Region:Asia

Author(s):Shubham

Product Code:KRAA8729

Pages:80

Published On:November 2025

By Type:The market is segmented into various types of coated glass, including Low-E Glass, Reflective Glass, Tinted Glass, Laminated Glass, Solar Control Glass, Patterned/Decorative Coated Glass, and Others. Each type serves specific applications and consumer preferences, with Low-E Glass being particularly popular due to its energy-saving and solar control properties .

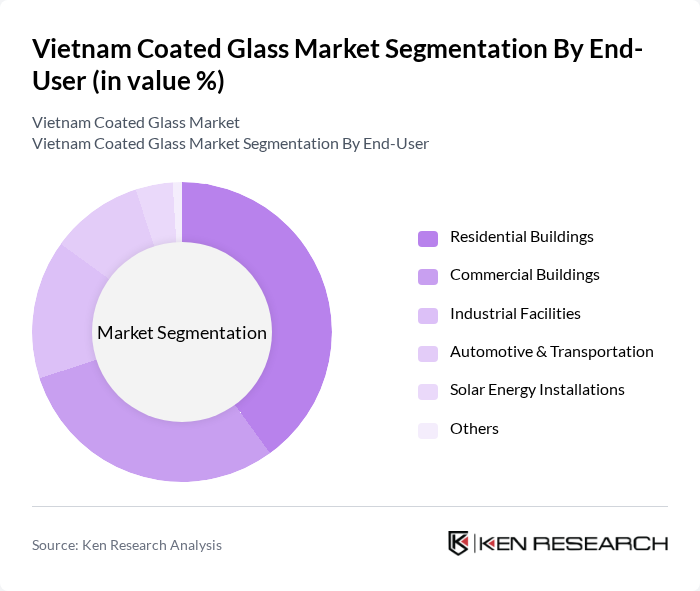

By End-User:The end-user segmentation includes Residential Buildings, Commercial Buildings, Industrial Facilities, Automotive & Transportation, Solar Energy Installations, and Others. The residential and commercial sectors are the largest consumers of coated glass, driven by modern architecture, energy-efficient building practices, and the increasing adoption of green building certifications .

The Vietnam Coated Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viglacera Corporation (Vietnam Glass Industry Corporation), Vietnam Float Glass Company Limited (VFG, joint venture of NSG Group and Viglacera), AGC Flat Glass Vietnam Co., Ltd. (AGC Asia Pacific), Saint-Gobain Vietnam Co., Ltd., Tr??ng Thành Group, Hanel Glass JSC, Minh Long Glass Co., Ltd., Vietglass (Vietnam Glass and Ceramics JSC), Dong Tam Group, Hoa Sen Group, Long Giang Investment and Urban Development JSC, Phu My Flat Glass Co., Ltd., Chu Lai Truong Hai Glass Co., Ltd. (THACO Industries), Bach Khoa Glass Technology JSC (BK Glass), An Phat Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam coated glass market is poised for significant growth, driven by increasing urbanization and a strong governmental push towards sustainable construction practices. As the demand for energy-efficient buildings rises, the market is expected to see innovations in glass technology, particularly in smart glass applications. Additionally, the integration of IoT in building materials will likely enhance functionality and appeal, positioning coated glass as a vital component in modern architecture and construction.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-E Glass Reflective Glass Tinted Glass Laminated Glass Solar Control Glass Patterned/Decorative Coated Glass Others |

| By End-User | Residential Buildings Commercial Buildings Industrial Facilities Automotive & Transportation Solar Energy Installations Others |

| By Application | Architectural Glazing Facades & Curtain Walls Automotive Glass Solar Panels Interior Partitions & Furniture Electronics & Displays Others |

| By Coating Type | Hard Coated (Pyrolytic) Soft Coated (Magnetron Sputtered) Others |

| By Distribution Channel | Direct Sales (Manufacturers to End-Users) Distributors/Dealers Online Sales Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Market Maturity | Emerging Market Established Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Architects, Contractors, Home Builders |

| Commercial Building Developments | 80 | Project Managers, Real Estate Developers |

| Automotive Glass Applications | 50 | Automotive Manufacturers, Supply Chain Managers |

| Retail and Distribution Channels | 60 | Retail Managers, Distribution Executives |

| Energy-Efficient Building Materials | 70 | Sustainability Consultants, Building Inspectors |

The Vietnam Coated Glass Market is valued at approximately USD 570 million, driven by the increasing demand for energy-efficient building materials and the expansion of the construction sector, particularly in urban areas like Ho Chi Minh City and Hanoi.