Region:Asia

Author(s):Rebecca

Product Code:KRAD6300

Pages:81

Published On:December 2025

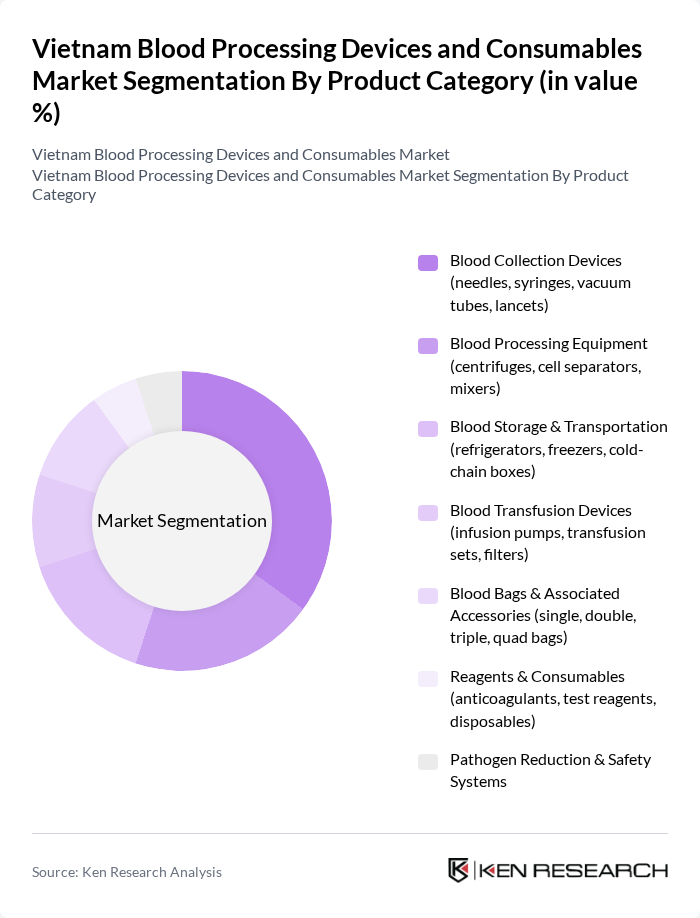

By Product Category:The product category segmentation includes various subsegments such as Blood Collection Devices, Blood Processing Equipment, Blood Storage & Transportation, Blood Transfusion Devices, Blood Bags & Associated Accessories, Reagents & Consumables, and Pathogen Reduction & Safety Systems. Among these, Blood Collection Devices are currently leading the market due to their essential role in the initial stages of blood processing and the increasing number of blood donation drives.

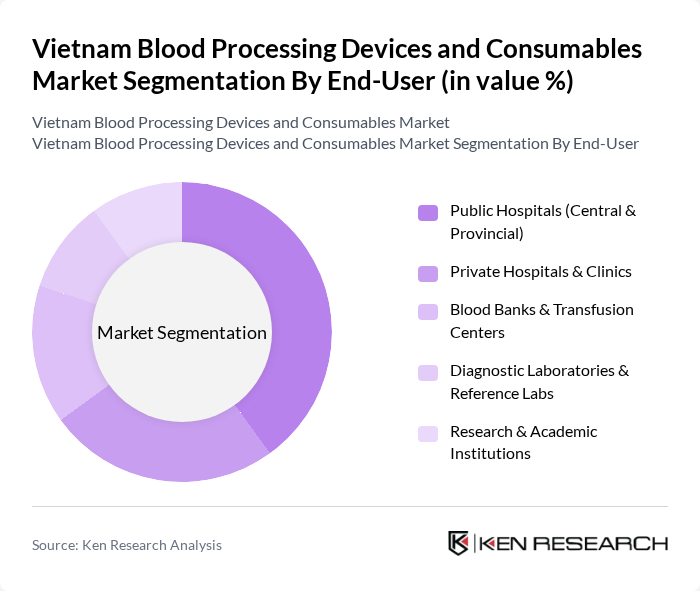

By End-User:The end-user segmentation encompasses Public Hospitals, Private Hospitals & Clinics, Blood Banks & Transfusion Centers, Diagnostic Laboratories & Reference Labs, and Research & Academic Institutions. Public Hospitals are the dominant segment, driven by government funding and the increasing number of patients requiring blood transfusions and related services.

The Vietnam Blood Processing Devices and Consumables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Terumo Corporation (Terumo Vietnam Co., Ltd.), Fresenius Kabi AG (Fresenius Kabi Vietnam Co., Ltd.), B. Braun SE (B. Braun Vietnam Co., Ltd.), Haemonetics Corporation, Grifols S.A., Baxter International Inc., Abbott Laboratories (Abbott Laboratories S.A. Vietnam), F. Hoffmann-La Roche Ltd (Roche Vietnam Co., Ltd.), Siemens Healthineers AG (Siemens Healthcare Vietnam Co., Ltd.), Sysmex Corporation (Sysmex Vietnam Co., Ltd.), Beckman Coulter, Inc. (Beckman Coulter Vietnam Co., Ltd.), Bio-Rad Laboratories, Inc. (Bio-Rad Laboratories Vietnam), Ortho Clinical Diagnostics (a QuidelOrtho company), Terumo BCT, Inc., Local Distributors & Integrators (e.g., VietMedical, VietLife Healthcare) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam blood processing devices and consumables market is poised for significant transformation, driven by technological advancements and increasing healthcare investments. In future, the integration of artificial intelligence in blood management systems is expected to enhance operational efficiency. Additionally, the expansion of healthcare facilities in rural areas will improve access to blood processing technologies, fostering a more robust healthcare infrastructure. These trends indicate a promising future for the market, with a focus on innovation and improved patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Blood Collection Devices (needles, syringes, vacuum tubes, lancets) Blood Processing Equipment (centrifuges, cell separators, mixers) Blood Storage & Transportation (refrigerators, freezers, cold-chain boxes) Blood Transfusion Devices (infusion pumps, transfusion sets, filters) Blood Bags & Associated Accessories (single, double, triple, quad bags) Reagents & Consumables (anticoagulants, test reagents, disposables) Pathogen Reduction & Safety Systems |

| By End-User | Public Hospitals (Central & Provincial) Private Hospitals & Clinics Blood Banks & Transfusion Centers Diagnostic Laboratories & Reference Labs Research & Academic Institutions |

| By Clinical Application | Transfusion Medicine & Blood Component Preparation Hematology & Hemostasis Testing Immunohematology & Blood Grouping Therapeutic Apheresis & Plasmapheresis Infectious Disease & NAT Screening of Donor Blood |

| By Procurement / Distribution Channel | Centralized Public Tenders (MOH & Social Security) Direct Sales to Hospitals & Blood Centers Local Distributors / Importers Online / E-procurement Platforms |

| By Region | Northern Vietnam (including Hanoi & Red River Delta) Central Vietnam (including Da Nang & Central Coast) Southern Vietnam (including Ho Chi Minh City & Mekong Delta) Highlands & Other Emerging Provinces |

| By Level of Automation | Fully Automated Blood Processing Systems Semi-automated Systems Manual / Conventional Processing |

| By Policy & Funding Support | Central Government Programs & Budget Lines Provincial Health Department Support International Donor & PPP-funded Procurement Other Incentives (tax, import duty, fast-track registration) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blood Processing Device Manufacturers | 45 | Product Managers, R&D Directors |

| Blood Bank Administrators | 40 | Operations Managers, Quality Control Officers |

| Healthcare Procurement Officers | 35 | Supply Chain Managers, Purchasing Agents |

| Clinical Laboratory Technicians | 30 | Lab Managers, Technical Supervisors |

| Regulatory Affairs Specialists | 25 | Compliance Officers, Regulatory Managers |

The Vietnam Blood Processing Devices and Consumables Market is valued at approximately USD 12 million, driven by increasing demand for blood transfusions, advancements in medical technology, and a growing focus on blood safety and disease detection.