Region:Asia

Author(s):Dev

Product Code:KRAB5408

Pages:87

Published On:October 2025

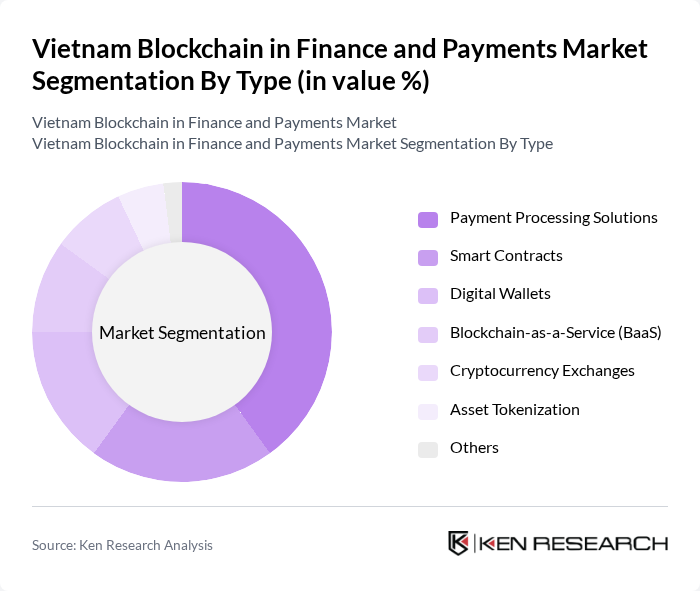

By Type:The market is segmented into various types, including Payment Processing Solutions, Smart Contracts, Digital Wallets, Blockchain-as-a-Service (BaaS), Cryptocurrency Exchanges, Asset Tokenization, and Others. Among these, Payment Processing Solutions are leading due to the increasing demand for efficient and secure transaction methods. The rise of e-commerce and digital transactions has significantly boosted the adoption of these solutions, making them essential for businesses and consumers alike.

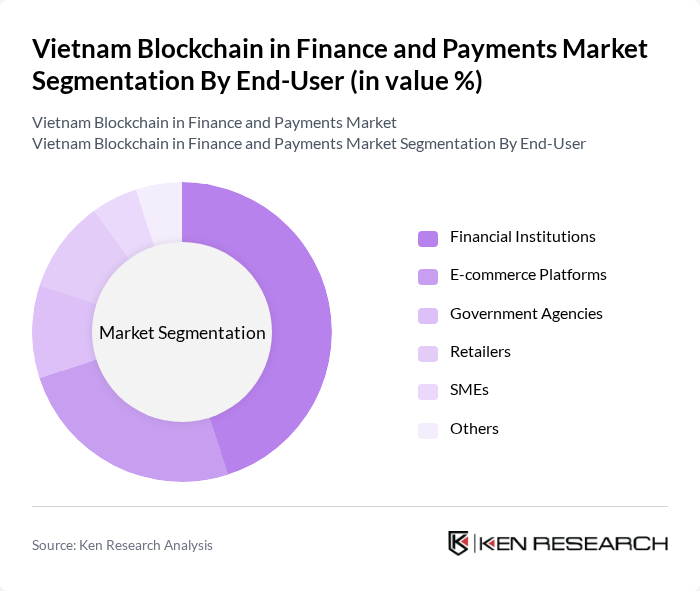

By End-User:The end-user segmentation includes Financial Institutions, E-commerce Platforms, Government Agencies, Retailers, SMEs, and Others. Financial Institutions are the dominant segment, leveraging blockchain technology to enhance transaction security and streamline operations. The increasing need for transparency and efficiency in financial services is driving the adoption of blockchain solutions among banks and other financial entities.

The Vietnam Blockchain in Finance and Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, MoMo, VNPay, Timo, Trusting Social, FPT Corporation, ZaloPay, Blockchain Vietnam, Coin98, Kyber Network, TienPhong Bank, Sacombank, BIDV, Agribank, and Vietcombank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blockchain market in Vietnam's finance and payments sector appears promising, driven by increasing digitalization and government initiatives. As the digital economy expands, the integration of blockchain technology into traditional banking systems is expected to enhance efficiency and security. Furthermore, the rise of decentralized finance (DeFi) platforms will likely reshape financial services, offering innovative solutions that cater to the evolving needs of consumers and businesses alike, fostering a more inclusive financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Solutions Smart Contracts Digital Wallets Blockchain-as-a-Service (BaaS) Cryptocurrency Exchanges Asset Tokenization Others |

| By End-User | Financial Institutions E-commerce Platforms Government Agencies Retailers SMEs Others |

| By Application | Cross-Border Payments Remittances Supply Chain Finance Identity Verification Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Others |

| By Investment Source | Venture Capital Private Equity Government Grants Crowdfunding Others |

| By Regulatory Compliance | KYC Compliance AML Compliance Data Protection Compliance Others |

| By User Demographics | Age Group Income Level Geographic Location Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fintech Startups in Blockchain | 100 | Founders, CTOs, Product Managers |

| Traditional Banks Adopting Blockchain | 80 | Innovation Officers, Risk Managers |

| Payment Service Providers | 90 | Operations Managers, Compliance Officers |

| Consumer Attitudes Towards Blockchain Payments | 150 | General Consumers, Tech-Savvy Users |

| Regulatory Bodies and Policy Makers | 50 | Regulators, Policy Analysts |

The Vietnam Blockchain in Finance and Payments Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital payment solutions and the government's initiatives for financial inclusion through technology.