aluminum profiles in automotive, rail, and two?wheeler components, as well as emerging electric vehicle and logistics fleets where weight reduction and corrosion resistance are critical.

The Vietnam Aluminum Extrusion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam National Aluminium Profile Joint Stock Company (Vijalco), TungYang Co., Ltd. (Vietnam), Dai Dong Tieng Viet Aluminium Joint Stock Company, Dong A Aluminium Joint Stock Company (Nhôm ?ông Á), Hyundai Aluminum Vina Co., Ltd., Tung Shin Vietnam Co., Ltd. (Aluminum Extrusions), Vietnam Yongxing Aluminium Co., Ltd., Sapphire Aluminium Vietnam Co., Ltd., Vina Aluminium Co., Ltd., Sunjin Aluminium Co., Ltd. (Vietnam), Nam Kim Aluminium Profiles Joint Stock Company, Phu My Aluminium Extrusion Joint Stock Company, Viet Phap Aluminium Joint Stock Company (Vifa), Minh Phat Aluminium Co., Ltd., Tien Phong Aluminium Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam aluminum extrusion market is poised for significant growth, driven by increasing demand from the construction and automotive sectors. As the government continues to promote sustainable practices, the adoption of aluminum in various applications is expected to rise. Additionally, advancements in extrusion technology will enhance production efficiency. However, challenges such as competition from alternative materials and raw material price volatility will require strategic responses from industry players to capitalize on emerging opportunities effectively.

| Segment | Sub-Segments |

|---|---|

| By Type (Extrusion Type) | Solid Profiles Semi-Hollow Profiles Hollow Profiles Rods & Bars Pipes & Tubes Precision / Fabricated Extrusions Others |

| By End-User Industry | Building & Construction (windows, doors, curtain walls, façade, formwork) Transportation (automotive, rail, commercial vehicles) Electrical & Electronics Industrial & Machinery Consumer Durables & Furniture Others |

| By Application | Architectural Systems (frames, curtain walls, façades) Structural Components Heat Sinks & Electrical Profiles Transportation Components (body parts, chassis, roof rails) Industrial Frames & Equipment Solar & Renewable Energy Mounting Systems Others |

| By Alloy & Temper | xxx Series (e.g., 6061, 6063) xxx & 3xxx Series xxx Series Other Specialty Alloys By Temper (T4, T5, T6, Others) |

| By Surface Finish | Mill Finish Anodized Powder Coated Wood Grain & Decorative Finishes Others |

| By Distribution Channel | Direct Sales to OEMs & Contractors Distributors & Stockists Project-Based Sales (EPC, construction bids) Online / Digital Platforms Retail / Trade Counters Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Aluminum Usage | 100 | Project Managers, Procurement Officers |

| Automotive Industry Applications | 90 | Design Engineers, Production Managers |

| Consumer Goods Manufacturing | 70 | Product Development Managers, Supply Chain Analysts |

| Architectural Aluminum Solutions | 60 | Architects, Building Material Suppliers |

| Industrial Applications of Aluminum Extrusions | 80 | Operations Managers, Quality Control Specialists |

The Vietnam Aluminum Extrusion Market is valued at approximately USD 2.0 billion. This figure reflects a significant portion of the overall aluminum market in Vietnam, where extrusions account for around 40% of the total market value.